House of the rising Fed

The Federal Reserve, much like Atlas the Titan in Hesiod’s Theogony, is trapped

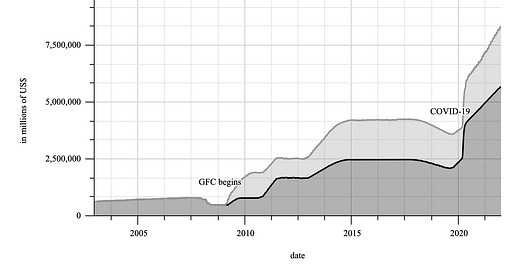

Since the U.S. Federal Reserve (“Fed”) first announced and implemented its quantitative easing (“QE”) programme in March 2009, economists and pundits alike have hotly debated its effects on financial markets. Specifically, the conversation has focused on the Fed’s ability to control the monetary supply, inflation, and interest rates.

Before the global fi…