Vol. 2, No. 4

On the cost of capital. Corporate shuffleboard. Credit creation, cause & effect. An undervalued Chinese classifieds business.

Valuabl is an independent, value-oriented journal of financial markets. Delivered fortnightly, Valuabl helps contrarians pop bubbles, buy low, and sell high.

HOUSEKEEPING

To include the latest data from the Fed’s h.4.1 Thursday releases, Valuabl will be delivered every second Friday, instead of Thursday.

In today’s issue

The cost of capital (3 minutes)

Corporate shuffleboard (3 minutes)

Credit creation, cause & effect (6 minutes)

Investment idea (12 minutes)

The cost of capital

U.S. stocks extended their losses from January as they fell again last fortnight. The S&P500, an index of U.S. stocks, started the month at 4,516 and fell 2.5% to 4,402 by February 14. The market is down 2.5% for the month, down 7.6% for the year, and up 11.9% for the last twelve months. Headlines seemed less apocalyptic than they did in the previous fortnight, although concerns about inflation and the Russo-Ukrainian conflict remained front and centre.

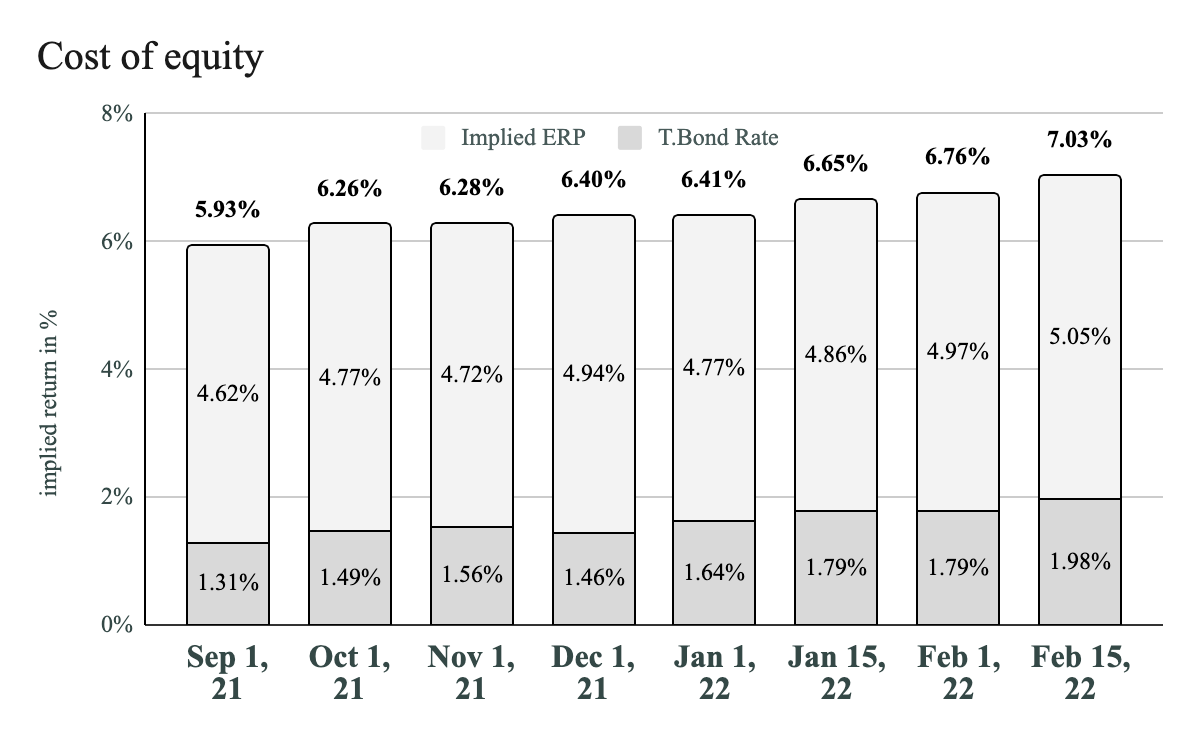

Last fortnight, the yield on 10-year Treasury bonds increased by 19bp from 1.79% to 1.98%. They briefly broke through the 2% mark before declining and are at their highest level since July 2019. The 10-year breakeven inflation rate also increased by 4bp to 2.48%. But, even with Treasury bond yields rising, investors are still willing to endure negative real returns.

