Vol. 2, No. 26

The S&P 500 is fairly valued. Globally, public companies paid out $3.4trn in the past year. The end of the tightening cycle is approaching. Value in an Eastern European market exchange.

Welcome to Valuabl, a twice-monthly digital newsletter providing rigorous, value-oriented analysis of the forces shaping global capital markets. New here? Learn more

HOUSEKEEPING

On January 1st, the price of a new Valuabl subscription will rise from $740 per year to $964. Get clarity on where to invest by upgrading to a paid membership today.

And don’t be a Scrooge—give a subscription to a mentee, colleague, friend, or family member this Christmas.

In today’s issue

Cartoon: All I want for Christmas

Ideas arena

Cost of capital (3 minutes)

Global stocktake (3 minutes)

Credit creation, cause and effects (5 minutes)

Debt cycle monitor (3 minutes)

Rank and file (2 minutes)

Investment idea (22 minutes)

"Just as food eaten without appetite is a tedious nourishment, so does study without zeal damage the memory by not assimilating what it absorbs."

— Leonardo da Vinci

Cartoon: All I want for Christmas

Ideas arena

Intelligent debate with a global community in subscriber-only discussions.

•••

Top topics from the ideas arena

Cost of capital

Interest rates are finance’s most important yet misunderstood prices. Here’s what happened to the cost of money in the past fortnight.

•••

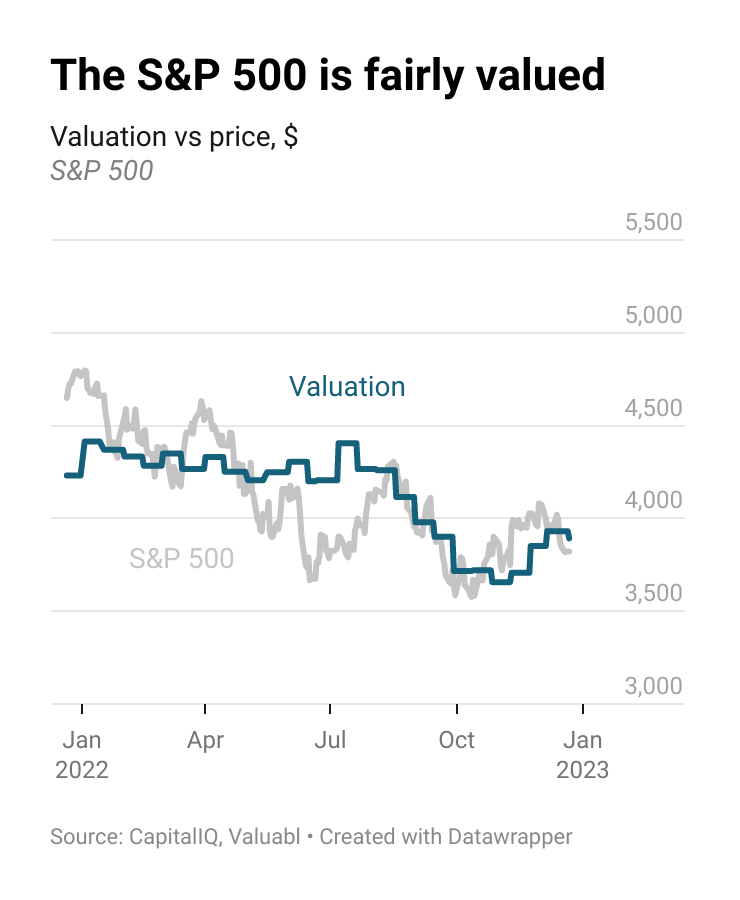

Stock prices fell again last fortnight. The S&P 500, an index of big American companies, dropped 3% to 3,822. But investors cut $5.6trn from global market capitalisations (see: Global stocktake) as inflation-adjusted interest rates rose. The market has bounced back from its October lows but is still down 18% in the past year.

I value the S&P 500 at 3,893, which suggests it is fairly valued.

The companies in the index earned $1.8trn after tax in the past year. They paid out $504bn in dividends and $1,025bn in buybacks and issued $72bn worth of equity. Analysts reckon their earnings will rise to $1.9trn as companies report by the end of this year and $2trn next.

