Vol. 4, No. 14 — Getting green from red and blue

Markets don’t really care about elections; IPOs make poor investments; Slightly higher unemployment does not a recession make; A $9bn logistics company with 80% upside

Contents

The world this fortnight | A summary of economic and financial news

Leader | Getting green from red and blue

Letters to the editor | On Nvidia and inflation

Finance | Steer clear of IPOs

Economics | The economic machine chugs along

Cost of capital | Analysis of the ever-changing price of money

Investment idea | A $9bn logistics company with 80% upside

Indicators | Economic data, markets and commodities

The world this fortnight

The British election was a whitewash. Keir Starmer, the leader of the Labour Party, has become the new prime minister. It was the worst result for the conservative Tory party ever. Outgoing prime minister, Rishi Sunak, acknowledged the British people’s desire for change. It’s the first Labour win since Tony Blair’s prime ministership from 1997 to 2007. Mr Starmer pledged to prioritise national renewal of the public service.

Across the pond, the American economy grew at an annualised 1.4% rate in the first quarter, slightly above economists’ estimates, driven by investment spending. Personal incomes rose by 0.5% in May as companies bumped up wages. However, unemployment also rose to 4.1% in June, despite companies adding 206,000 jobs and the number of job openings increasing to 8.1m. The Federal Reserve, the country’s central bank, kept its target interest rate steady at 5.25-5.50%. Forecasters still only expect one rate cut this year.

Micron, a computer memory and storage company, announced a much better third quarter this year than last. Quarterly sales almost doubled to $6.8bn, and net income hit $332m, a vast improvement from a $1.9bn loss last year.

In contrast, trendy shoemaker, Nike, announced it had a rough fourth quarter. Sales fell from $12.8bn last year to $12.6bn. However, the firm’s profitability improved. Net income jumped from $1.0bn to $1.5bn.

Two prominent American banks, JPMorgan and Morgan Stanley, announced they will buy back stock. JPMorgan plans to repurchase up to $30bn worth, and Morgan Stanley intends to buy up to $20bn worth.

The Euro Area’s annual inflation rate fell to 2.5% in June from 2.6% in May. Consumer prices rose 2.1% in France, 2.2% in Germany, and just 0.8% in Italy. Consumer and business sentiment in Germany fell, too, indicating economic stagnation. Manufacturers especially are gloomy about their prospects.

The Reserve Bank of Australia kept its cash rate at 4.35% in June, unchanged for the fifth time since November last year. Due to rapidly rising service costs, inflation remains above the bank’s 2-3% target. Despite slowing economic growth and rising unemployment, the bank remains cautious about inflation. However, consumers felt a little better in June than they did in May, as the consumer sentiment index rose 1.7%, its highest reading since February. However, families are still on edge about inflation and interest rates.

The number of Canadians looking for but unable to find a job rose in June. The unemployment rate hit 6.4%, up from 6.2% in May, the highest since January 2022. The Bank of Canada said higher interest rates have hurt the jobs market. But, worryingly, the annual inflation rate rose to 2.9% in May, up from 2.7% the month before, as transportation and food costs leapt. Canadians frothing over rate cuts will have to wait a little longer. ■

HOW TO VALUE STOCKS: This new book will teach you how to value any public company, guiding you step-by-step through the process with real-world examples. Whether you’re new to valuation or an experienced investor, this book will help you make better investment decisions:

Leader | Elections and markets

Getting green from red and blue

Despite the punditry, markets don’t really care about elections. Here’s why you should look past the politics.

It’s a monumental year for democracy. There are 83 national elections taking place across 78 countries this year—there are more elections than countries because of European Union (EU) membership. In Britain, voters just kicked the Conservatives out of government and elected the left-wing Labour Party. The French gave the right-wing National Rally party their seal of approval in the first round of votes. And in America, the presidential campaign is heading into its final act.