The equity risk premium (“ERP”) increased by 8bp from 4.97% to 5.05% and is at its highest level since 2019. The cost of equity—or the implied return—for U.S. stocks increased by 27bp from 6.76% to 7.03%, its highest level since 2019.

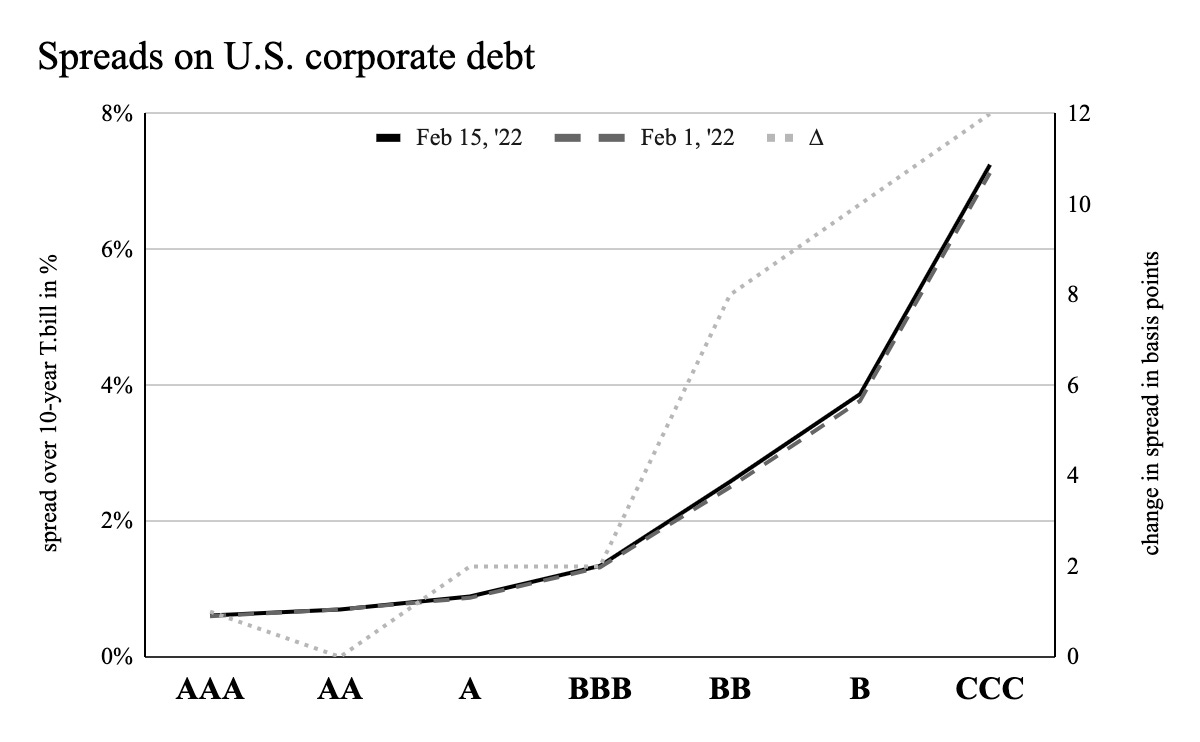

U.S. corporate debt spreads increased a little, too, with the lower-rated end increasing more than the higher-rated end. Spreads on CCC corporate bonds increased by 12bp, while BBB ones increased by 2bp, and AAA ones increased by 1bp. Compared to a fortnight ago, it costs the average AAA rated corporation an extra 20bp to borrow, the average BBB rated corporation an extra 21bp to borrow, and the average CCC corporation an extra 31bp to borrow.

Using the average ERP of the last 5-years, the current 10-year T.bill yield, analysts’ consensus earnings estimates, and a stable payout ratio based on the S&P500’s average return on equity over the last decade, I value the index at 4,284 compared to its level of 4,402. This suggests it is 2.8% overvalued.

READY FOR MORE?

Valuabl is a reader-supported publication. To receive new issues and support independent research, consider becoming a free or paid subscriber.

Corporate shuffleboard

A smattering of headlines from the world of corporate shuffleboard. Pushing discs won’t create value, but it can springboard its revelation.

Initial public offerings

Vår Energi offer price fixed at NOK 28 per share.

Hualan Biological Becterin set pricing for Shenzhen IPO.

AD Ports raised $1bn before market debut.