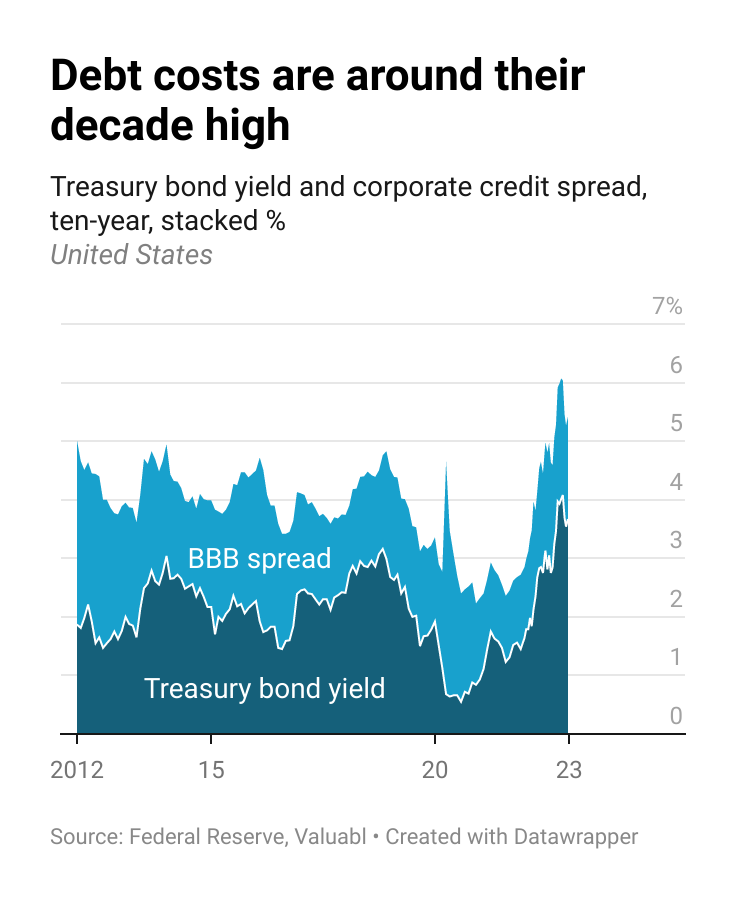

Government bond prices fell. Yields, which move the opposite way to prices, rose as inflation expectations did. The yield on a ten-year US Treasury bond, a critical variable analysts use to value financial assets, climbed 27 basis points (bp) to 3.7%. Investors expect inflation to average 2.3% over the next decade, up 1bp from the rate they expected last fortnight.

Hence, the real interest rate, the difference between yields and expected inflation, jumped 26bp to 1.4%. These inflation-adjusted rates rose 2.4 percentage points in the past year.

Corporate bond prices also fell. Credit spreads, the extra return creditors demand to lend to businesses instead of the government, inched up by 1bp to 1.8%. The spread on these BBB-rated bonds is up 50bp in the past year.

The cost of debt, the annual return lenders expect when lending to these companies, leapt 28bp to 5.4%. Refinancing costs have almost doubled, up 2.7 percentage points, in the past year. Lenders now charge firms about the highest interest rates since 2009. But these rates are on track to return to their long-term average.

