Vol. 2, No. 14

Tech workers are getting the sack; Policymaker and pundits don't understand the monetary system; The base money supply is shrinking; Value in an online brokerage.

Valuabl is an independent, value-oriented journal of financial markets. Delivered fortnightly, Valuabl helps investors pop bubbles, buy low, and sell high.

HOUSEKEEPING

Unless you’re a paid subscriber, you will be automatically unsubscribed if you haven’t opened an email in the last six months. This will be done automatically.

In today’s issue

Cartoon: Cost of drinking crisis

Cost of capital (5 minutes)

Adrift in a sea of money (15 minutes)

Global stocktake (4 minutes)

Corporate shuffleboard (3 minutes)

Credit creation, cause & effects (8 minutes)

Debt cycle monitor (2 minutes)

Investment ideas (12 minutes)

“But investing isn’t about beating others at their game. It’s about controlling yourself at your own game.”

―Benjamin Graham

Cartoon: Cost of drinking crisis

Cost of capital

Interest rates and capital costs are capitalism's most consequential yet misunderstood prices, connecting the future to the present.

•••

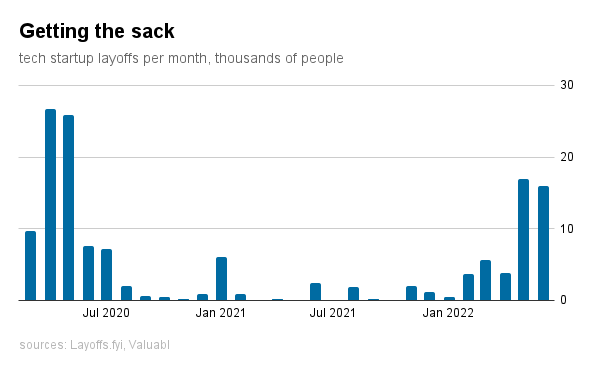

Companies are sacking more of their employees. Layoffs haven’t reached their COVID-19 peak, but tech startups fired 33,000 of their staff in the past two months. The recession is biting. Rising capital costs have crushed the shares of unprofitable companies and inhibited their ability to raise money. Workers have been miffed by stock-based compensation that’s now worth a fraction of what they expected. The economy is contracting.

Despite this, stock markets rose last fortnight. The S&P 500, an index of big American companies, climbed 2% to 3,831. The index has dropped 20% since January, its peak, and 12% over the past year. Investors added $734bn to global equity markets (see: Global stocktake) and again marked up the risk price for both equity and credit. Investors are struggling to reconcile the effects of a recession on monetary policy and valuations. The compromise has been to increase spreads. Punters reckon the recession is here and that central banks will turn dovish sooner rather than later.

The price of government bonds rose. Yields, which move inversely to prices, fell as inflation expectations did. The yield on a ten-year American Treasury bond, a key variable for valuing financial assets, dropped 43bp to 2.9%. Bond investors’ forecasts for inflation over the next ten years fell by 31bp to 2.3% per year. These traders are giving the Federal Reserve, America’s central bank, credit for their plan to raise rates and bring inflation down.

Consequently, the real interest rate, the difference between yields and expected inflation, fell by 12bp. Fixed-income investors expect to increase their purchasing power by 0.6% per year. This return, albeit tepid, is 162bp better than it was at the start of the year.

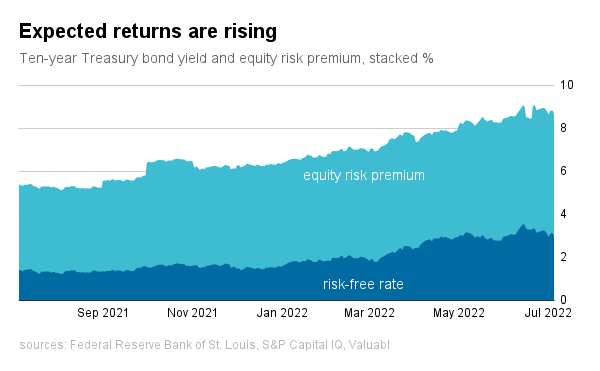

The equity risk premium (ERP), the extra return investors want for buying stocks instead of bonds, is still rising. It rose 17bp last fortnight as recessionary fears continued to build. The current 5.9% premium is much higher than the average over the past five years of 5.1% and is the highest since the peak of COVID uncertainty in April 2020. It is up 110bp since January and 191bp over the past year.

