Vol. 2, No. 16

Recent stock market rallies are justified; Eastern European firm's are still cheap; A tug-of-war between businesses and workers is starting; Value in digging for iron ore

Valuabl is an independent, value-oriented journal of financial markets. Delivered fortnightly, Valuabl helps investors pop bubbles, buy low, and sell high.

HOUSEKEEPING

In the last issue, I mistakenly wrote that the federal funds rate is the rate at which the central bank lends. This is incorrect. It is the rate at which banks lend reserves to each other. Sorry.

It’s my birthday. To celebrate, I’m giving 31% off all annual subscriptions for the next 24 hours.

In today’s issue

Cartoon: ESG?

Cost of capital (6 minutes)

Global stocktake (4 minutes)

Credit creation, cause & effects (9 minutes)

Corporate shuffleboard (5 minutes)

Debt cycle monitor (2 minutes)

Investment ideas (15 minutes)

“What value does cryptocurrency actually add? No one's been able to answer that question for me.”

—Steve Eisman

Cartoon: ESG?

Cost of capital

Interest rates and capital costs are capitalism's most consequential yet misunderstood prices, connecting the future to the present.

•••

The Bank of England hiked interest rates by 50bp to 1.75% yesterday. Britain's central bank is responding to rising inflation, mirroring moves by the European Central Bank and the Federal Reserve. The bank expects inflation to surpass 13% this year, dramatically higher than its May forecast. Andrew Bailey, the bank's governor, also said they expect the country to be in recession until the end of 2023.

Like most of the rich world, Britain is wrestling with a cost of living crisis. Rising prices are making it more difficult for families to make ends meet. Stretched households reaching for the credit card to plug their budget gaps will find this option more painful as interest rates go up.

Bailey's slow interest rate amble indicates he doesn't think bank lending is causing inflation. If he believed prices were being pulled up by demand, he would hike rates and sell bonds faster. Instead, it suggests he believes rising costs have pushed inflation up and is slowly walking rates to prevent a sterling collapse. Either way, governments need to get inflation under control before the tension between businesses, wanting to grow their bottom lines, and workers, wishing to increase their wages, turns into a tug-of-war.

Policymakers worldwide, typically on generous salaries, are out of touch. They should quit asking workers to stop demanding pay hikes. Instead, they should use their monetary and fiscal policy tools to target the causes of our inflation and provide support to those who need it. Without doing this, social tension will boil over, and the resulting inflationary spiral will make everyone poorer and worse off.

Despite interest rate hikes, stock markets rose last fortnight. The S&P 500, an index of big American companies, rose 5% to 4,155. Whispers of a central bank pivot pleased traders, and they bought. These investors added $2.3trn to global stock markets (see: Global stocktake) while discounting the price of risk for both equity and debt.

The market has fallen 13% since January and 6% over the past year. But it is up 13% from its June lows. The VIX, an estimate of stock market uncertainty, has fallen from 34 to 22. Perhaps traders are feeling less dubious about the future?

The price of government bonds jumped with stocks. Yields, which move inversely to prices, fell as inflation expectations rose. The yield on a ten-year American Treasury bond, a key variable for valuing financial assets worldwide, dropped by 29bp to 2.7%. Bond investors' forecasts for inflation over the next decade leapt by 12bp to 2.5% per year.

Consequently, the real interest rate, the difference between yields and expected inflation, fell by a colossal 41 basis point. Fixed-income investors expect to increase their purchasing power by 0.2% per year. This insipid return is 144bp better than a year ago but remains unappealing.

