Vol. 2, No. 20

The Old Lady rides to the rescue; Equity risk premiums are stabilising; Private sector raises are better than public ones, but disinflation is spreading; Value in Swiss pharmaceuticals

Welcome to Valuabl, a twice-monthly digital newsletter providing rigorous, value-oriented analysis of the forces shaping global capital markets. New here? Learn more

In today’s issue

Cartoon: 50 Shades of Jay

Cost of capital (6 minutes)

Global stocktake (5 minutes)—Paid subscribers only

Rank and file (2 minutes)—Paid subscribers only

Credit creation, cause & effects (8 minutes)—Paid subscribers only

Debt cycle monitor (2 minutes)—Paid subscribers only

Investment idea (19 minutes)—Paid subscribers only

“Central bank priorities are not the priorities of working people”

— Bill Mitchell

Cartoon: 50 Shades of Jay

Money talks—it just needs an interpreter

Take an annual subscription to Valuabl and get three months for free.

Cost of capital

Interest rates and capital costs are finance’s most consequential yet misunderstood prices—connecting the future to the present. Here’s what happened to the price of money in the past fortnight.

Rundown

The Bank of England stepped in to save Britain’s pension industry

Real interest rates are the highest they’ve been since 2010

The S&P 500 is fairly valued, and investors expect 9.1% annual returns

•••

The Bold Lady

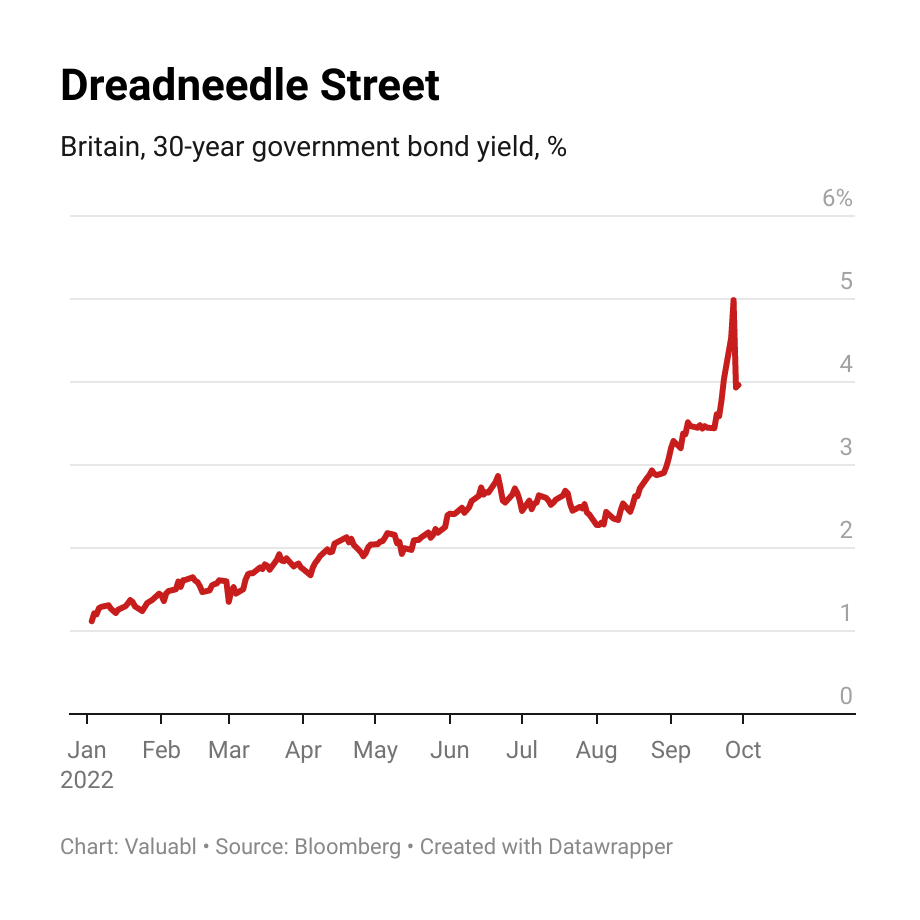

The Bank of England threw herself into financial markets in spectacular scenes this week. Yields on long-dated gilts, British government bonds, had shot up, and margin calls threatened to bring the country’s pension industry to its knees.