The cost of equity, the return stock-investors demand to part with their money, is 8.8%, down 26bp from last fortnight when Valuabl last went to press. Equity costs—which we can think of as expected returns—have risen 246bp since January and 342bp in the past year. Equity costs a helluva lot more now than then.

Creditors marked up risk last fortnight. Corporate bond prices fell as government ones rose. Credit spreads, the difference between corporate bond yields and Treasury yields on BBB-rated bonds, rose 20bp. These spreads are up 84bp since the start of the year and 97bp over the last 12 months. Risk is becoming much more expensive, particularly at the speculative end.

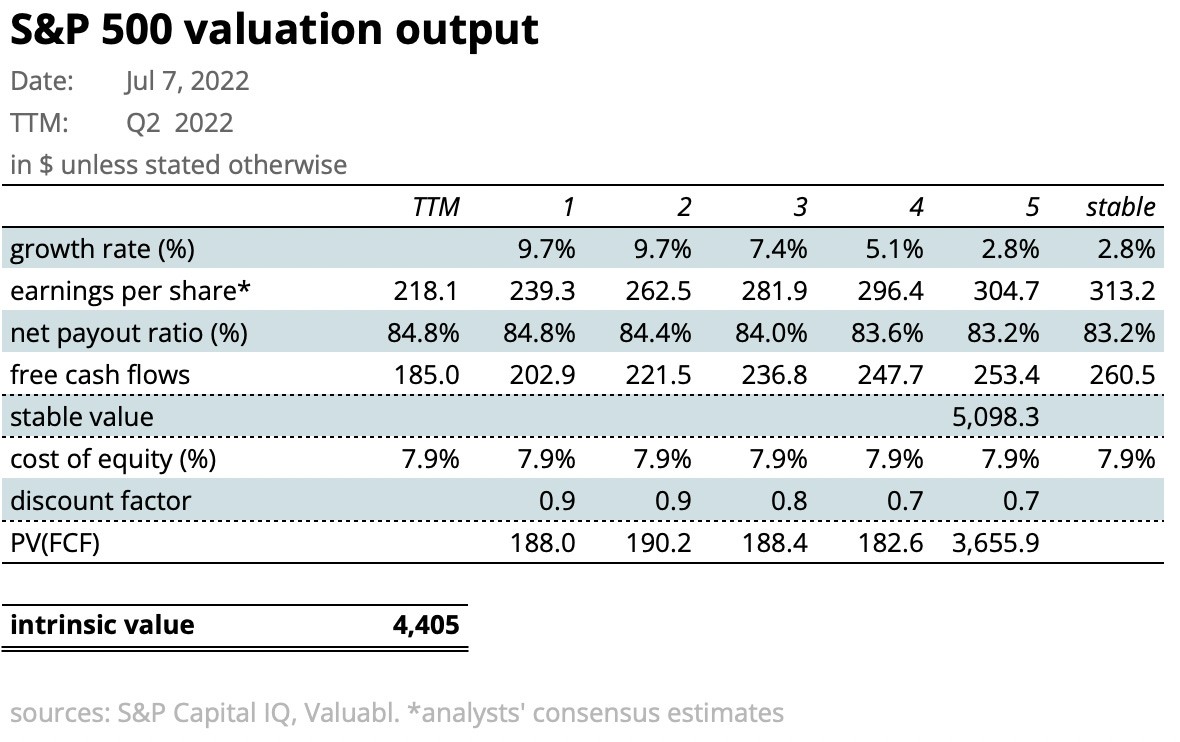

Using the average ERP of the past five years, the current ten-year Treasury bond yield, analysts' consensus earnings estimates, and a stable payout ratio based on the S&P 500's average return on equity over the last decade, I value the index at 4,405 compared to its level of 3,831. The slight drop in earnings forecasts was more than offset by the decrease in equity costs over the past two weeks. Consensus earnings for 2023 fell to $250.70 from $251.99.

This valuation suggests the S&P 500 index is 13% undervalued compared to 9% overvalued at the start of the year and 21% overvalued last year. Although investors buying stocks can expect an 8.8% per year return at these prices, the index isn’t good value yet. Let’s see what happens over the next few weeks.

READY FOR MORE?

You are at the end of the free portion of Valuabl. To access all issues, and investment ideas, and support independent research, become a paid subscriber.