Vol. 2, No. 18

The energy price crisis; Screening for cheap stocks; Monetary tightening is taking off; Value in refining oil

Valuabl is an independent, value-oriented journal of financial markets. Delivered fortnightly, Valuabl helps investors pop bubbles, buy low, and sell high.

HOUSEKEEPING

The Corporate Shuffleboard section is gone. I have replaced it with a new section called Rank and file, displaying my fortnightly screen of the cheapest regions from the Global stocktake. The Investment idea is usually the most undervalued stock from that screen.

In today’s issue

Cartoon: Price Gouge Electrics Inc

Cost of capital (6 minutes)

Global stocktake (3 minutes)

Rank and file (2 minutes)

Credit creation, cause & effects (6 minutes)

Debt cycle monitor (2 minutes)

Investment ideas (15 minutes)

“To understand Modern Monetary Theory, understand why the banker in Monopoly can never run out of money.”

— Unknown

Cartoon: Price Gouge Electrics Inc

Cost of capital

Interest rates and capital costs are capitalism's most consequential yet misunderstood prices, connecting the future to the present. Here’s what happened to the price of money and the market in the past fortnight.

•••

“Our electricity contract finishes its term next month, and the cheapest available new tariff on the market has increased our electricity costs from £44,000 per year to £162,000 per year. We can’t pass on those costs to customers who themselves are in a cost of living crisis. Many businesses are really going to struggle this year and government needs to step in and control these energy costs.” — Ye Olde Fleece Inn, Kendal, United Kingdom

We are staring down the barrel of a global energy price crisis. Power prices have quadrupled in the past two years. According to the Federal Reserve’s international cost of energy index, they are at their highest level ever.

Small businesses, especially independent high street ones, will be burned the worst. If high rents and business rates weren’t enough to finish many of them off coming out of lockdowns, energy bills and inflation likely will.

The British Beer and Pub Association, a group of ale advocates, reckon that without government support, half of the independent pubs in the UK will be forced to close doors. In a letter to Boris Johnson, the outgoing prime minister and fellow fan of the booze, the group urged the government to outline an immediate support package.

The economic mood is souring, and investors feel it.

The price of stocks went down last fortnight. The S&P 500, an index of big American businesses, fell 7% to 3,955. These investors trimmed $7.7trn from global market capitalisations (see: Global stocktake) while upping the price of risk.

The market has fallen 17% since January and 13% over the past year. But it is up 7% from its June lows. The VIX, an estimator of investor uncertainty, went up to 27 from 20 a fortnight ago.

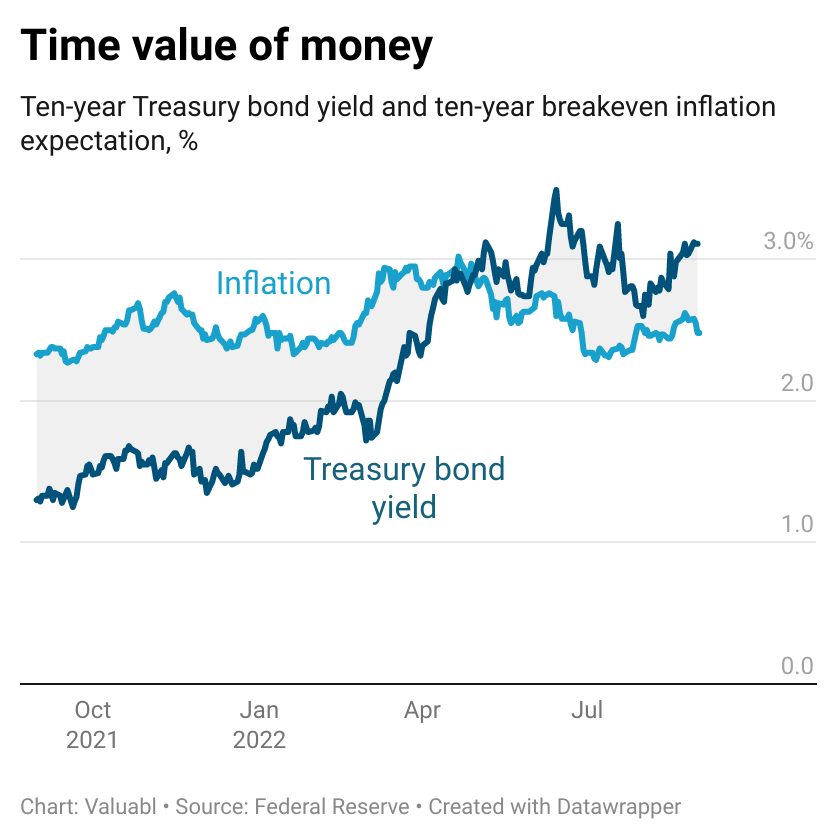

The price of government bonds fell again. Yields, which move inversely to prices, went up more than inflation expectations. The yield on a ten-year American Treasury bond, a key variable for valuing financial assets worldwide, climbed by 22bp to 3.1%. Bond investors' forecasts for inflation over the next decade rose by 2bp to 2.5% per year.

Consequently, the real interest rate, the difference between yields and expected inflation, rose by 20 basis points. Fixed-income investors expect to increase their purchasing power by 0.6% per year. This limp real-return is 167bp better than a year ago but remains unappealing.