To extinguish the blaze, the bank said it would buy as many bonds as needed to sedate markets and lead an orderly transition to lower prices. The Investment Association, a club of British fund managers, reckons that £1.6trn of the country’s £2.5trn defined benefit pension assets were at risk should the bank not have acted.

Many questioned the move. Some pundits see it as socialism for the rich, bailing out bankers who got too greedy. Others interpreted these events as evidence of a financial system hopelessly addicted to easy money. While some armchair economists, like me, enjoy the drama and romanticise collapse.

These points miss the mark for three reasons: First, a central bank’s primary job is to ensure the smooth functioning of the financial system. Without that, price discovery cannot happen, and runaway feedback loops needlessly destroy lives. Second, pensions shouldn’t be at risk. The pension system reduces the retirement funding burden on the state, increases economic confidence, and raises living standards. Third, investment managers and regulators, not civilians, are to blame. The time for finger-wagging is after the blaze is extinguished and the family has been saved.

Money markets

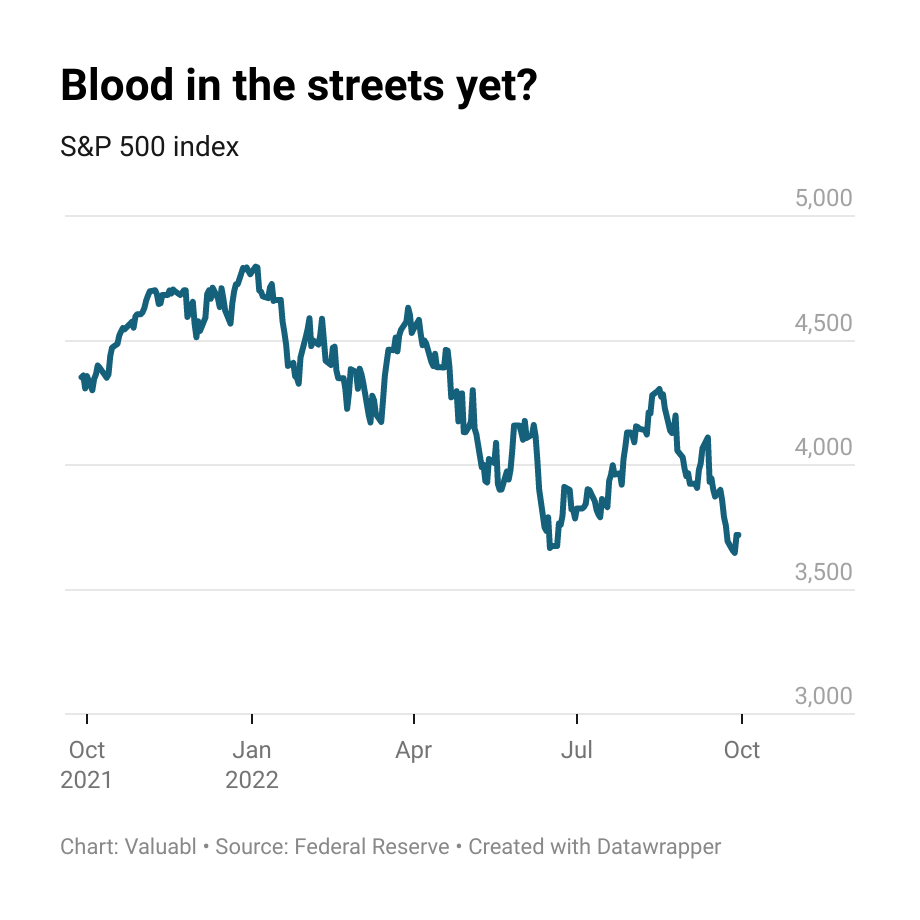

Stock markets tanked last fortnight.

The S&P 500, an index of big American firms, fell 6% to 3,719. Investors knocked $7.5trn off global market capitalisations (see: Global stocktake) while inflation-adjusted interest rates and risk premiums rose.

