Vol. 2, No. 6

On the cost of capital. Corporate shuffleboard. Credit creation, cause & effect. Subscribers' requested valuations. An undervalued watch business.

Valuabl is an independent, value-oriented journal of financial markets. Delivered fortnightly, Valuabl helps contrarians pop bubbles, buy low, and sell high.

In today’s issue

The cost of capital (4 minutes)

Corporate shuffleboard (3 minutes)

Credit creation, cause & effect (5 minutes)

Subscribers’ requested valuations (8 minutes)

Investment ideas (15 minutes)

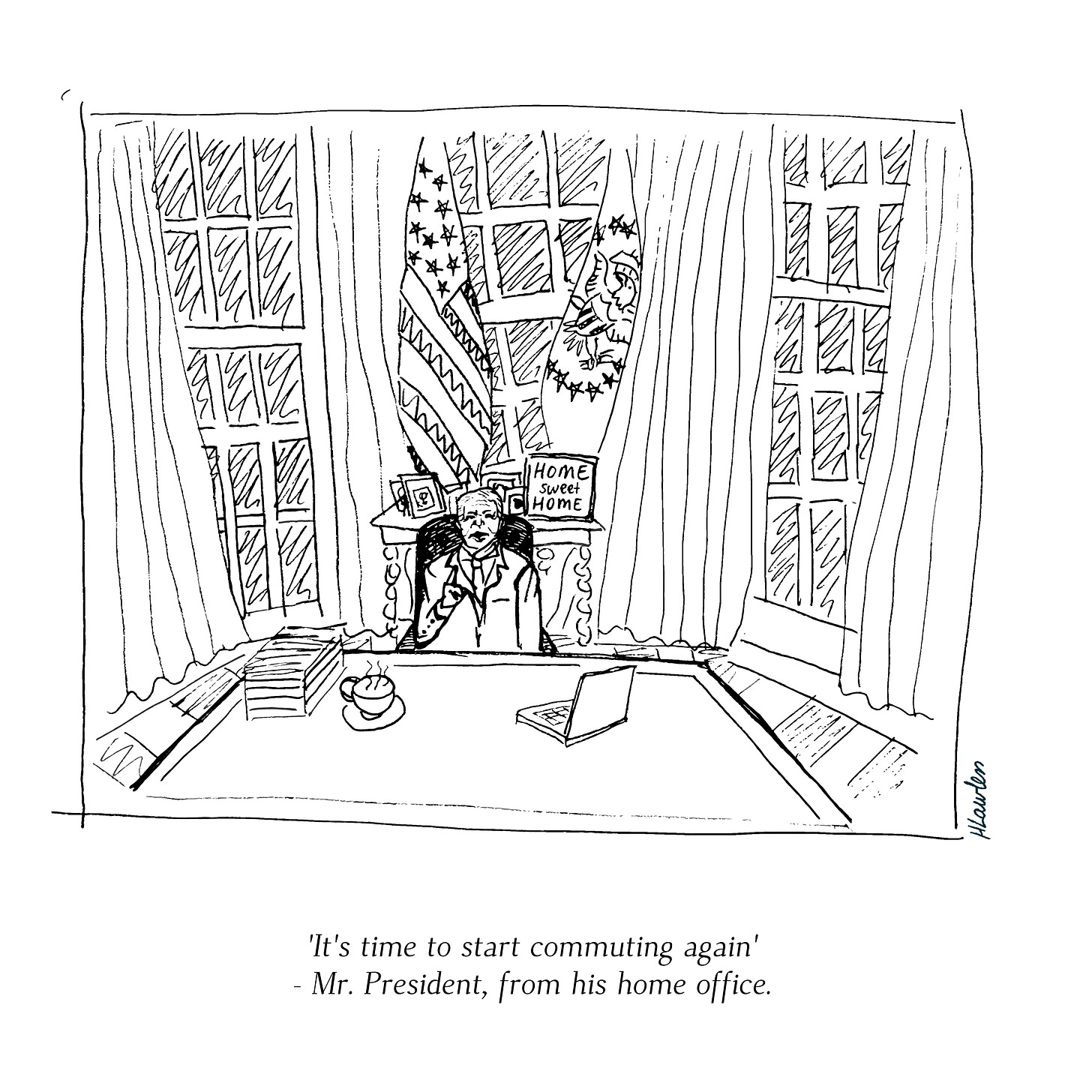

Working from 1600 Pennsylvania Avenue

The cost of capital

Interest rates and capital costs are the most consequential yet misunderstood prices in capitalism, connecting the future to the present.