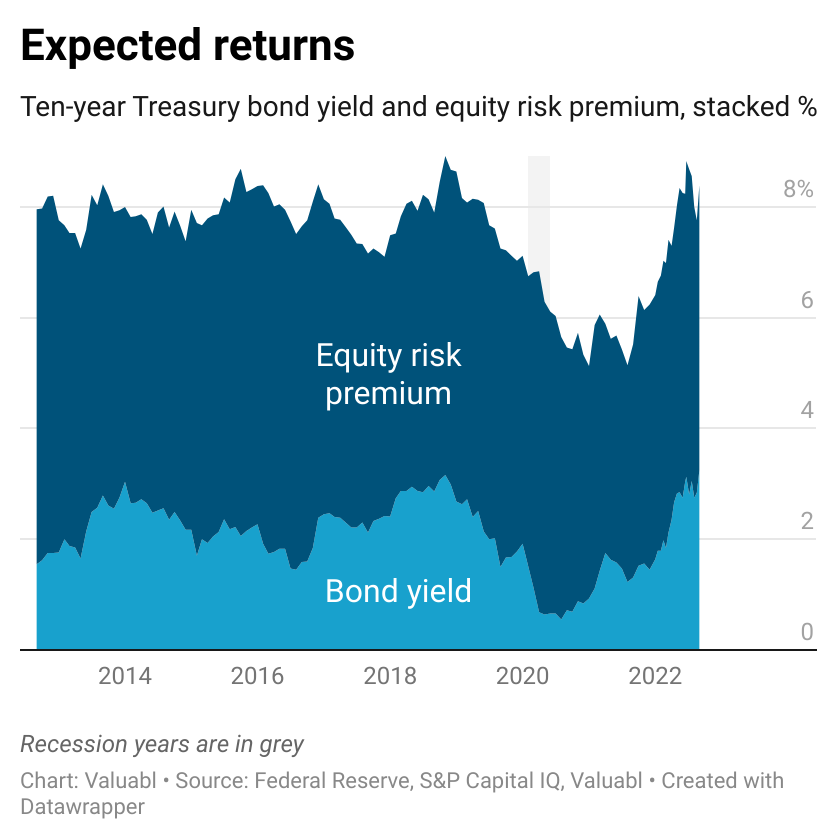

Investors reckon stocks are riskier than they did last fortnight. The equity risk premium (ERP), the extra return investors want for buying stocks instead of bonds, went up by 23bp to 5.2%. The current premium is in line with the past five years' average. It is up 38bp since the start of the year and 94bp in the past 12 months.

The cost of equity, the return stock-investors demand to part with their money, is 8.3%, up 45bp from last fortnight when Valuabl last went to press. Equity costs—which we can think of as expected returns—have risen 197bp since January and 275bp in the past year.

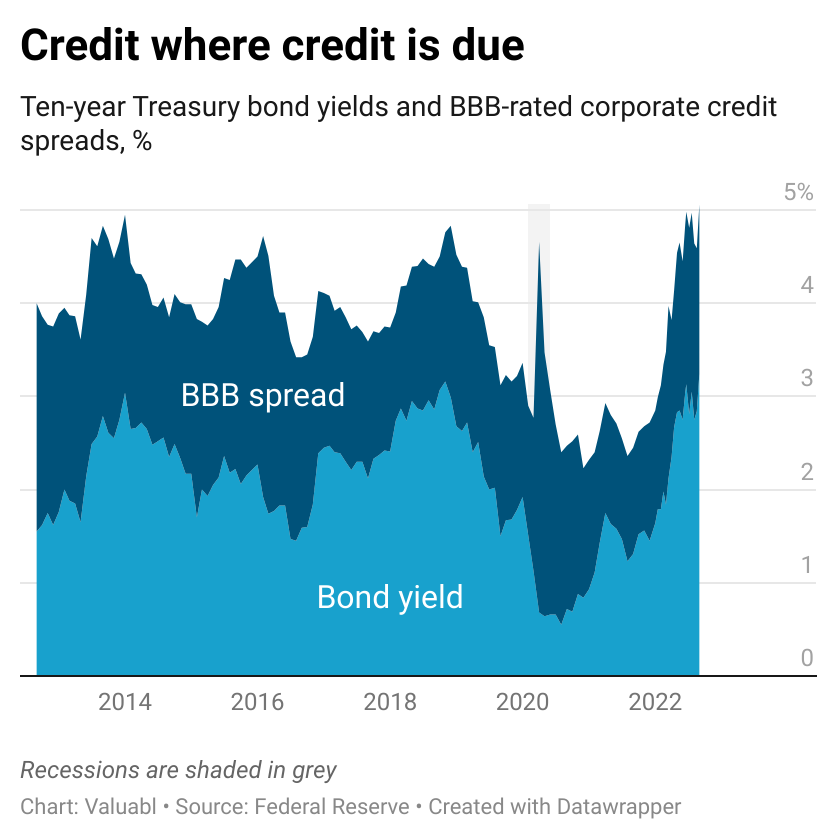

Creditors are charging slightly more for risk than they did a fortnight ago. Corporate bond prices fell further than government ones did. Credit spreads, the gap between corporate and Treasury yields, on BBB-rated bonds, went up 6bp. These spreads are up 61bp since the start of the year and 68bp over the past 12 months.

Using the average ERP of the past five years, the current ten-year Treasury bond yield, analysts' consensus earnings estimates, and a stable payout ratio based on the S&P 500's average return on equity over the last decade, I value the index at 3,979 compared to its level of 3,955.

While analysts now expect companies to earn slightly less next year than they expected them to last fortnight (consensus earnings for 2023 went down from $243.8 to $243.6), rising capital costs are taking a toll on valuations.

This valuation suggests the S&P 500 index is 1% undervalued compared to 9% at the start of the year and 15% last year. Investors buying this index of stocks can expect an 8.4% per year return at these prices and be fairly compensated for their risk.

READY FOR MORE?

You are at the end of the free portion of Valuabl. Become a paid subscriber to access all issues and investment ideas, and support independent research.

Global stocktake

An aggregate look at valuations of regional stock markets to help us find suitable ponds to fish for value. Which markets are over or undervalued?

•••