Vol. 2, No. 17

Markets are recovering; Eastern Europe looks cheap; The government should reduce the deficit; Value in smokes

Valuabl is an independent, value-oriented journal of financial markets. Delivered fortnightly, Valuabl helps investors pop bubbles, buy low, and sell high.

In today’s issue

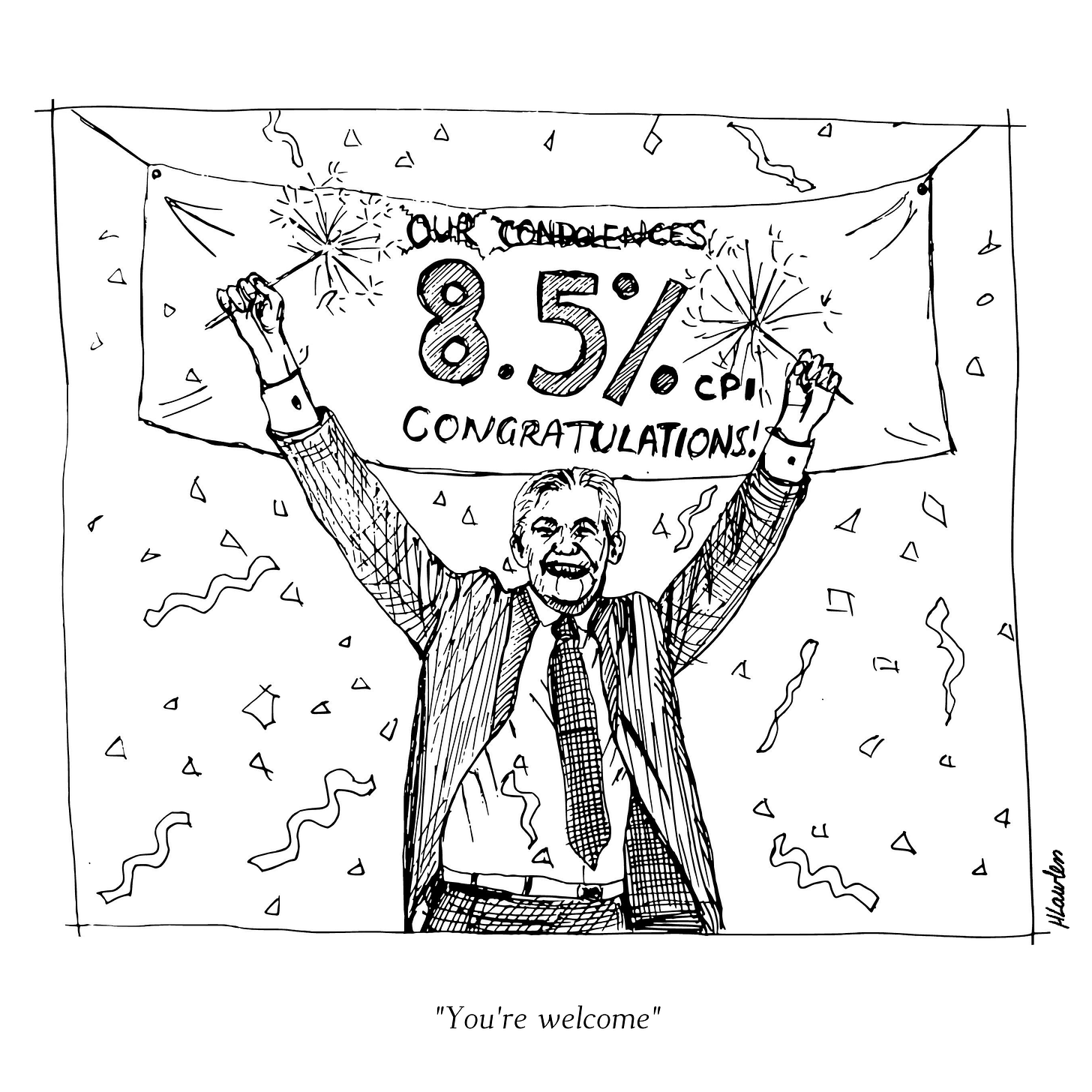

Cartoon: You’re welcome

Cost of capital (5 minutes)

Global stocktake (4 minutes)

Credit creation, cause & effects (8 minutes)

Debt cycle monitor (2 minutes)

Investment ideas (10 minutes)

“The most important quality for an investor is temperament, not intellect.”

— Warren Buffett

Cartoon: You’re welcome

Cost of capital

Interest rates and capital costs are capitalism's most consequential yet misunderstood prices, connecting the future to the present.

•••

Stock markets rose last fortnight. The S&P 500, an index of big American companies, went up 3% to 4,274. Despite its unlikeliness, further whispers of a central bank pivot made traders happy, and they bought. These investors added $4trn to global market capitalisations (see: Global stocktake) while discounting the price of risk for both equity and debt.

The market has fallen 10% since January and 4% over the past year. But it is up 17% from its June lows. The VIX, an estimator of investor uncertainty, has fallen from 34 to 20.

