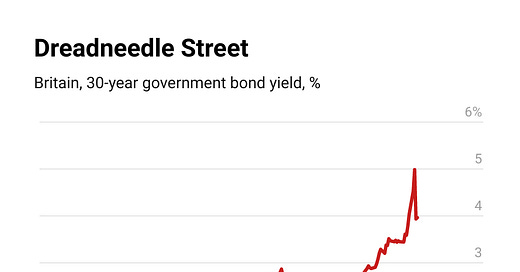

The Bank of England threw herself into financial markets in spectacular scenes this week. Yields on long-dated gilts, British government bonds, had shot up, and margin calls threatened to bring the country’s pension industry to its knees.

To extinguish the blaze, the bank said it would buy as many bonds as needed to sedate markets and lead an orderly tra…