U.S. stock prices dropped again last fortnight. The S&P500, an index of U.S. stocks, fell 4.6% to 4,173. It started the month at 4,374. The index is down 12.4% for the year but is still up 5.1% over the last 12-months.

The price for 10-year U.S. Treasury notes also dropped, increasing yields. Yields rose by 42bp to hit 2.14%, their highest level in 3 years. The 10-year breakeven inflation rate also increased. The rate was 2.62% at the start of the month and rose to 2.93%, the highest level of expected inflation since the Federal Reserve began reporting this data in 2003. As real yields, the difference between expected inflation and nominal yields, are still negative, investors in these bonds remain willing to lose purchasing power over the next decade.

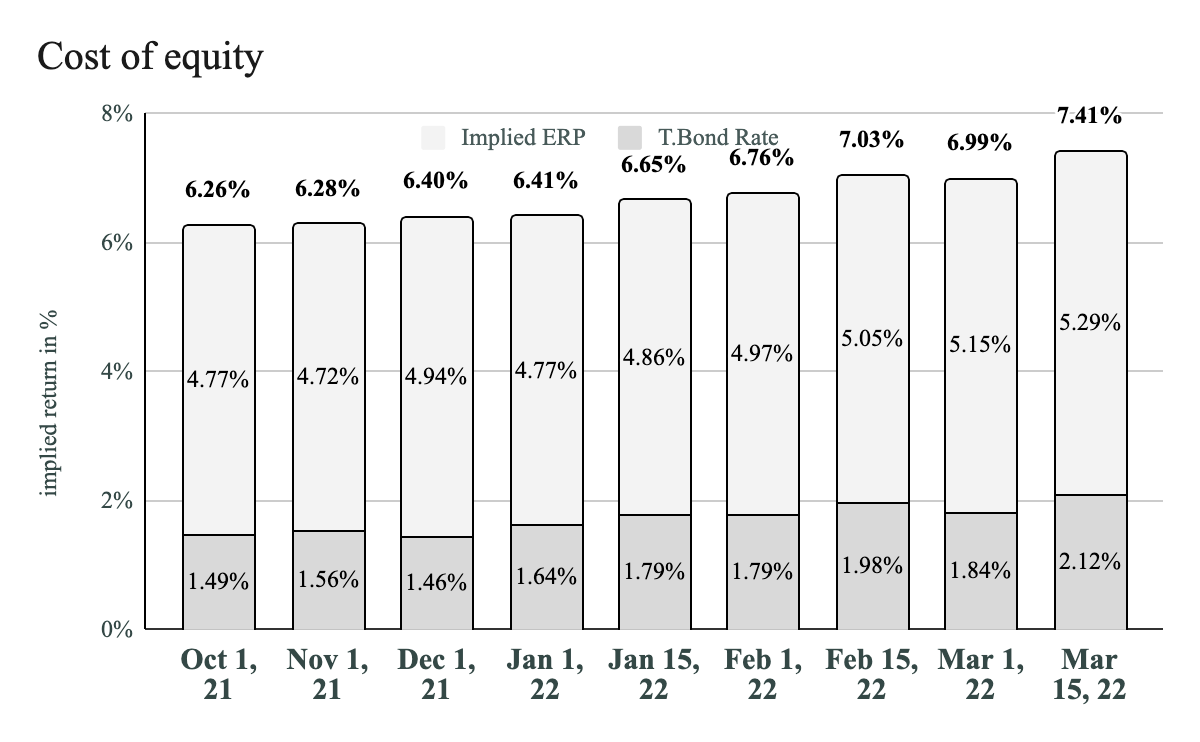

The equity risk premium rose by 14bp to 5.29%, its highest level since 2018. Investors think U.S. equities are 86bp riskier than they were 12-months ago. The cost of equity, and the implied return, for U.S. stocks, increased by a whopping 42bp. Stocks are now offering a 7.41% expected return, their highest implied returns since 2018.

