Vol. 2, No. 8

On the cost of capital. Corporate shuffleboard. Credit creation, cause & effects. Value in fashion retail and a food delivery business.

Valuabl is an independent, value-oriented journal of financial markets. Delivered fortnightly, Valuabl helps contrarians pop bubbles, buy low, and sell high.

HOUSEKEEPING

As a reminder, all valuations and investment ideas are now organised in a searchable archive. Paid subscribers have unfettered access here.

In today’s issue

Cartoon: Housing market mania

The cost of capital (5 minutes)

Corporate shuffleboard (4 minutes)

Credit creation, cause & effect (5 minutes)

Investment ideas (33 minutes)

Cartoon: Housing market mania

The cost of capital

Interest rates capital costs are the most consequential yet misunderstood prices in capitalism, connecting the future to the present.

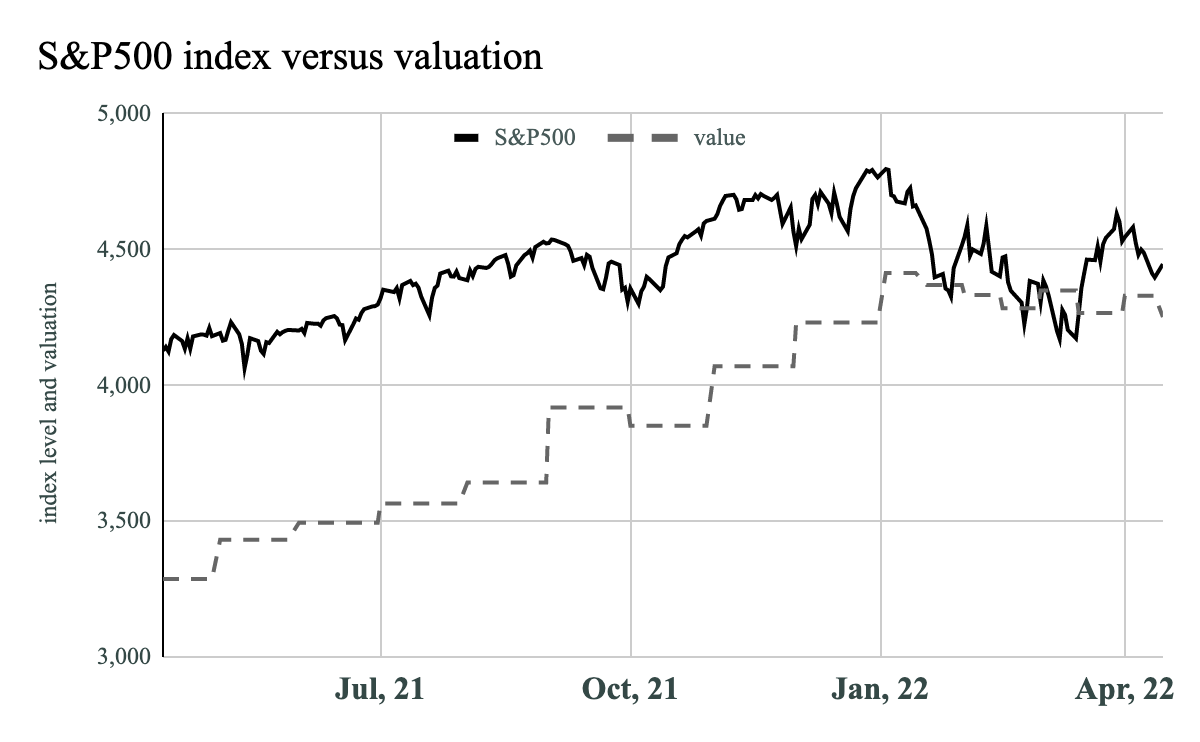

U.S. stock prices fell last fortnight. The S&P500, an index of large U.S. companies, was down 1.9% to 4,447. While the index is up from its March lows, it is down 6.7% for the year to date. However, the market is still up 6.6% over the last 12-months.

