Vol. 4, No. 15 — Violent streak

Assassination attempts are becoming more common; Chinese house prices will continue to fall; Three industries will struggle to pay their debts over the next year; A gambling company with 40-50% upside

Contents

The world this fortnight | A summary of economic and financial news

Leader | Violent streak

Letters to the editor | On unemployment and IPOs

Economics | House of horrors

Finance | Stressed out

Cost of capital | Analysis of the ever-changing price of money

Investment idea | A large gambling company with 40-50% upside

Indicators | Economic data, markets and commodities

The world this fortnight

America’s big banks released strong quarterly earnings. JPMorgan Chase’s net profit rose 25% to $18.1bn, Morgan Stanley’s jumped 41% to $3.1bn, and Goldman Sachs’s profit doubled to $3bn. Citigroup’s net income increased by 10% but profits at Bank of America and Wells Fargo fell. Investment banking fees for the five largest banks, excluding Wells, grew 40%, reflecting an industry resurgence.

Aeroplane maker, Boeing, will plead guilt to misleading air-safety regulators about its 737 Max aircraft before two fatal crashes in 2018 and ‘19. This new agreement will overturn a 2021 settlement, where Boeing admitted two employees has misled regulators, that the government claims the firm failed to comply with. Recent mishaps including a door plug blowing off a 737 Max have added to safety concerns. The families of the crash victims are unsatisfied because by pleading guilty Boeing will avoid the scrutiny of a trial.

Rich-person credit card company, American Express, raised its full-year profit forecast, buoyed by wealthy customers spending on travel, dining, and entertainment. The firm reported a second-quarter profit of $3bn, or $4.15 per share, a 39% jump from last year. Revenues climbed 9% to $16.3bn. Because AmEx, as it’s known, focuses exclusively on wealthy wallets, it has been shielded from broader economic weakness. The company also bought restaurant-booking platform Tock to boost its presence in the dining industry.

Microsoft, a software company, has reportedly relinquished its board seat at OpenAI, the group behind ChatGPT, due to scrutiny from competition regulators about their partnership. Microsoft holds a minority economic interest in OpenAI. Meanwhile, Apple, the iPhone maker, has decided not to join OpenAI’s board as an observer. Instead, the firms struck a deal to incorporate ChatGPT into Apple’s new operating system.

China’s economy expanded by 4.7% year-on-year in the second quarter, the slowest rate since early 2023 thanks to real estate and trade problems. Retail sales growth also slowed to 2% in June, below forecasts of 3.3%. The annual inflation rate also dropped to 0.2% that month, down from 0.3% the month before and lower than economists’ predictions. While this is the fifth month in a row that consumer prices rose, it’s the slowest pace since March.

Consumer prices across America rose 3% year-on-year in June, the lowest annual increase since June 2023. Energy costs rose slower than they have been and car prices fell. The core inflation rate, which ignores volatile food and fuel prices, slowed to 3.3%. Retail sales stalled from May but the number of building permits rose 3.4%, driven by multi-unit buildings across the Midwest and South.

Across the pond, Britain’s unemployment rate stayed at 4.4% in May, in line with predictions. While there are more part-time and self-employed workers, there are still 1.5m Brits who want a job but can’t find one. The inflation rate also held steady. Consumer prices rose 2% year-on-year in June, with higher prices at restaurants and hotels and for transport. But prices for clothes, shoes and food eased.

Gold prices hit a record high of $2,465 a troy ounce, a unit of measure for previous metals approximately equal to 31 grams. Goldbugs reckon that weaker inflation data will prompt the Federal Reserve to cut interest rates. They also believe that a Trump presidency will increase gold’s appeal as a safe investment. ■

HOW TO VALUE STOCKS: This new book will teach you how to value any public company, guiding you step-by-step through the process with real-world examples. Whether you’re new to valuation or an experienced investor, this book will help you make better investment decisions.

Leader | Assassination attempts are far too common

Violent streak

The attempt on Trump’s life is shocking, but unsurprising. If history is a guide, these attacks will become more frequent.