The market is down by almost a quarter since January and is 15% lower than a year ago. It continues to plumb new depths. The VIX, a volatility index used to estimate investor uncertainty, rose from 26 to 32. Investors are becoming increasingly wary.

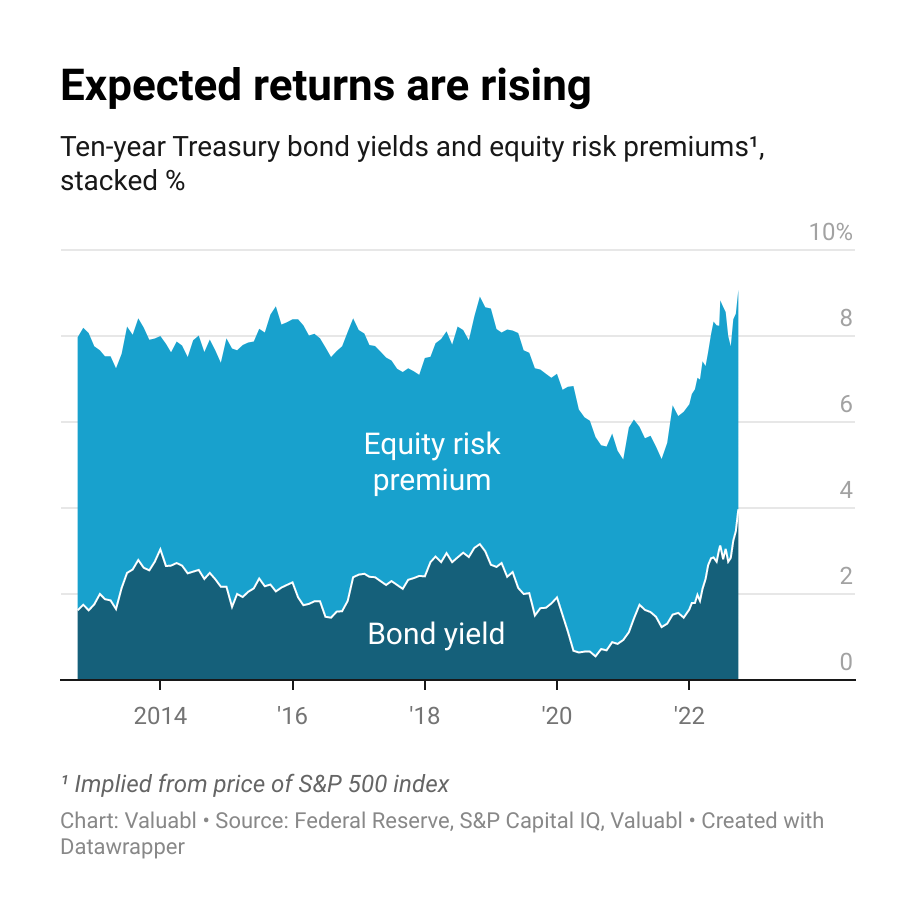

The price of American government bonds fell again. Yields, which move inversely to prices, went up despite inflation expectations dropping. The yield on a ten-year American Treasury bond, a key variable for valuing financial assets worldwide, climbed 56 basis points (bp) to 4%. Bond investors’ forecasts for inflation over the next decade dropped by 13bp to 2.3% per year.

The real interest rate, the difference between yields and expected inflation, rose by 69bp—this follows its 29bp rise last. Fixed-income investors expect to increase their purchasing power by 1.6% per year. This heroic real-return is 2.7 percentage points better than at the start of the year and is the highest since 2010.

Stock investors reckon stocks are a bit riskier than last fortnight. The equity risk premium (ERP), the extra return investors demand to buy stocks instead of bonds, went up by 5bp to 5.1%. The premium is still in line with the past five years’ average of 5.1%. It is up 34bp since the start of the year and 90bp in the past 12 months.

The cost of equity, the return stock-investors demand to part with their money, rose to 9.1%, up 61bp from last fortnight when Valuabl last went to press. Equity costs—which we can think of as expected returns—have risen 2.8 percentage points since January and 3.3 percentage points in the past year.