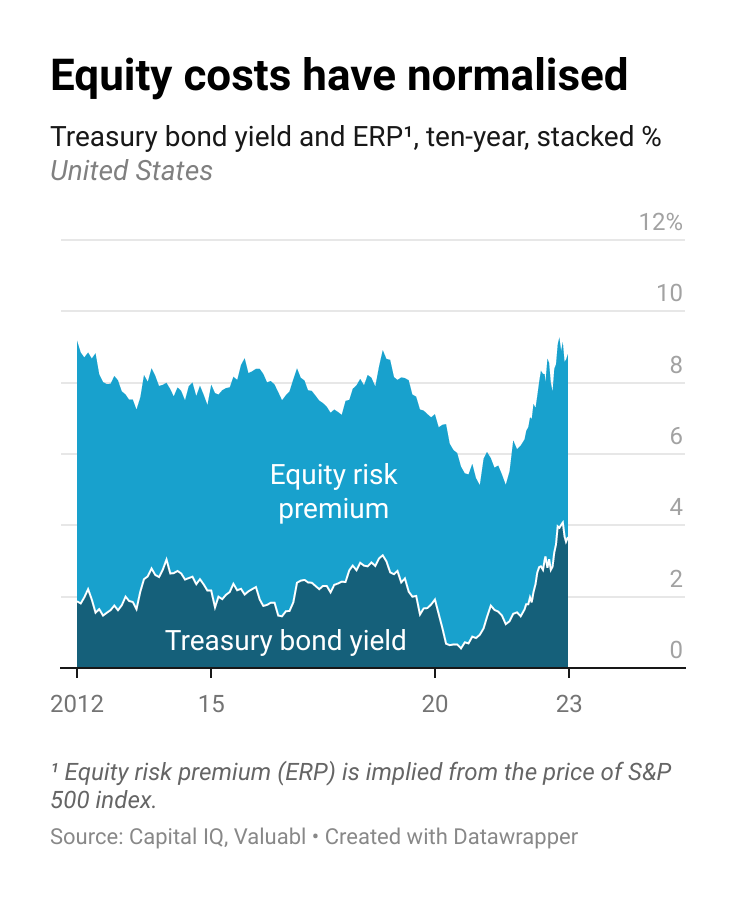

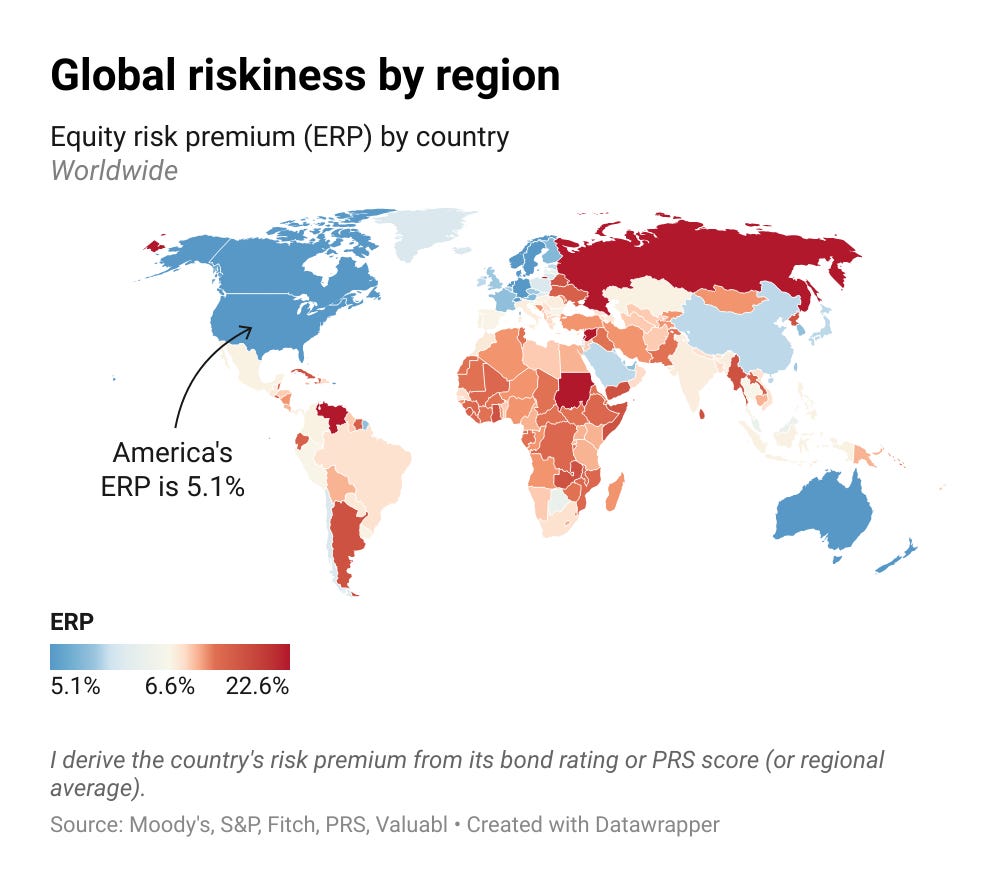

The equity risk premium (ERP), the extra return investors demand to buy stocks instead of risk-free bonds, rose 3bp to 5.1%. It’s now 35bp higher than where it was a year ago. In addition, the cost of equity, the total annual return these investors expect, rose 30bp to 8.8%, 2.6 percentage points higher than last year. These expected returns are also in line with the long-term average.

