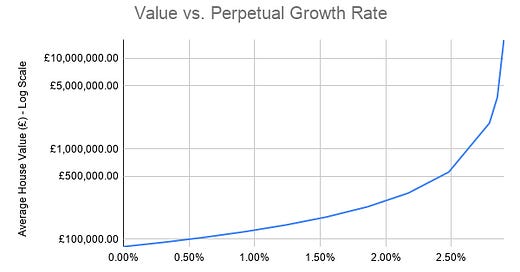

The relationship between interest rates and economic growth

And, what happens to valuations when we forget this relationship.

Dear Reader,

Today’s newsletter covers a more technical and nuanced, but highly impactful point.

There is an underappreciated relationship between the risk-free rate of return and expectations of future economic growth. These measures influence each other in a reflexive way. As central bank’s expectations of future growth go down, so does the rate they o…