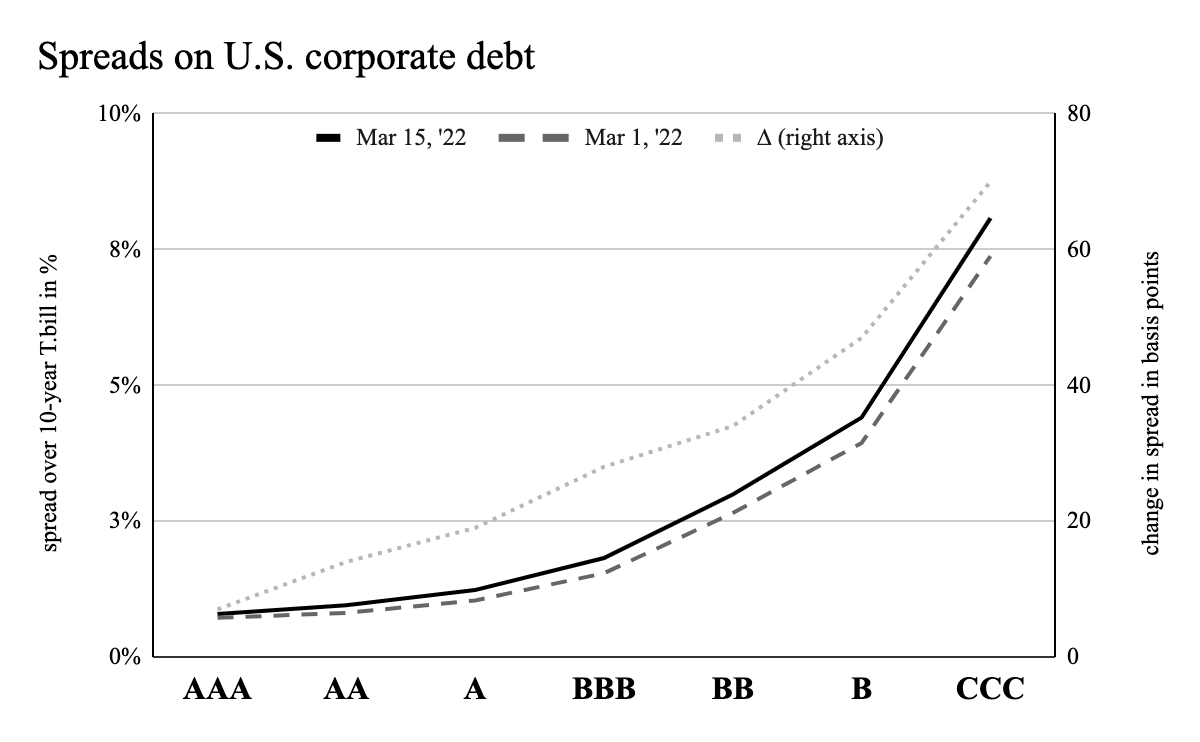

The spreads on U.S. corporate debt over 10-year Treasury bonds rose by 31bp on average. The riskier end of the rating curve rose more than the safe. Spreads on AAA-rated bonds rose by 7bp, while BBB rose by 28bp and CCC by 70. Investors reckon corporate debt is getting riskier.

