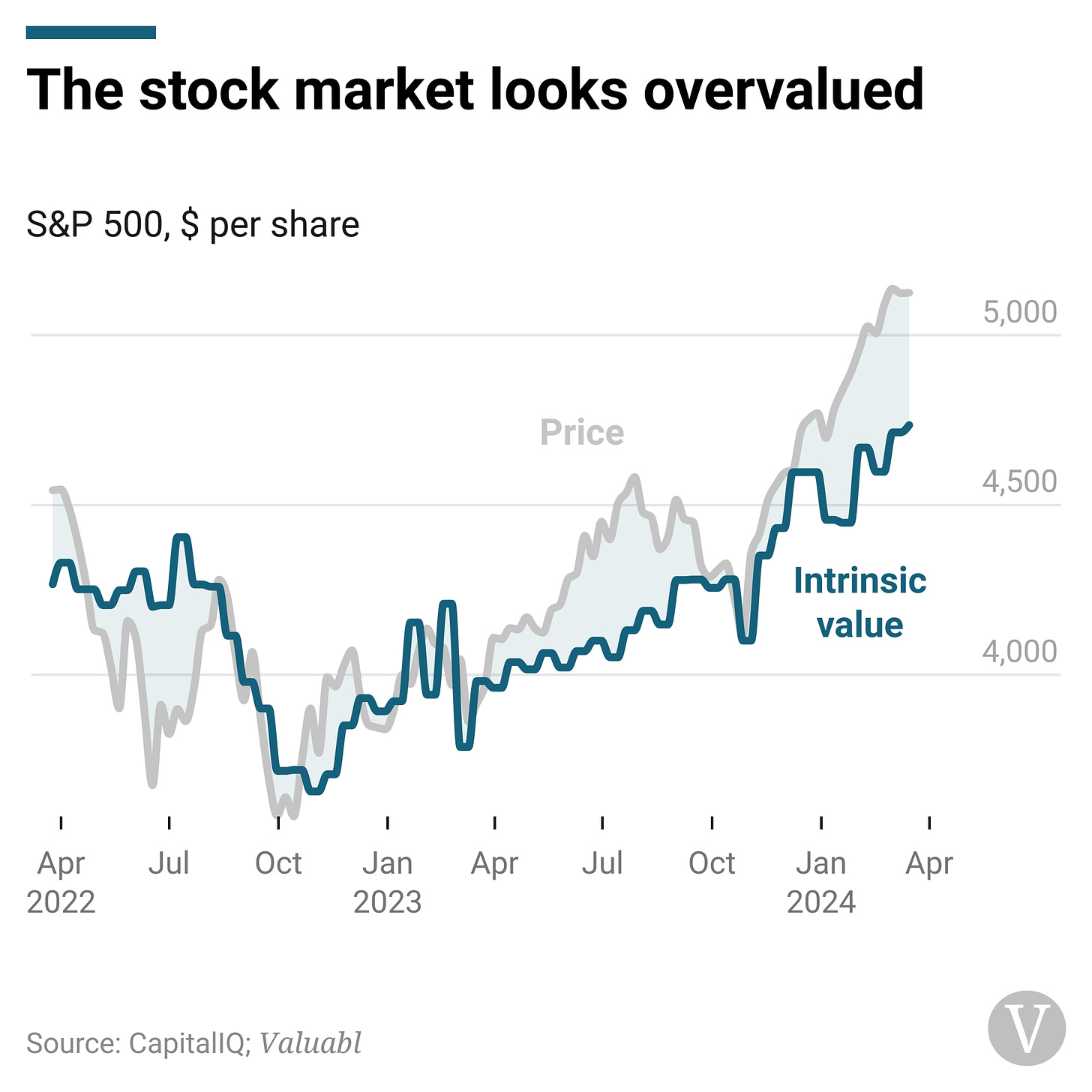

Stock prices rose last fortnight. The S&P 500 index of big American companies climbed 1.1% to 5,150. Earnings per share for the index fell by 30c. At the current price, the S&P 500 offers a 9.0% annual expected return. Those are some of the highest returns on offer in over a decade.

𝑉𝑎𝑙𝑢𝑎𝑏𝑙’s discounted cash flow model suggests the S&P 500 is wort…