Like punters at the horse races, many investors are trying to predict upcoming ballots. They reckon that’ll give them an edge and help them adapt their investing strategies based on who they think will win. But it won’t. Apart from some short-term market volatility in the first few days, elections and their results hardly impact markets. As counterintuitive as it seems, investors should probably ignore them.

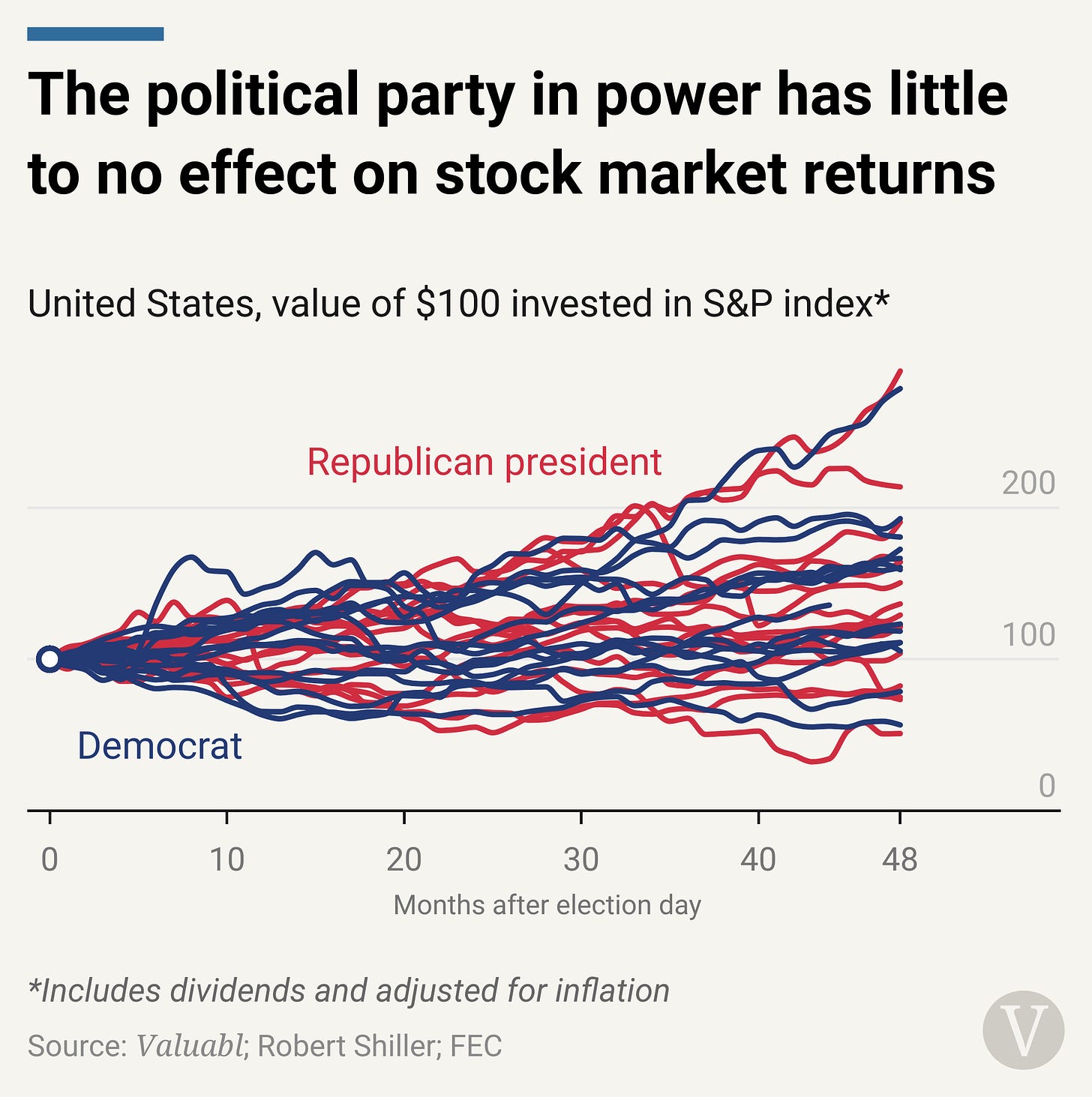

Markets don’t care which party is in power. For example, since 1900, America has had 31 presidential elections. In the 48 months after each, investors received the same average total real return regardless of which party was in. After adjusting for inflation, investors made 38% under Republican presidents and 42% under Democrats. Moreover, each party produced similar results in their first year. In the first 12 months after the election, investors enjoyed a positive real return 63% of the time a Republican took office and 67% of the time it was a Democrat. Put simply, over the medium term, markets don’t care which party is in power. There is no reason to expect higher or lower returns simply because one party occupies the White House.

Fundamentals, not politics, drive markets. Of course, taxes and regulations have an impact, but the state of the economy and business innovation is a much more significant driver of returns than politicians. While 𝑉𝑎𝑙𝑢𝑎𝑏𝑙 found no relationship between political parties and returns, there is a strong link between earnings and returns. This analysis revealed a +0.8 correlation between earnings growth and returns using monthly data from January 1900 to June 2024. Instead of trying to predict the outcome of an election, it’s much more fruitful to remain invested and to study the financial and economic fundamentals.

Repositioning your portfolio based on political punditry is also risky and challenging. Even if you could predict who would win the election, you can’t predict what the market will do. For example, Donald Trump was a fossil fuel booster during his presidency. However, according to data from Capital IQ, a fancy financial data platform, green energy stocks crushed fossil fuel ones by 50% per year under Trump. Then, Joe Biden took the opposite position. He has lambasted the coal and oil industry and boosted clean energy. Yet, under President Biden, fossil fuel stocks have outperformed green energy by 42% annually.