Now that equity costs have normalised and hover around their long-term average, stock market movements should be driven by earnings expectations. I will watch closely how these evolve over the next few months.

Money talks—it just needs an interpreter

You are at the end of the free portion of Valuabl. Become a paid subscriber to access all issues and investment ideas.

Global stocktake

Valuing regional and global stock markets to help us find the best ponds in which to fish for value.

•••

The valuations

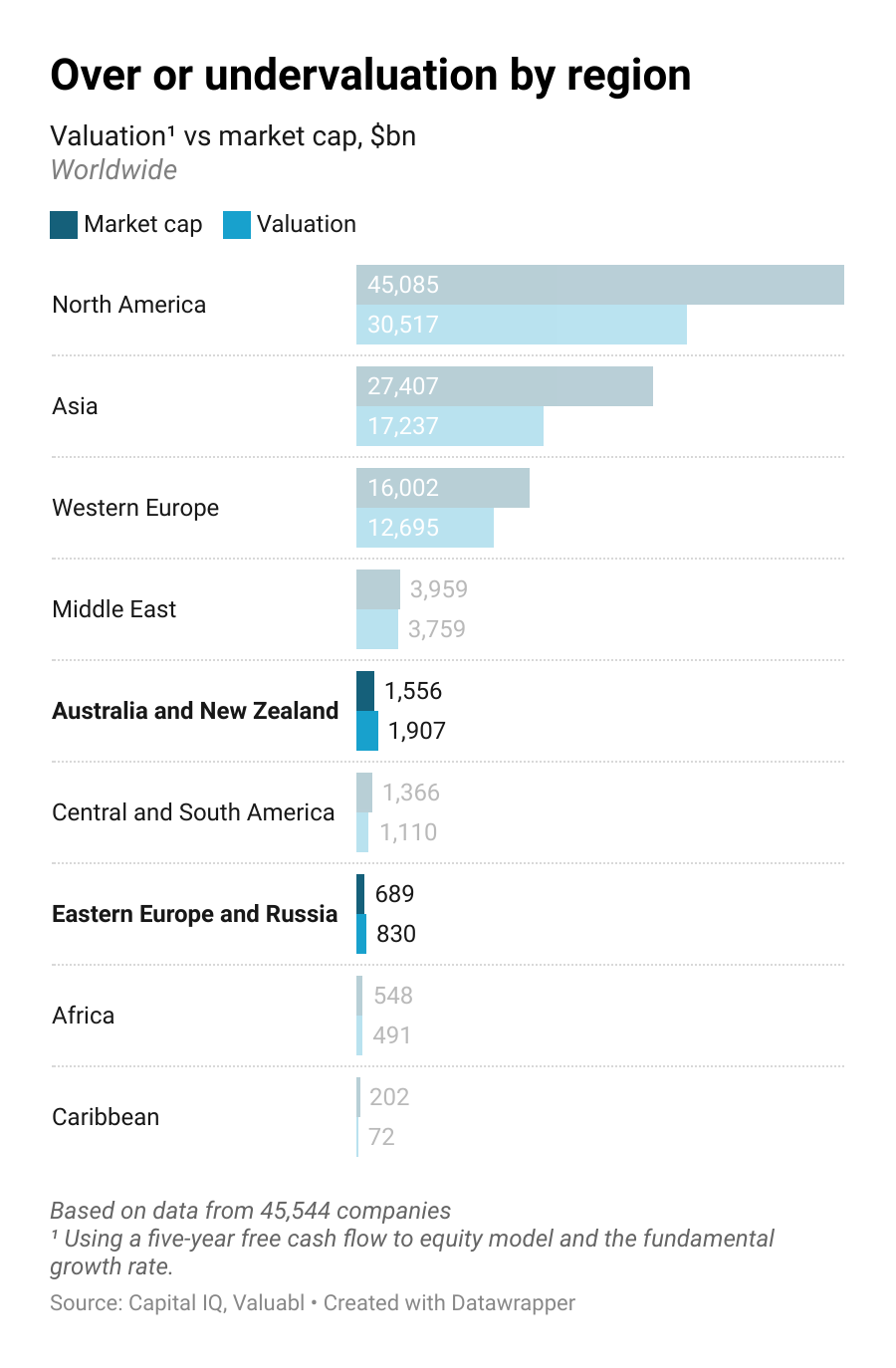

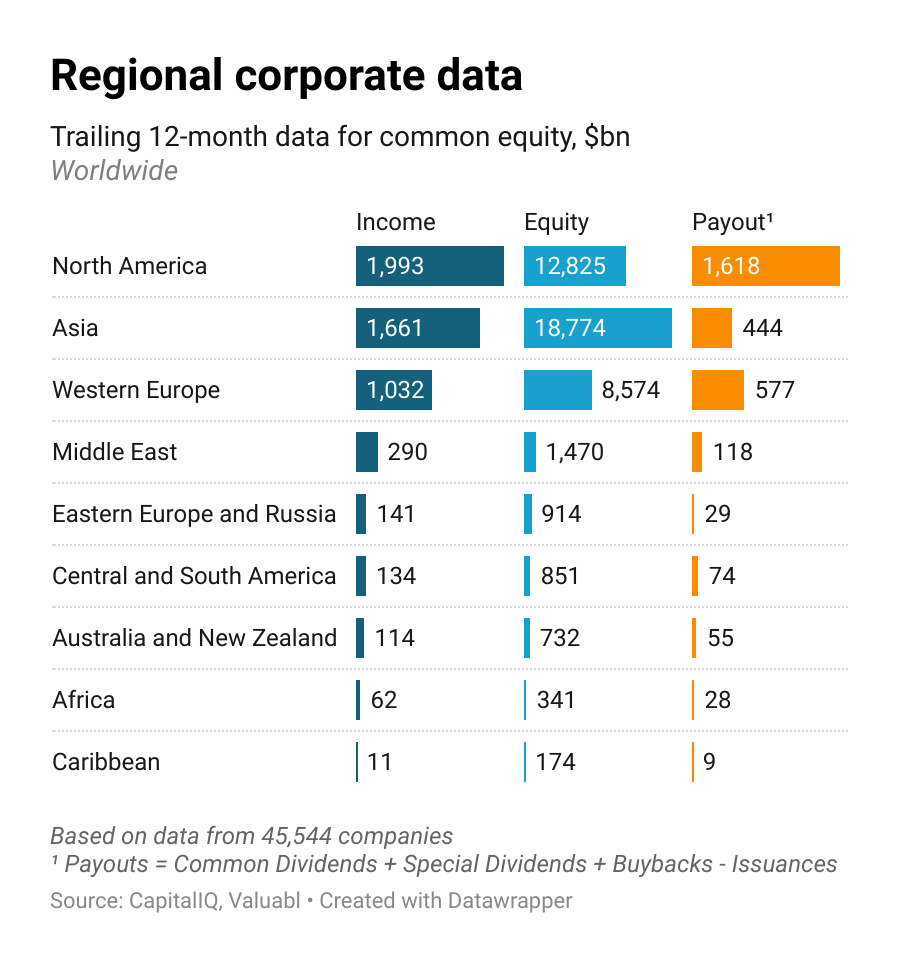

I used a five-year free cash flow to equity (FCFE) model and the fundamental growth rate, the growth in earnings predicted by the return on equity and retention ratios, to value stocks at $68.3trn globally. This model suggests stocks are worth 5% less than a fortnight ago. But given the $97trn price tag, global share markets, on average, still don’t look attractive to shrewd value investors.

Eastern European and Antipodean stocks look the cheapest. But Caribbean, Asian, and North American ones look the most expensive.

Country and regional risks

The global equity risk premium, the extra return investors demand to buy global shares instead of bonds, increased by 3bp to 6.5%.

No government bond ratings changed.

Regional and sectoral data

Investors sliced $5.6trn off global stock markets last fortnight. The market capitalisation of all publicly traded companies tumbled to $97trn as incomes and payouts dropped. The amount of equity capital invested in these companies also fell. It went down by $1.1trn, or a 2.5% drop in just a fortnight.

Many investors and bosses expected the global economy to fall into recession. As a result, they encouraged companies to save money, trim staff, and reduce payouts. Payout ratios dropped. But, incomes haven’t fallen as many feared, and payouts are rising again—the global payout ratio inched up to 54.3% from 53.8%. This suggests bosses are less nervous about the economy than they previously were. As of publication, public companies had returned almost $3trn of their $5.4trn in after-tax income to shareholders in the past year.