It was a moment that changed American politics forever. Or so it seemed. A 20-year-old man, Thomas Crooks, tried to assassinate US presidential hopeful Donald Trump. His volley of shots from a nearby rooftop came close to killing the Republican, grazing his ear. Mr Crooks’s stray bullets killed a man in the crowd and seriously injured two more. Snipers with the Secret Service, the people who guard the president, shot him dead.

The motive for the assassination attempt is not clear. Mr Crooks was a gun enthusiast, and folks who knew him described him as a quiet loner with no mental health issues. Mr Trump left the stage imploring his supporters to “Fight! Fight! Fight!” The dramatic events have left many wondering what has become of American politics. For a nation obsessed with guns, is an assassination attempt even unexpected? Sadly, the answer is no. Violence is a mainstay of American politics.

The first question this draws is: how likely is the president to be assassinated? Historically speaking, remarkably likely. There have been 46 presidents since the nation’s birth. Hitmen rubbed out four of them, which is a 9% hit rate. If you become president, there’s a roughly 1-in-11 chance you will be offed, based on past data. Those are incredibly high odds. The presidency has a similar four-year survival rate as Hodgkin lymphoma, a brutal cancer.

You’re also likely to have someone try to kill you even if you run for president but don’t get it. Including the latest attempt on Mr Trump, there have been 22 assassination attempts on presidential candidates in US history. That means almost a quarter of those who make it onto the ballot will have someone try to kill them—the same chance as drawing hearts from a deck of cards.