Spanish fashion retailer, Tendam, sees €2bn valuation in IPO.

Thyssenkrupp CFO said possible listing of Nucera would take place in H1.

Kids Clinic India filed for IPO.

Al-Dawaa Medical Services IPO price range set at SAR 65-73 per share.

India’s Life Insurance Corp filed for $8bn IPO.

Mergers & acquisitions

Shipping group MSC targets successor to Alitalia.

British Government fined JD Sports (LON: JD), Footasylum $6.4m for breaching terms.

End of Lockheed-Aerojet (NYSE: LMT, AJRD) deal pressures leadership of both firms.

Intel (NASDAQ: INTC) unveiled $5.4bn Tower (TLV: TSEM) deal.

Crypto firm Fireblocks bought payments tech platform for $100m.

Spotify (NYSE: SPOT) acquired Podsights and Chartable to grow podcasting business

U.S. sued to stop merger of Rhode Island hospital companies

Divestitures & spin-offs

Repsol (BME: REP) struggled to tempt buyers to renewables unit.

Toshiba (TYO: 6502) is considering sale of air conditioner business.

Danish pension fund ditched Wizz Air (LON: WIZZ) over labour rights.

Italy’s Leonardo (BIT: LDO) suspends search for automation division partner.

Discovery-WarnerMedia (NASDAQ: DISCA) deal cleared U.S. antitrust review.

Australia’s AGL (ASX: AGL) sees job cuts, cost savings as demerger plans progress.

EDF (EPA: EDF) confirms deal to take over French nuclear turbine unit from GE (NYSE: GE).

Informa (LON: INF) announced sale of Pharma Intelligence for £1.9bn to Warburg Pincus (NYSE: WPCA).

RWE (FRA: RWE) could add $19bn in value if it ditches brown coal according to Enkraft.

Share repurchases & buybacks

Essilorluxottica SA (EPA: EL) buyback reflects confidence in long-term prospects.

Amgen (NASDAQ: AMGN) to buy back $6bn in shares this quarter.

ArcelorMittal (AMS: MT) raised dividend and announced new $1bn capital return.

SPREAD THE WORD

Help make Valuabl an indispensable part of your friends’ and associates’ fortnightly routines. Click the button below to spread the word.