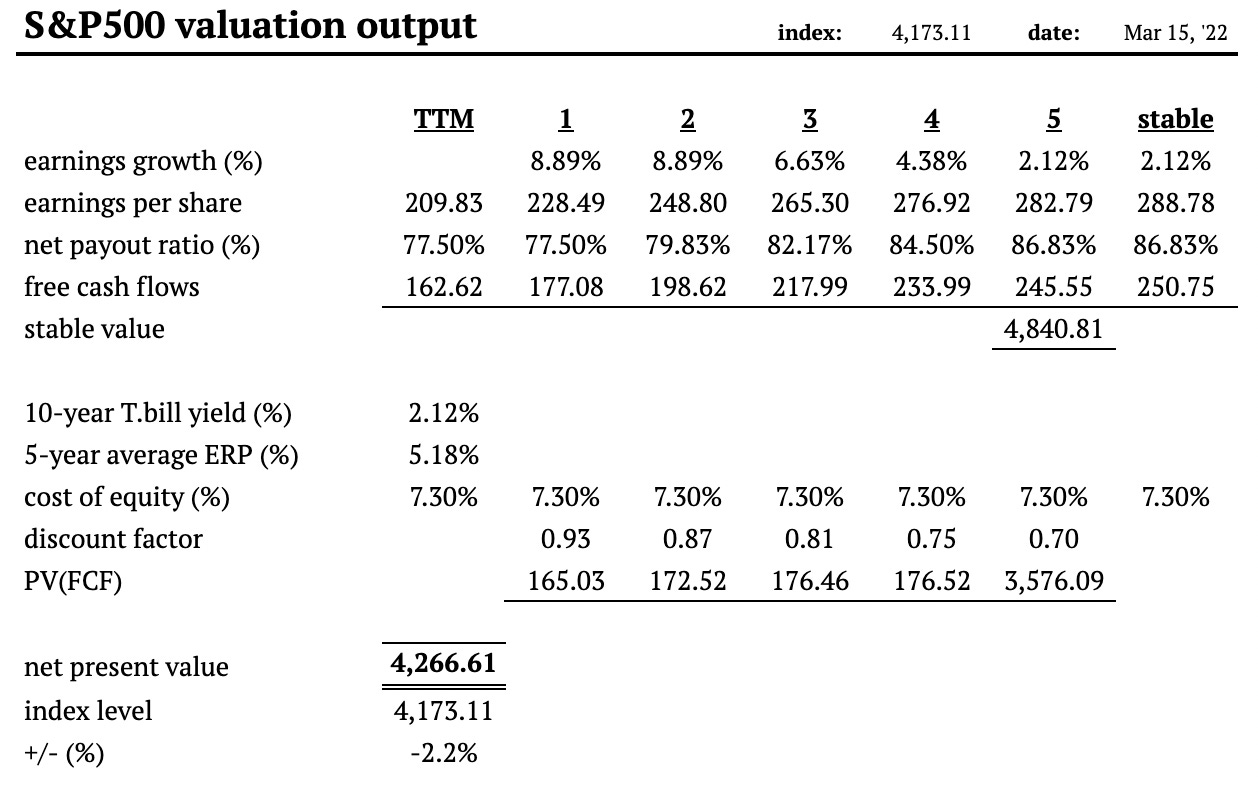

Using the average ERP of the last 5-years, the current 10-year T.bill yield, analysts’ consensus earnings estimates, and a stable payout ratio based on the S&P500’s average return on equity over the last decade, I value the index at 4,267 compared to its level of 4,173. This valuation suggests it is 2.2% undervalued.

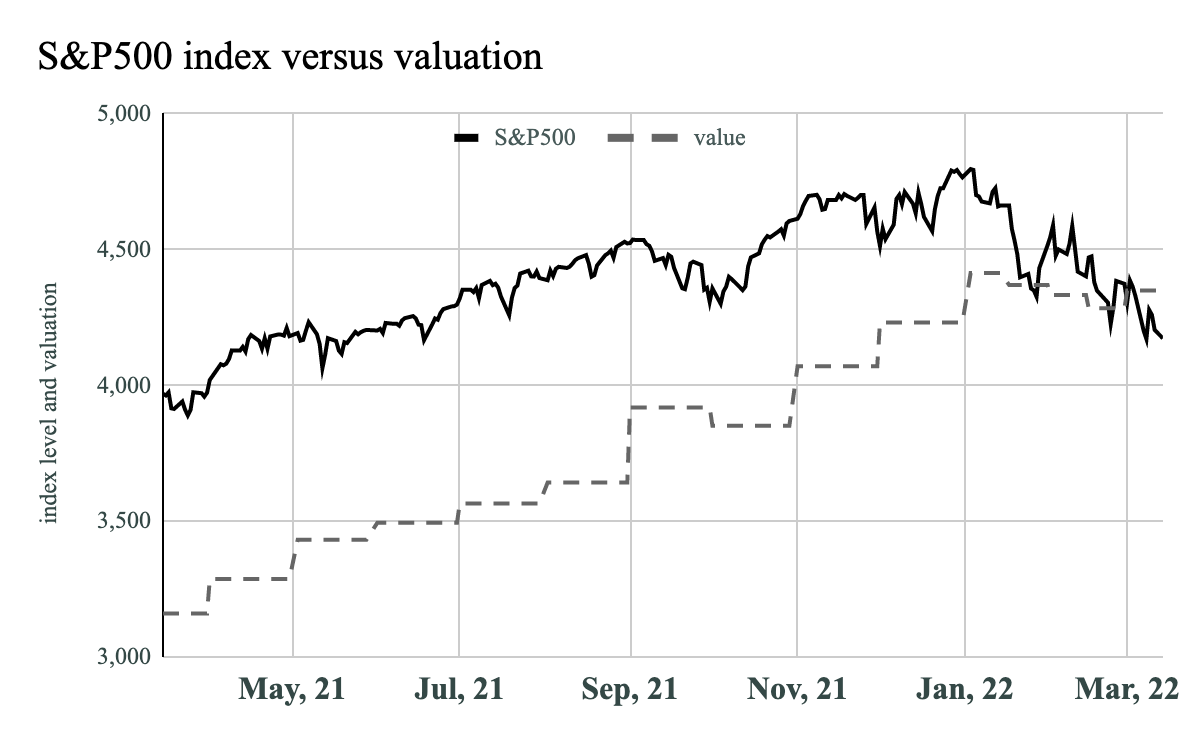

The price of the S&P500 index has, since the start of the year, declined rapidly towards, and now past, my intrinsic value estimate. This valuation suggests the S&P500 index is 2.2% undervalued compared to 8% overvalued at the start of the year and 25.6% overvalued 12-months ago.

READY FOR MORE?

Valuabl is a reader-supported publication. To receive new issues and support independent research, consider becoming a free or paid subscriber.