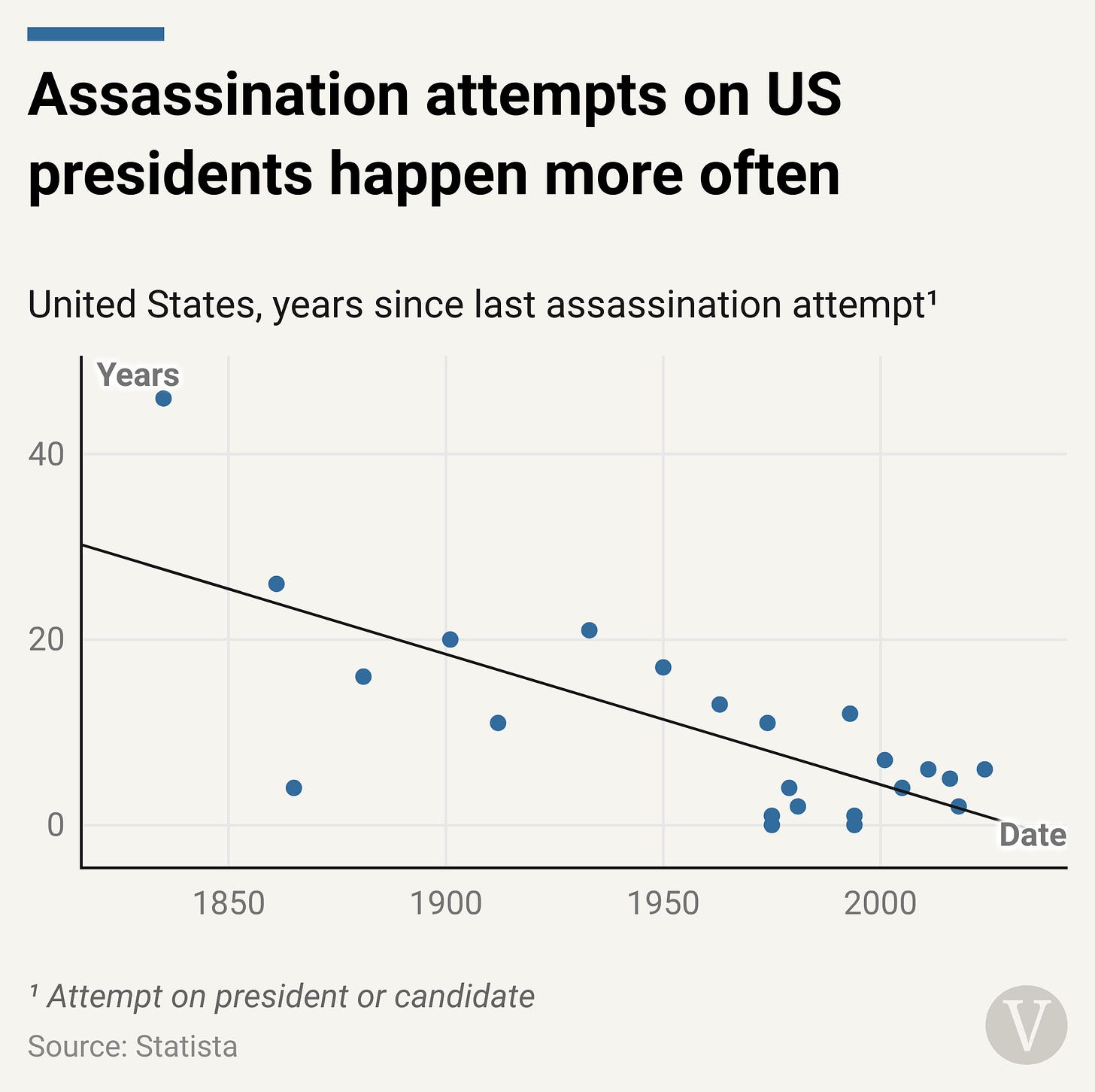

Assassination attempts have become more frequent. In the 1800s, a would-be assassin tried to bump off the man in the top job once every 23 years on average. In the 1900s, it was once every nine years. And since 2000, someone has tried to kill the president once every five years. Some pundits will blame social media. But that’s not true. America’s entire political history is soaked in blood. The rising frequency of assassination attempts is a trend that far pre-dates Facebook or TikTok. So why are they happening more often?

The most straightforward answer is the most probable and the least satisfying: a large population with easy access to devastating weaponry. The more people there are, the more likely that there is at least one person with the desire, capability, and munitions to try to knock off the president. America’s population was 5.3m in 1800. If 0.00001% of the population are budding presidential assassins, then that’s just one person for the 1800s Secret Service to worry about. But, in a population of 332m, that’s 33.

It looks like assassination attempts are not only here to stay but will continue to increase in frequency. Let’s hope the Secret Service can keep the president and candidates safe. The ballot box, not the bullet box, should decide who runs the free world. ■

SPREAD THE LOVE: Share 𝑉𝑎𝑙𝑢𝑎𝑏𝑙 with your friends and colleagues to look like the smartest person they know. You’ll also go into the draw to win a free six-month subscription*.

*One draw every two weeks. Winners will be notified by e-mail.

Letters to the editor

Hit job?

I found your article on unemployment (“The economic machine chugs along“ Vol. 4, No. 14) a bit too dismissive of the real concerns about a possible recession. Yes, the unemployment rate only went up to 4%, but that still shows many people are struggling. Saying the job market is fine just because there are more jobs than seekers ignores the quality of those jobs and how many people have to work many jobs to make ends meet. Plus, if the economy is so great, why is the government’s deficit so large?

— Eliana Kirchner, Austin

Shot of IPO, and then the chaser

I’ve lost a fair bit of money chasing big next things when they IPO. Your point about IPOs underperforming the broader market (“Steer clear of IPOs“ Vol. 4, No. 1 4) is spot on. Honestly, I wish I had learned to avoid them ages ago. Now, I just stick to investing in ETFs and indexes. It’s much wiser to put your money in established indices like the S&P 500 as they’re safer and less volatile.

— Alan MacCallion, Edinburgh

Reply directly to this email or send your commentary, critiques, and rebuttals to valuabl@substack.com. You can also direct message ValuablOfficial on X. Please include your name and city. Letters may be edited for brevity.

Economics | Chinese house prices

House of horrors

China’s real estate market is in a scary place. Prices have fallen and will continue to do so. Here’s how China got into this mess and what will happen next.

While the world’s economy has zigged, China’s has zagged. Most countries raised interest rates to battle high inflation. A move that many pundits figured would drag down the inflation rate and house prices but didn’t. Yet, China went in the opposite direction. They cut interest rates to battle deflation and stop house prices from falling. But it hasn’t worked. Consumer goods and house prices are still both on the way down. And China’s economy is about to undergo a long-term fundamental shift.