Vol. 3, No. 16 — That’s not a recession… that’s a recession

Australia will probably go into recession next year; How to use the Kelly method to optimise your portfolio; Stocks are overvalued; Value in luxury perfumes and moisturisers

In this issue

Quote from Michael J. “Crocodile” Dundee

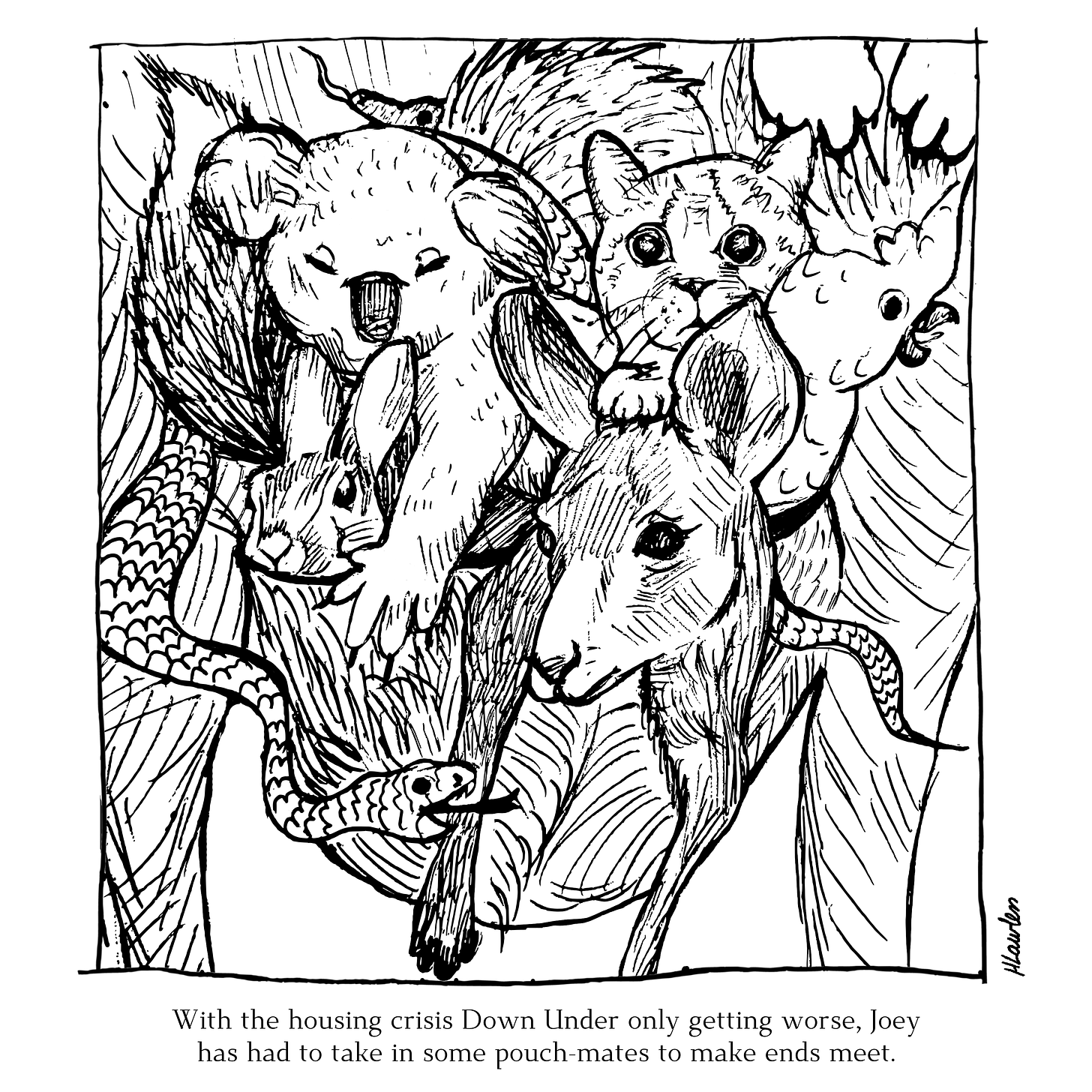

Cartoon: Pouch mates

That’s not a recession… that’s a recession

Di-worse-ification

Cost of capital

Regions and sectors

Stock screen

Debt cycle monitor

Investment idea: L’Occitane International

Read time: 27 minutes

Quotation

"Well, you see, Aborigines don't own the land. They belong to it. It's like their mother. See those rocks? Been standing there for 600 million years. Still be there when you and I are gone. So arguing over who owns them is like two fleas arguing over who owns the dog they live on."

— Michael Dundee

Cartoon: Pouch mates

That’s not a recession… that’s a recession

The thunder is brewing Down Under. Here’s why Australia will probably go into recession next year.

•••

Talking heads refer to Australia as the lucky country. After all, apart from during the pandemic, the country's last recession was in 1992. But the Reserve Bank of Australia (RBA), the country's central bank, has raised interest rates like mad. Some economists expect a recession is on the way. They're right. Rate hikes and the government's surplus will hurt demand. That comes as public sector wages are rising, slowing inflation's decline.

The Australian government is aiming to run a budgetary surplus this year. Jim Chalmers, the Treasurer, says he expects it to be A$20bn, or 3% of GDP. When the state spends less than it taxes—a surplus—it pulls money out of the private sector. With less money, either spending drops or families and firms borrow more.