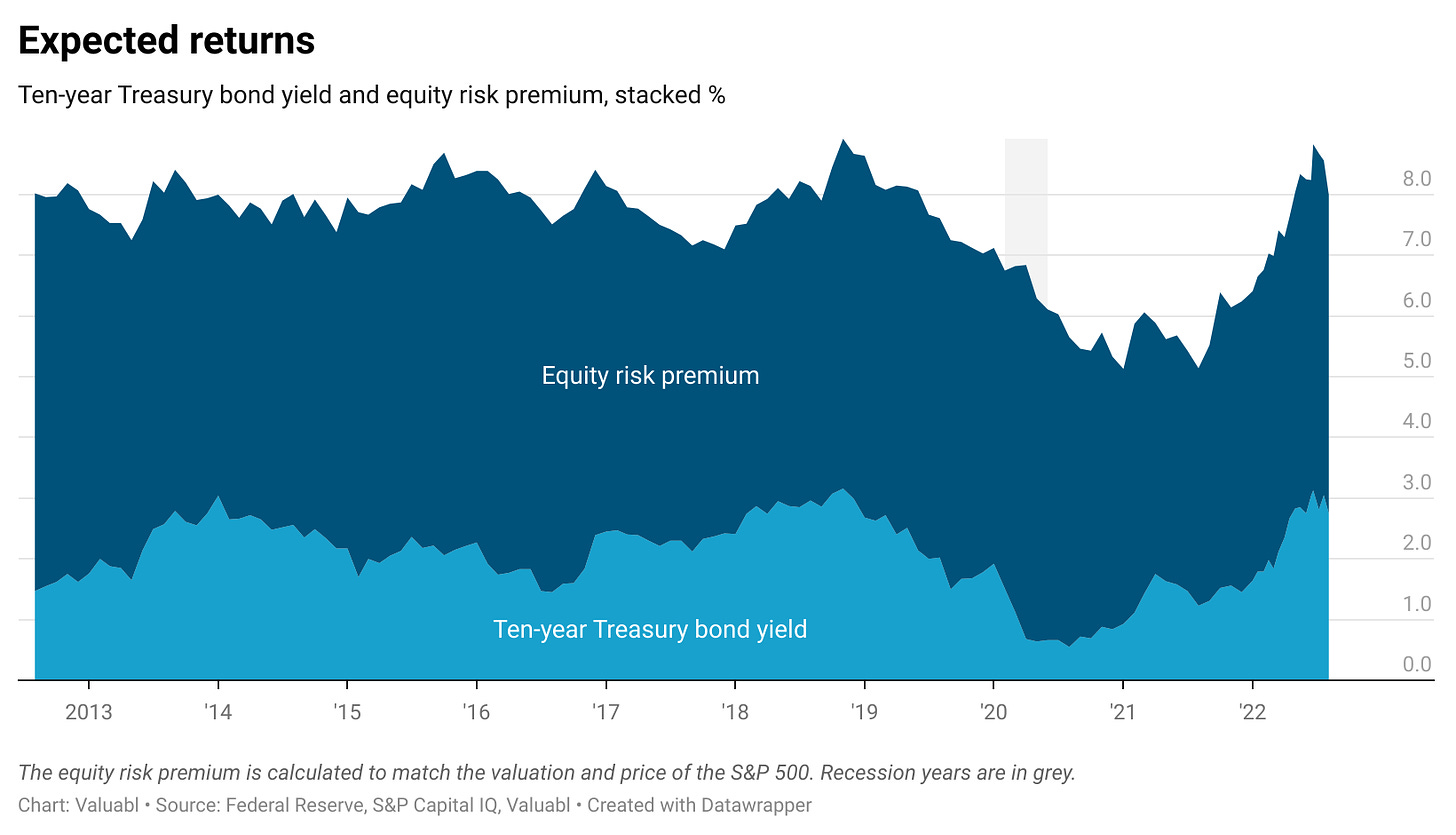

The equity risk premium (ERP), the extra return investors want for buying stocks instead of bonds, dropped for the second consecutive fortnight. It fell 26bp to 5.2%. The current premium is comparable to the average over the past five years of 5.1%. It is up 48bp since January and 134bp over the past year.

The cost of equity, the return stock-investors demand to part with their money, is 8%, down 55bp from last fortnight when Valuabl last went to press. Equity costs—which we can think of as expected returns—have risen 171bp since January and 290bp in the past year. Stock buyers demand a much larger return now than they did then.