Credit creation, cause & effect

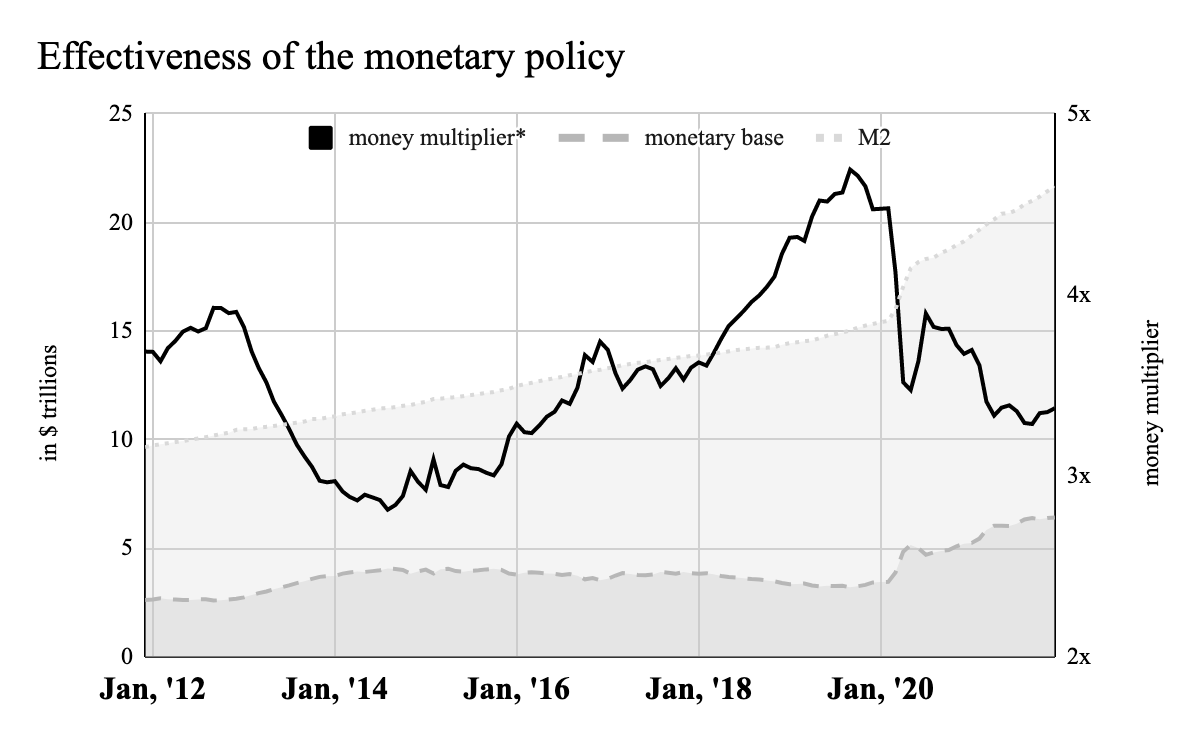

The Federal Reserve buys and sells securities and sets interest rates to influence: borrowing costs, lending activity, inflation and employment; to varying effects.

The Federal Reserve buys & sells securities

The Fed’s balance sheet expanded by $20.85bn last week as they bought more U.S. Treasury and mortgage-backed securities. The balance sheet has grown by $30.04bn over the last fortnight. Growth in U.S. Treasury security holdings is decelerating and is down to 9.7% for the previous month on a compound annual rate of change (“CAR”) basis. Monthly growth in mortgage-backed security holdings is decelerating too, but is still at 15.0%, as the Fed continued supporting the housing market. Total Reserve Bank credit grew at 8.6%, much slower than the quarterly, semiannual, and annual rates, indicating that the quantitative easing is slowing.

The Fed has signalled that they are likely to prioritise reducing the size of their mortgage-backed security portfolio over reducing the Treasury security holdings. They also signalled that this could mean active selling rather than letting the assets run off the balance sheet by holding them to maturity. As with everything the Fed says, their signals here are hedged and, of course, ‘data dependent.’