The price of government bonds fell. Yields, which move inversely to prices, rose despite inflation expectations dropping. The yield on a ten-year American Treasury bond, a key variable for valuing financial assets worldwide, climbed by 9bp to 2.8%. Bond investors' forecasts for inflation over the next decade declined by 4bp to 2.5% per year.

Consequently, the real interest rate, the difference between yields and expected inflation, rose by 13 basis points. Fixed-income investors expect to increase their purchasing power by 0.4% per year. This flaccid return is 143bp better than a year ago but remains unappealing.

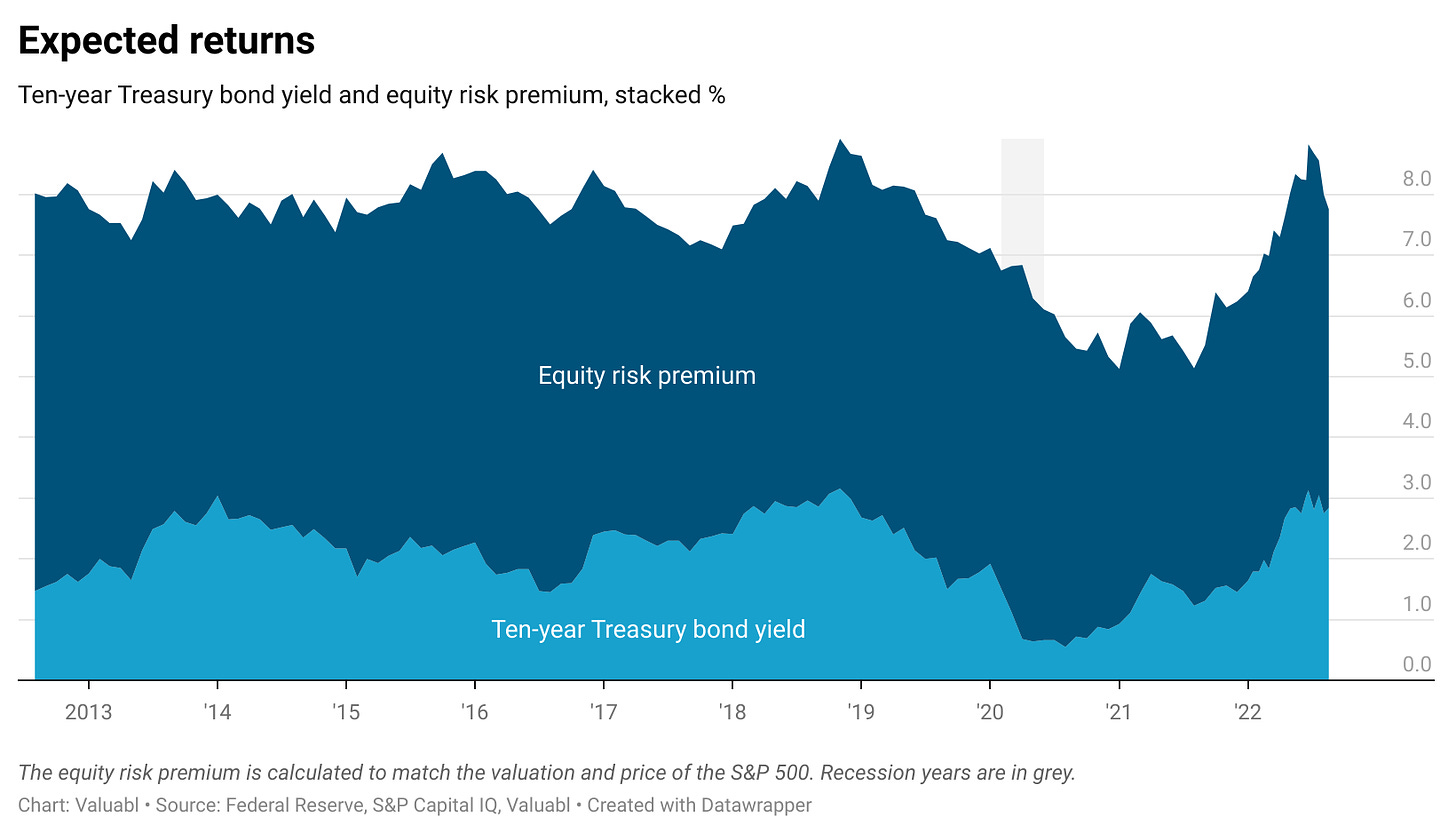

The equity risk premium (ERP), the extra return investors want for buying stocks instead of bonds, dropped again in the past fortnight. It fell 33bp to 4.9%. The current premium is comparable to the average over the past five years of 5.1%. It is up just 15bp since January and 101bp over the past year.

The cost of equity, the return stock-investors demand to part with their money, is 7.7%, down 44bp from last fortnight when Valuabl last went to press. Equity costs—which we can think of as expected returns—have risen 145bp since January and 257bp in the past year. Stock buyers demand a much larger return now than they did then.

