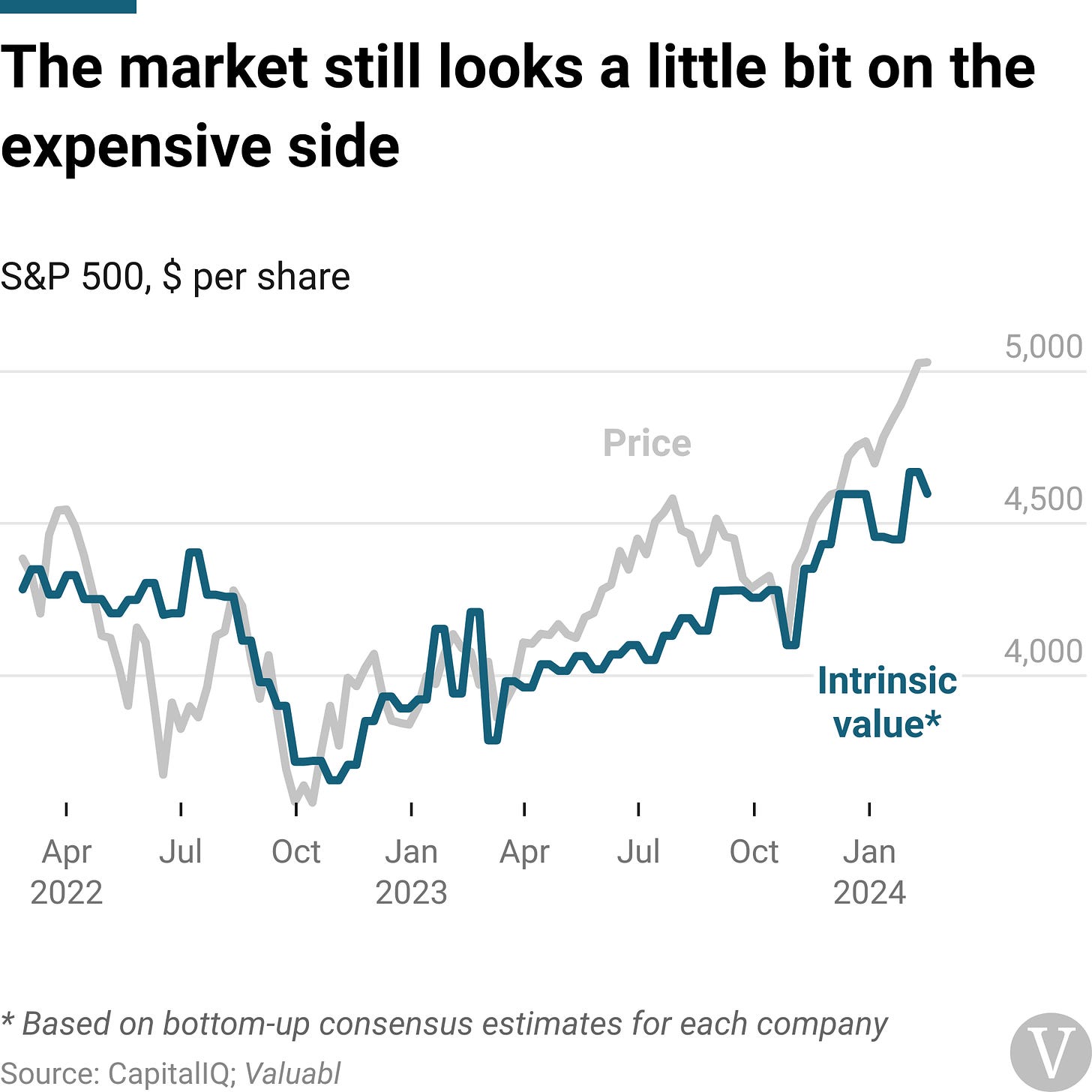

Stock prices rose last fortnight. The S&P 500 index of big American companies climbed 1.9% to 5,001 as corporate earnings rose. Earnings per share for the index rose 20 cents to $214.40. It offers an 8.9% expected return at the current price, some of the highest returns in over a decade.

Valuabl’s discounted cash flow model suggests the S&P 500 is worth …