If you had gone back to 2015 and knew that Mr Trump would win, you’d probably have bought coal miners and oil drillers—and your investments would have stunk even though your political prediction was correct. Then, if you knew that Mr Biden would win, you’d probably have stocked up on solar panel and electric vehicle makers. And today, despite being spot-on with your presidential predictions, you’d be poorer for it. The lesson is to ignore political punditry. Focus on diversification and the fundamentals. It turns out that you can get green out of both red and blue. ■

SPREAD THE LOVE: Share 𝑉𝑎𝑙𝑢𝑎𝑏𝑙 with your friends and colleagues to look like the smartest person they know. You’ll also go into the draw to win a free six-month subscription*.

*One draw every two weeks. Winners will be notified by e-mail.

Letters to the editor

The all-time high of a worldwide all-time high

Very interesting take about Nvidia (“Artificial or intelligent?” Vol. 4, No. 13). I agree to an extent, surely we have to be wary of buying an all-time high of a worldwide all-time high. But on the other hand, I think the AI industry is seriously here to stay, and although a retrace is likely, their current growth is backed by that notion.

— Finlay Williams, London

Money printer go brrr

I agree that inflation will remain high (“Inflation will remain stubbornly high”, Vol. 4, No. 13), but I believe the primary reason is different. It’s not just higher energy prices; it’s the relentless money printing. The central banks have been flooding the market with cash, and this excess liquidity is fuelling inflation. To truly combat this, rates need to at least double.

— Sam Turner, New York

Reply directly to this email or send your commentary, critiques, and rebuttals to valuabl@substack.com. You can also direct message ValuablOfficial on X. Please include your name and city. Letters may be edited for brevity.

Finance | IPOs make poor investments

Steer clear of IPOs

Don’t buy into the hype. Here’s why you should shut your eyes and ignore newly public companies.

It’s been a dull year for the investment bankers who take companies public. In America, there have only been 96 initial public offerings (IPOs) of common stock this year. Yet, when a new company goes public, investors still get giddy. They’re desperate to get in early on the next Google or Facebook. And they’re willing to roll the dice. The question remains: is it wise to invest in IPOs? The answer is: No. As a general rule, you should avoid them.