And sets interest rates

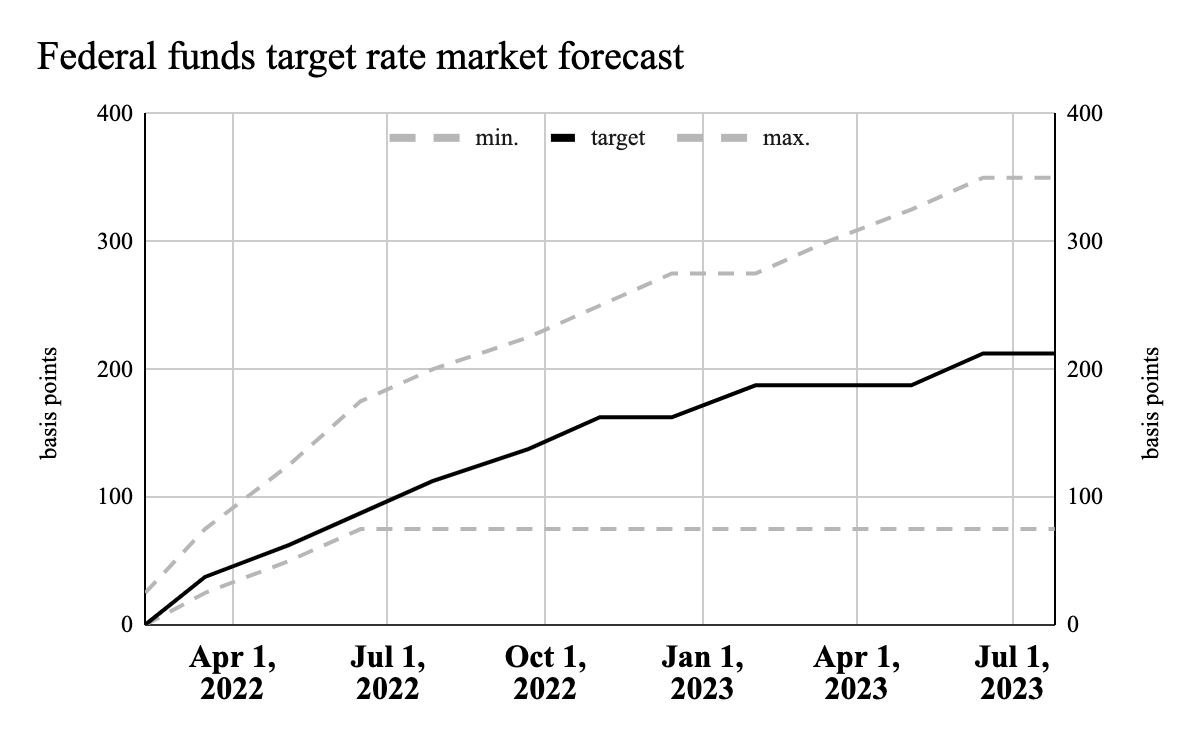

Federal Funds futures contract prices implied that consecutive rate hikes on March 16, May 4, and June 15 are almost inevitable. Further, the market expects a 25bp rate hike at every meeting bar the December 14 one this year, which would see the Federal Funds target rate reach 150-175bp by year-end. As the market sees it, the lower bound for rates by year-end is 75bp, while the upper bound is 275. Rates are going to rise. How quickly, and by how much is now the operative question.

To influence: borrowing costs

Treasury security yields rose dramatically across all maturities last week. The 10-year yield, a critical global measure for valuing financial assets, broke through 2% for the first time since 2019 as investors sold these assets in anticipation of rate rises. Short and medium-term bond yields rose the most. Three and 6-month yields rose by 14bp and 15bp respectively, while the 30-year rose by 12bp.

Lending activity

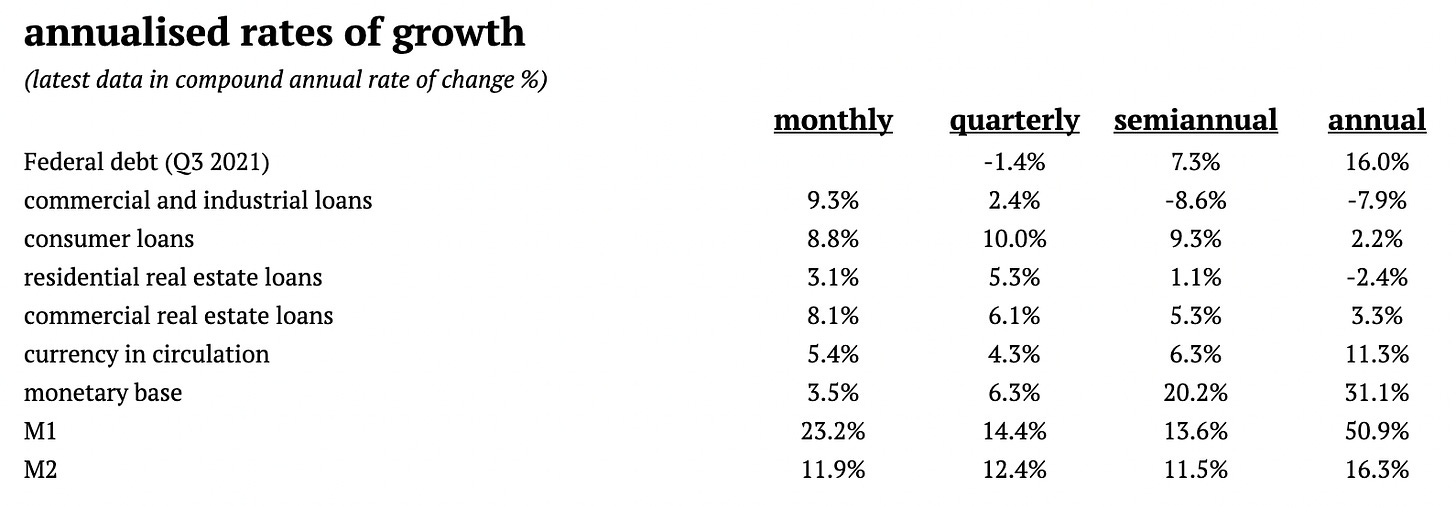

Low rates, and the fear of higher rates in the future, continued to drive growth in lending activity last month. Businesses, consumers, and landlords all borrowed more than they did a year ago. Credit flows are high as total credit expands.

However, even though the monetary base and the amount of currency in circulation are both expanding, they’re doing so at lower and declining rates. The M1 money supply is still growing explosively, while M2 growth is much more subdued and steady at 11.9% for the month.

