Housing market: Part 8 - A very long-term look at housing prices and population

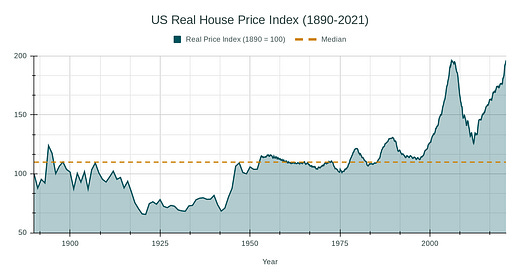

Looking at long-term real house prices and population growth trends in the UK, USA, and Amsterdam.

In my last post on the housing market, I wrote that:

“This post will, hopefully, conclude our discussion of the housing market.”

However, it seems like my research on this topic has struck a nerve. Some of your private responses to me included counterpoints like:

I should stick to valuing businesses because I clearly don’t understand real estate.

The US rea…