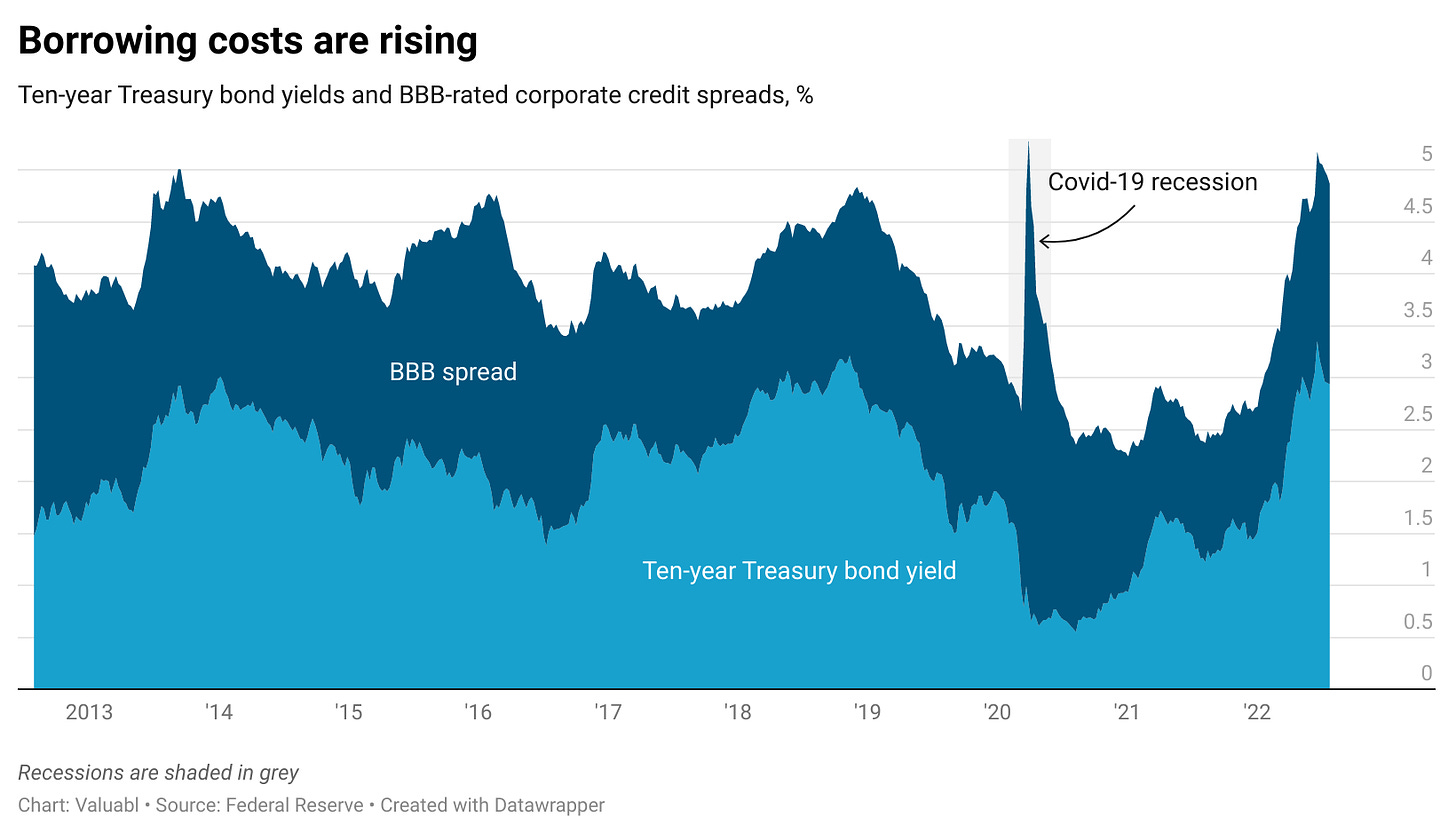

Creditors are charging slightly less for risk than they did a fortnight ago. Corporate bond prices rose slightly more than government ones. Credit spreads, the gap between corporate bond and Treasury yields, on BBB-rated bonds, fell 3bp. These spreads are up 68bp since the start of the year and 74bp over the past 12 months.

Borrowing is becoming increasingly expensive. Risk-free rates are rising, and credit spreads are widening—except for highly credit-worthy companies. Credit spreads on AAA and AA bonds have shrunk over the past quarter. In contrast, spreads at the riskier end are expanding. And the riskier the bond, the larger the expansion. Bond investors, expecting economic contraction, inflation and rising capital costs to hurt less credit-worthy companies, are shifting out of speculative credit and into investment-grade assets.