The economy is still in the credit and monetary expansion phase despite rate rises to come. Lending activity lags, so the numbers here will be illuminating over the next few months. Will the economy slide into credit and monetary contraction? Watch this space.

Inflation & employment

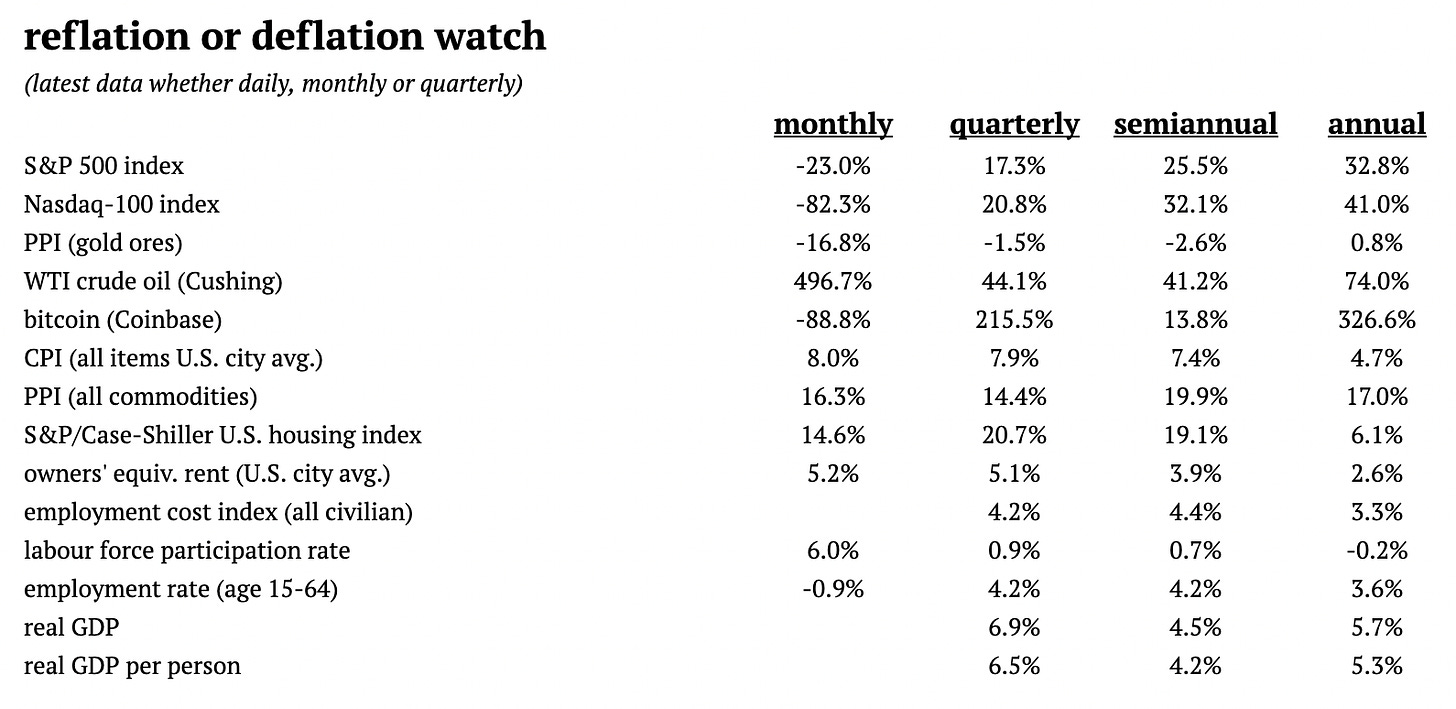

As markets, especially the tech-heavy, speculative end, declined, the WTI crude oil price rocketed and is up 74% on this time last year. Bitcoin continued its slump, giving weight to the argument that it is neither a store of value nor an uncorrelated hedge. The two primary measures of inflation, the CPI and the PPI, both grew at historic levels. CPI growth hit 8% last month, higher than the quarterly, semiannual and annual rates. PPI growth continued to be enormous, at 16.3%. Labour force participation increased substantially last month, but the employment rate dropped.

Markets and speculative assets are dropping, energy and housing costs are rising, and inflation is at modern peaks—tempestuous is an understatement.

To varying effects

SHARE WITH A CLICK

It’s a cakewalk! Simply click the share button beside the issue you wish to send to a friend, colleague, or client. They’ll thank you, and so do I.