Vol. 3, No. 20 — For Fox sake

A media mogul takes a half-a-step back and leaves his son semi-in charge; A new report shows most NFTs are worthless; The market has corrected; Value in nappies and tissues.

In this issue

Quote

Cartoon: Succession

For Fox sake

CryptoPunks get punked

Cost of capital

Regions and sectors

Stock screen

Debt cycle monitor

Investment idea: Kimberly-Clark Corporation

Read time: 22 minutes

Quotation

“It is better to be roughly right than be precisely wrong”

— John Maynard Keynes

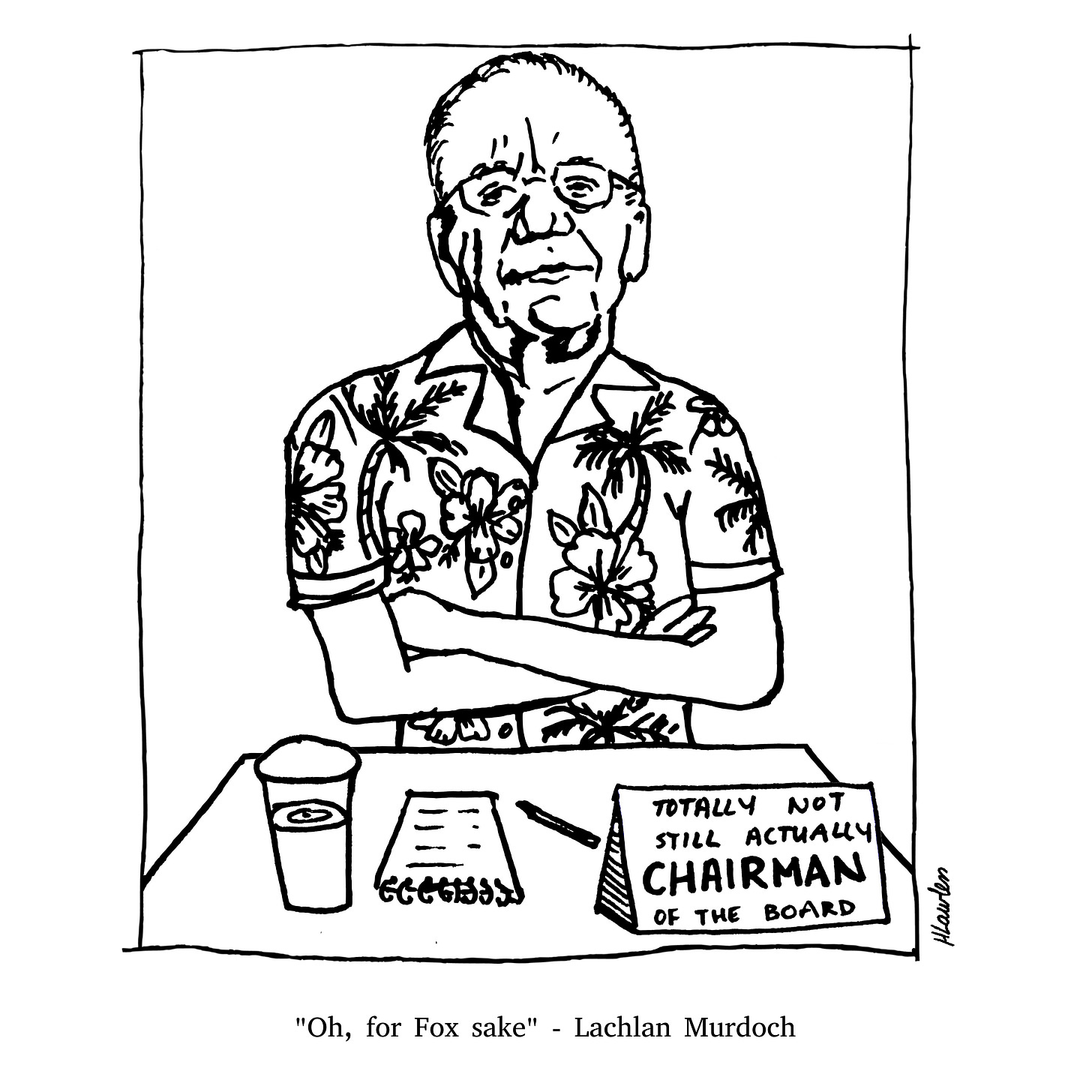

Cartoon: Succession

For Fox sake

A media mogul takes a half-a-step back and leaves his son semi-in charge. Will investors find value here?

•••

Four in ten Americans distrust Fox News. That's not a great record. Now, Rupert Murdoch, the man who created the divisive news organisation, is passing the baton to his son, Lachlan. The younger Murdoch will take over a scandal-ridden company whose share price has waned. That might have created an opportunity for value investors, but Rupert will only leave in body, not spirit. As a result, unless the firm can clean up its image, the stock will stay undervalued.

Last week, Fox Corporation announced that Rupert would stand down as chairman in November, and Lachlan would take over. Yet, Rupert is only stepping back in title. He has said everything will continue to go through him until he’s dead. That's a weird, controlling move, as it won’t make room for his son to lead the company his way.

With that said, and despite the many scandals, Fox is a solid media business. It has grown quickly and earned fat profits. The firm’s 18% operating margin puts it in the top quartile of media firms across the globe. And its 8% a year average growth rate since 2016 also ranks among the best. Being inflammatory and divisive has got them a lot of eyeballs, which helps sell ads. According to Nielsen, a data collector, Fox News gets over 2m prime-time viewers daily. That’s almost double MSNBC, their closest competitor.

While the shares look a bit undervalued, the gap probably won’t close soon. I value the shares at $33-35 each, a 20% premium to their current price. My valuation assumes growth will be slow and margins will decline a tad—in line with analysts' consensus. But value-seekers shouldn’t rush in. The shares will probably stay undervalued unless something dramatic changes.

Investors tend to knock about a quarter off the value of companies they see as evil. According to data from CapitalIQ, the market prices oil, tobacco, weapons, and alcohol companies at 20-26% below analysts’ fair-value estimate on average. Although Fox isn’t in any of these businesses, some traders see the company as the media version of cigarettes. Pension funds and other big capital allocators tend to shy away from these businesses as they consider them ethically dubious.

Frustratingly for Fox shareholders, woke-investing is all the rage. As a result, unless Fox cleans up its image, that gap won’t close any time soon. And the longer Rupert haunts the corridors, the longer that will take.

CryptoPunks get punked

A new report shows most NFTs are worthless. This won’t change.

•••

During the peak of the 2021 crypto boom, Gary Vaynerchuk, an entrepreneur famous on social media, bought a non-fungible token (NFT) of an ape wearing an orange hat for $5.9m. Two years later, it was worthless. A report from dappGambl, a crypto-gambling platform, shows this is the norm. Their research demonstrates that 95% of NFTs created are worth nothing. Sure, punters will always get caught up in speculative manias. But the NFT craze will never return.