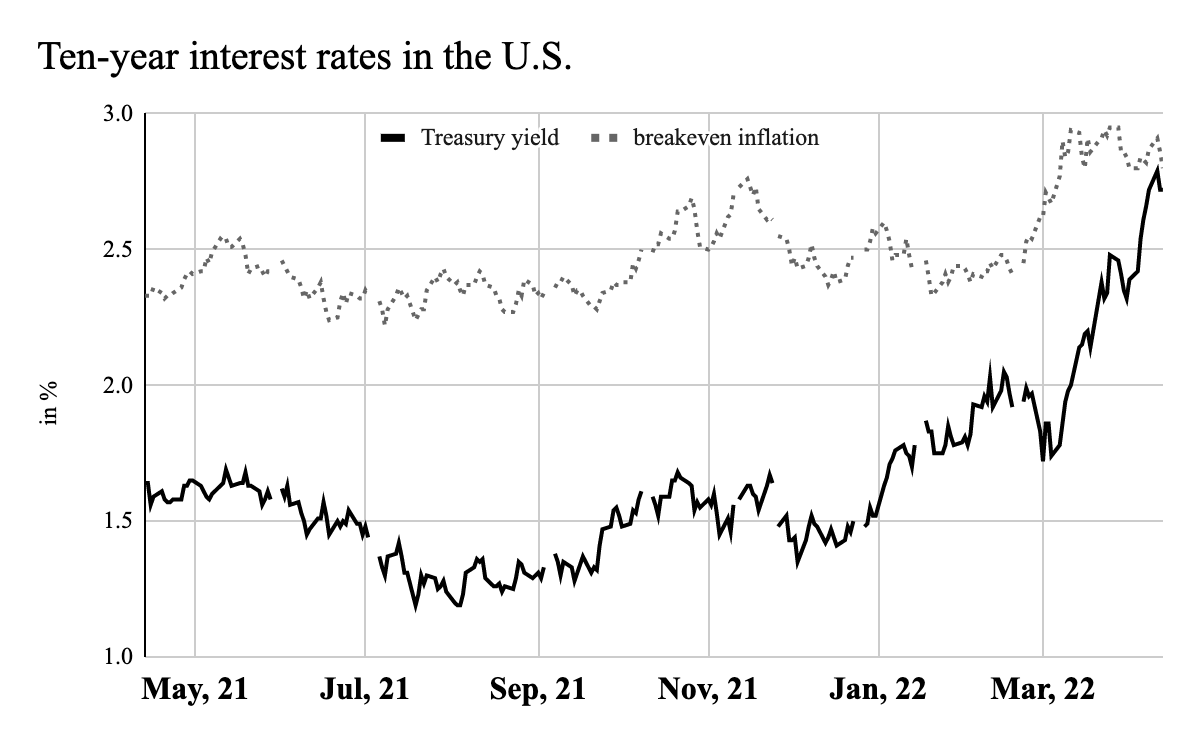

The price of 10-year U.S. Treasury notes dropped again as yields rose. Yields peaked at 2.79% on April 11, their highest point since 2018, before dropping slightly to 2.72%. While Treasury yields were climbing, the 10-year breakeven inflation rate remained steady at 2.86%. These are still historically high levels of expected inflation and about the highest levels since the Federal Reserve began reporting this data in 2003. The rally in yields means the gap between inflation and the risk-free rate is closing fast. Investors are losing just 0.14% of their purchasing power per year by investing in Treasuries instead of 0.52% at the start of the month. Sovereign bonds are beginning to look more attractive. Well, less unattractive, anyway.