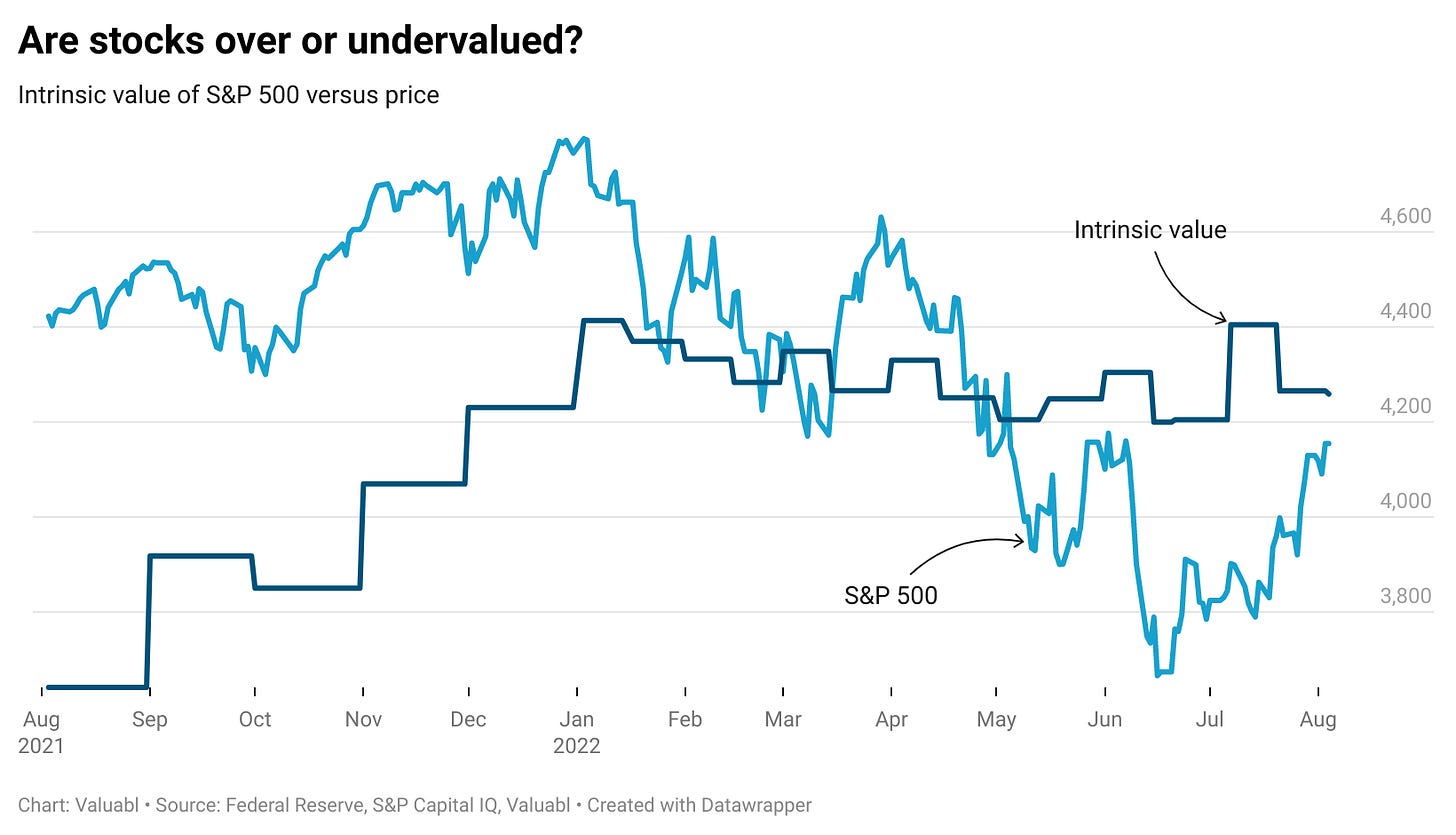

Using the average ERP of the past five years, the current ten-year Treasury bond yield, analysts' consensus earnings estimates, and a stable payout ratio based on the S&P 500's average return on equity over the last decade, I value the index at 4,259 compared to its level of 4,155. The slight drop in earnings forecasts was slightly offset by the decrease in equity costs over the past two weeks. Consensus earnings for 2023 fell to $246.33 from $249.13.

This valuation suggests the S&P 500 index is 2% undervalued compared to 9% overvalued at the start of the year and 20% overvalued last year. Investors buying this index of stocks can expect an 8% per year return atthese prices and be fairly compensated for their risk.

READY FOR MORE?

You are at the end of the free portion of Valuabl. Become a paid subscriber to access all issues and investment ideas, and support independent research.