Creditors are charging slightly less for risk than they did a fortnight ago. Corporate bond prices rose as government ones fell. Credit spreads, the gap between corporate and Treasury yields, on BBB-rated bonds, fell 13bp. These spreads are up 54bp since the start of the year and 60bp over the past 12 months. Borrowing is becoming increasingly expensive. Risk-free rates are rising faster than credit spreads are shrinking.

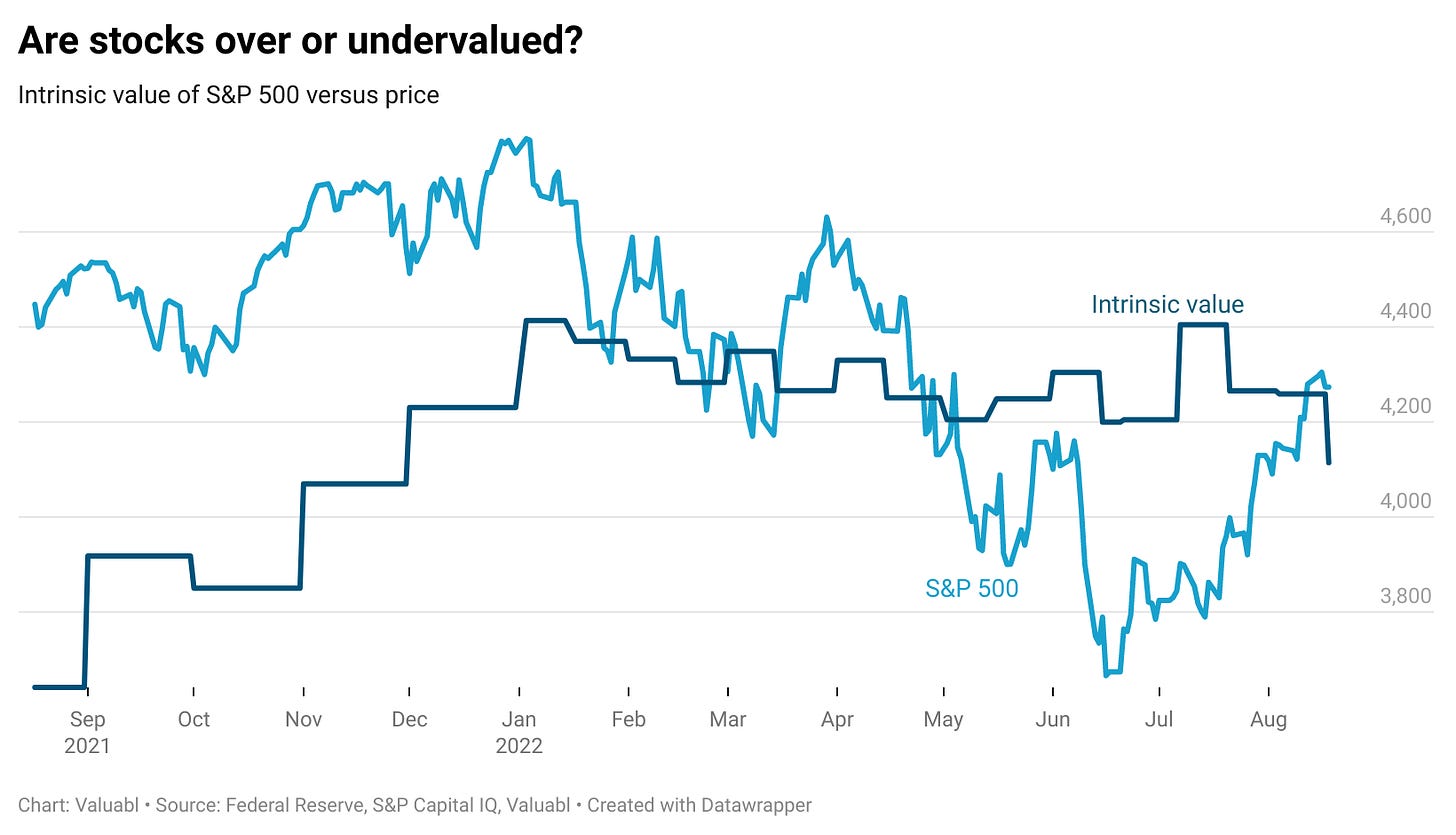

Using the average ERP of the past five years, the current ten-year Treasury bond yield, analysts' consensus earnings estimates, and a stable payout ratio based on the S&P 500's average return on equity over the last decade, I value the index at 4,115 compared to its level of 4,280. The slight drop in earnings forecasts was roughly offset by the decrease in equity costs over the past two weeks. Consensus earnings for 2023 fell again to $243.81 from $246.33.

This valuation suggests the S&P 500 index is 4% overvalued compared to 9% at the start of the year and 20% last year. Investors buying this index of stocks can expect an 8% per year return at these prices and be fairly compensated for their risk.

READY FOR MORE?

You are at the end of the free portion of Valuabl. Become a paid subscriber to access all issues and investment ideas, and support independent research.