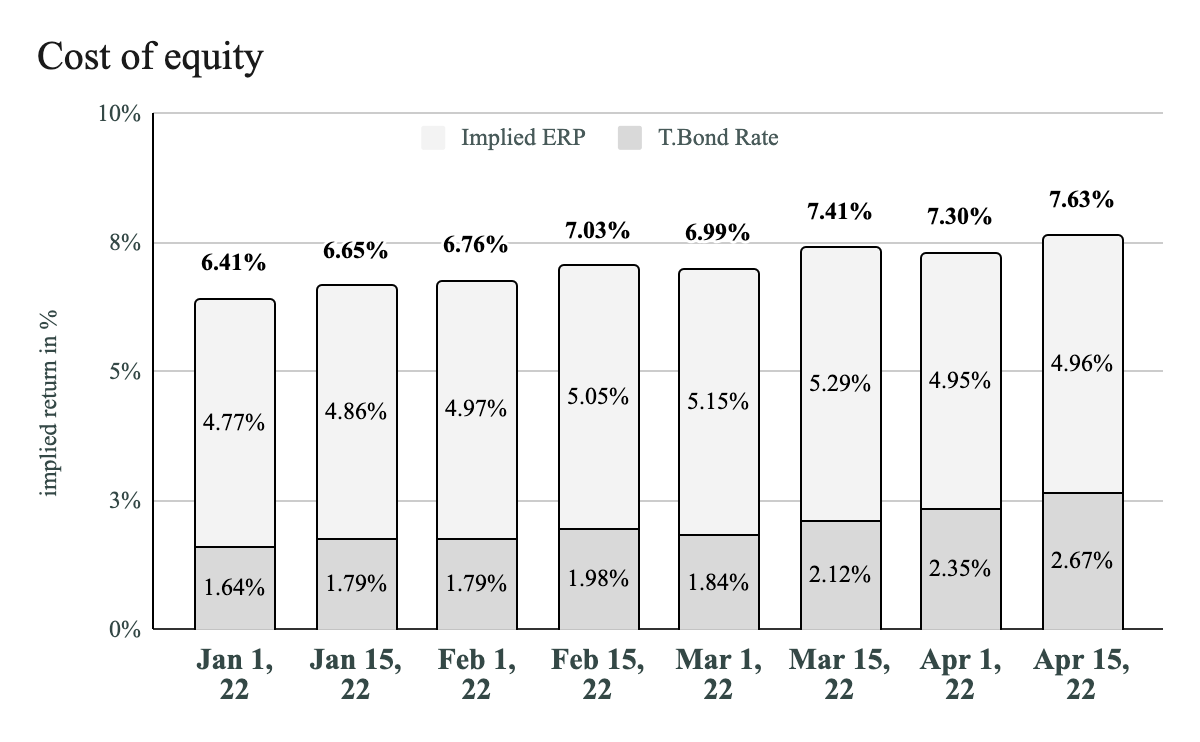

The equity risk premium (ERP), an estimate of the extra return investors demand for investing in stocks over government bonds, rose by a singular basis point. The current ERP, 4.96%, is down from its recent high of 5.29% in March, when investor fear was rapidly rising. The cost of equity, and the implied return, for U.S. stocks, has increased to 7.63%, its highest level since 2018. While risk-free rates are historically low, in the 18th percentile of data going back to 1960, equity risk premiums are above average in the 72nd percentile.

