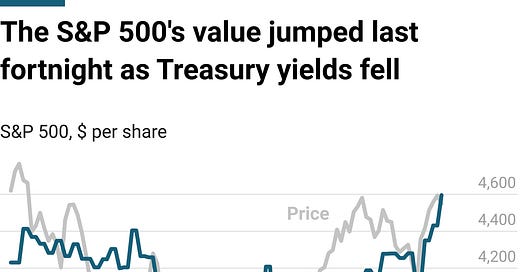

Stock prices fell slightly over the last two weeks. The S&P 500 index of big American companies dropped 0.2% to 4,549. But corporate earnings rose. Earnings per share for the index climbed 30 cents to $210.30. But the market isn’t undervalued yet. It’s trading at fair value. At the current price, it offers a 9.3% expected return, some of the highest ret…

© 2025 𝑉𝑎𝑙𝑢𝑎𝑏𝑙

Substack is the home for great culture