No, stocks are still not cheap

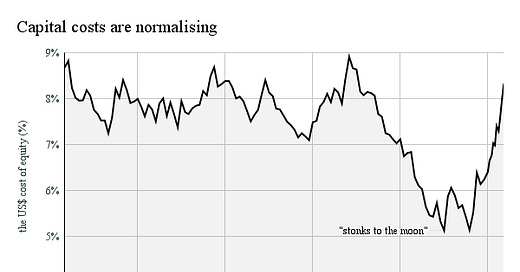

Stock values haven't come down; instead, the cost of money has gone up. The equity investor deciding where to put their money will need to do better than ogle recent highs.

With the Nasdaq-100, a technology-focused index of American-listed companies, down by a fifth this year, the prospective value investor may reason that stocks are cheap. After all, prices are markedly below their 52-week highs, yet companies have expanded. As one Twitter user said, "Facebook is the same price as in 2017 when revenues and earnings were a…