Expected equity returns are the highest they’ve been since January 2012.

Creditors are charging more for risk than they did a fortnight ago. Corporate bond prices fell more than government ones did. Credit spreads, the gap between corporate bonds and Treasury yields expanded 13bp. These spreads are up 74bp since the start of the year and 87bp over the past 12 months.

The cost of debt, the return creditors demand, for BBB-rated companies is 5.9%, up 69bp since the last issue of Valuabl. Debt costs have risen 3.2 percentage points since the start of the year and 3.3 percentage points in the past 12 months.

Expected BBB-rated corporate bond returns are the highest since March 2010.

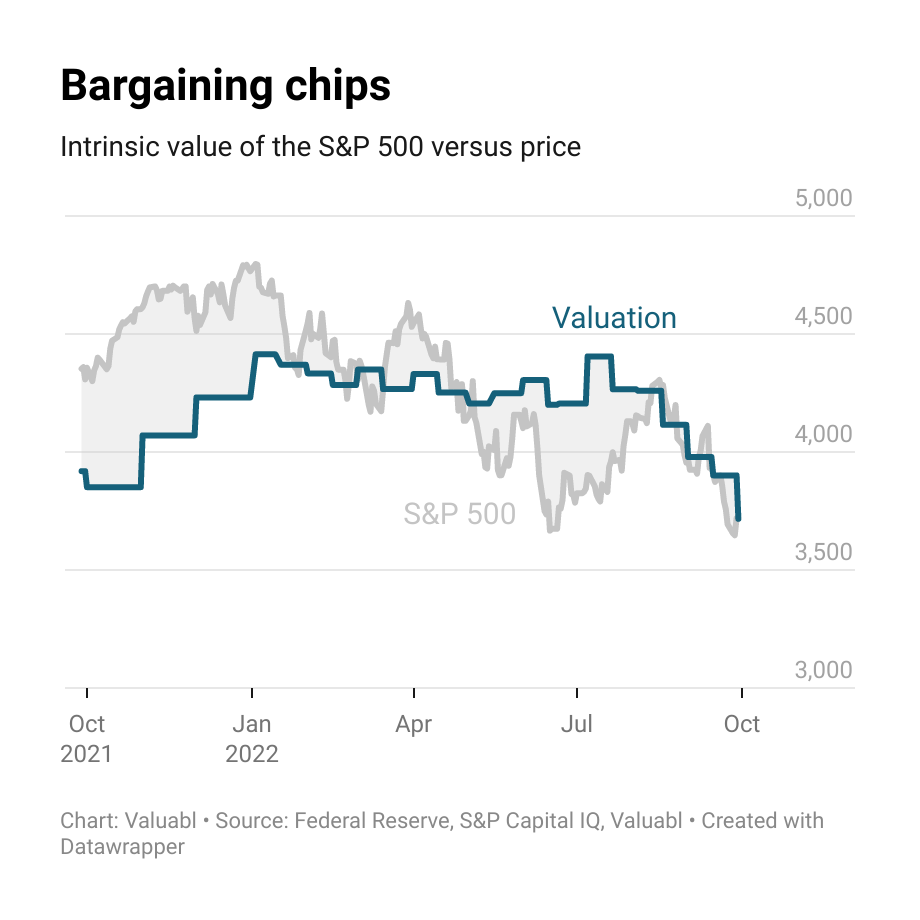

Using the average ERP of the past five years, the current ten-year Treasury bond yield, analysts’ consensus earnings estimates, and a stable payout ratio based on the S&P 500’s average return on equity over the last decade, I value the index at 3,717 compared to its level of 3,719.

While analysts expect big American companies to earn slightly less next year ($223.8 per share) than they expected them to last fortnight ($225.3 per share), rising real interest rates are taking a hatchet to valuations.

This valuation suggests the S&P 500 index is fair value. Investors buying this index of stocks can expect a 9.1% per year return at these prices and be fairly compensated for their risk.

Money talks—it just needs an interpreter

You are at the end of the free portion of Valuabl. Become a paid subscriber to access all issues and investment ideas.

Take an annual subscription to Valuabl and get three months for free.