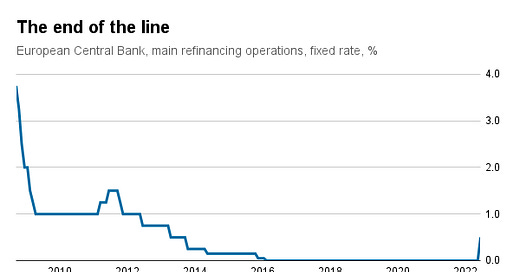

The European Central Bank (ECB) raised interest rates by 50bp, the first increase in 11 years. Consumer prices have risen 8.6% in the past year, forcing the bank to do something. Russia’s invasion of Ukraine has created an energy crisis, and consumer confidence indicators are already pointing to a slowdown. Increasing the rate will strain public and pri…

© 2025 𝑉𝑎𝑙𝑢𝑎𝑏𝑙

Substack is the home for great culture