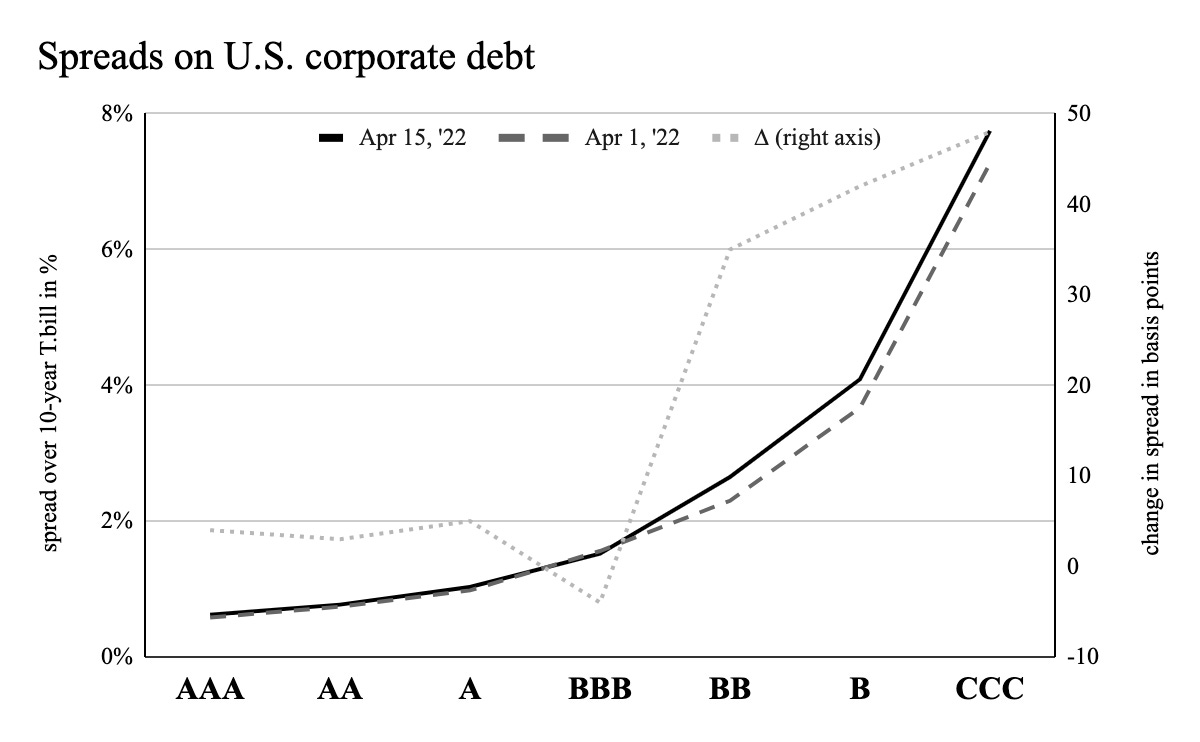

As equity risk premiums rose, so too did the spreads on U.S. corporate debt. The average spread of corporate bonds over 10-year Treasury bonds rose by 19bp. Spreads at the riskier end of the curve rose more than at the safe end. Creditors likely believe that rising interest rates will stress uncreditworthy companies the most. In an anomalyst twist, spreads on BBB-rated bonds fell by four bp.

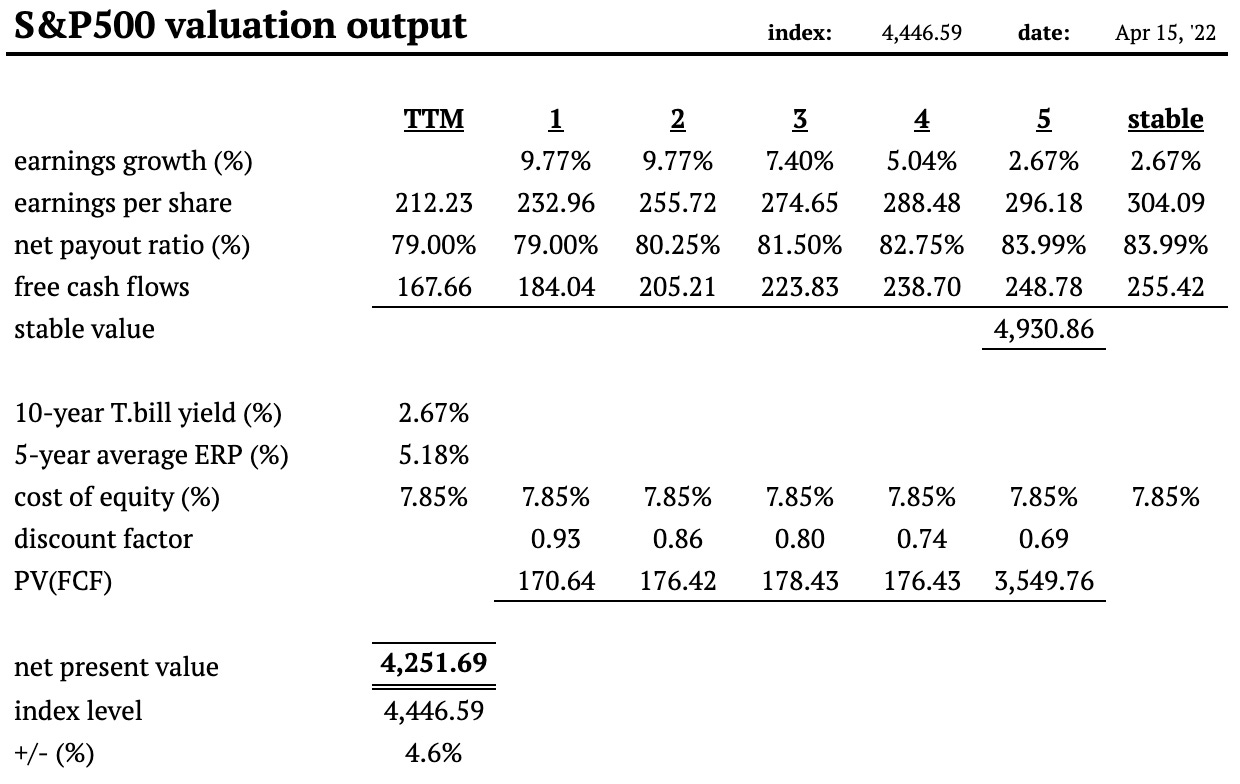

Using the average ERP of the last five years, the current 10-year T.bill yield, analysts’ consensus earnings estimates, and a stable payout ratio based on the S&P500’s average return on equity over the last decade, I value the index at 4,252 compared to its level of 4,447.

This valuation suggests the S&P500 index is now just 4.4% overvalued compared to 8% at the start of the year and 26% 12-months ago.

READY FOR MORE?

Valuabl is a reader-supported publication. To receive new issues and support independent research, consider becoming a free or paid subscriber.