Vol. 4, No. 19 — Read my lips

The lipstick effect is not a real thing; How America Inc defeated the Fed; Rent control hammered Argentine landlords and tenants; An Eastern-European food retailer with 61% upside

Contents

The world this fortnight | A summary of economic and financial news

Opinion | Read my lips

Letters to the editor | On OpenAI, price gouging and Berkshire

Finance | How America Inc defeated the Fed

Economics | In a fix

Cost of capital | Analysis of the ever-changing price of money

Investment idea | An Eastern-European food retailer with 61% upside

Indicators | Economic data, markets and commodities

The world this fortnight

A private crew of four astronauts, led by entrepreneur Jared Isaacman, flew 1,400km (870 miles) above Earth in a capsule built by SpaceX, Elon Musk’s rocket company. It’s the farthest humans have travelled into space apart from Moon missions. The crew also completed the first private spacewalk.

Brazil’s Supreme Court shut down X, Elon Musk’s social media platform, after a spat between Mr Musk and Alexandre de Moraes, a top jurist. The court voted unanimously to ban the platform after Mr Musk refused to remove alleged fake news, citing free speech. The government threatened to fine anyone who tries to access X in Brazil $9,000 daily. Lawmakers also froze accounts of Starlink, Mr Musk’s satellite internet company.

The European Court of Justice decreed that Apple must pay €13bn ($14.4bn) in back taxes. That reversed a 2020 decision that dismissed the case which stems from a 2016 finding that Apple benefited from an illegal tax deal in Ireland. Apple argues that lawmakers are changing tax rules retroactively.

In another blow to Apple, the firm’s new iPhone 16, which includes artificial intelligence features, failed to impress investors as some features won’t be available until 2025. Meanwhile, Huawei, a Chinese tech company, launched the Mate XT, the world’s first tri-fold smartphone, priced at $2,800.

Mario Draghi, the former president of Europe’s central bank and Italian prime minister, released his report on European growth and competitiveness. He called for the European Union to combine research spending and create a super-agency for advanced innovation projects. His report also recommended loosening competition rules and integrating capital markets.

The eurozone’s annual inflation rate fell to 2.2% in August. That’s the lowest it’s been for three years, raising expectations of further rate cuts by the European Central Bank (ECB). The ECB has already slashed its main interest rate to 3.5%. While consumer price pressures have eased, Christine Lagarde, the bank’s boss, said they expect inflation to rise again later this year before dropping towards the 2% target in the second half of next year.

America’s annual inflation rate dropped to 2.5% in August. However, core inflation, which excludes volatile food and energy prices, remained unexpectedly high. Markets reckon the Federal Reserve will cut interest rates for the first time in four years at its meeting on September 18th.

According to a report from the Centre for Cities, white-collar workers in London now spend 2.7 days a week in the office. That’s up from 2.2 days in 2023 but below the pre-pandemic average of 3.9 days. Only two-in-five workers go into the office on a Friday. The think-tank suggested that companies subsidise commutes to lure workers back instead of offering free food and drinks.

OPEC, a cabal of oil-producing countries, lowered its forecasts and expects global oil demand to grow by 2m barrels per day this year. That’s still higher than the 1.4m b/d growth before the pandemic. Oil prices fell to their lowest point this year, with a barrel of Brent crude costing around $72. ◼︎

HOW TO VALUE STOCKS: This new book will teach you how to value any public company, guiding you step-by-step through the process with real-world examples. Whether you’re new to valuation or an experienced investor, this book will help you make better investment decisions.

Opinion | Economic hodgepodge

Read my lips

Does the lipstick effect exist? And what does it tell us about where the economy is headed?

Recessions mean that televisions stay on shelves and golf clubs remain on racks. But, according to popular thought, lipstick bucks the trend. People buy small, affordable indulgences to feel better when the purse strings are tight. If you can’t afford a beautiful new Chanel suit, you settle for one of their lippies. Or so the theory goes.

Leonard Lauder, the chairman emeritus of Estee Lauder, the cosmetics firm his mother created, coined the term ‘lipstick effect’ in 2001. Lip makeup sales rose 11% during the doom ‘n gloom of that recession. It’s not exclusively a modern observation, either. Lipstick effect evangelists reckon that sales of lippie surged by a quarter during the 1930’s depression as the Dow Jones index crashed. These little stories are fun, and they have a lick of common sense. However, the lipstick effect isn’t a real thing. You’d best ignore it.

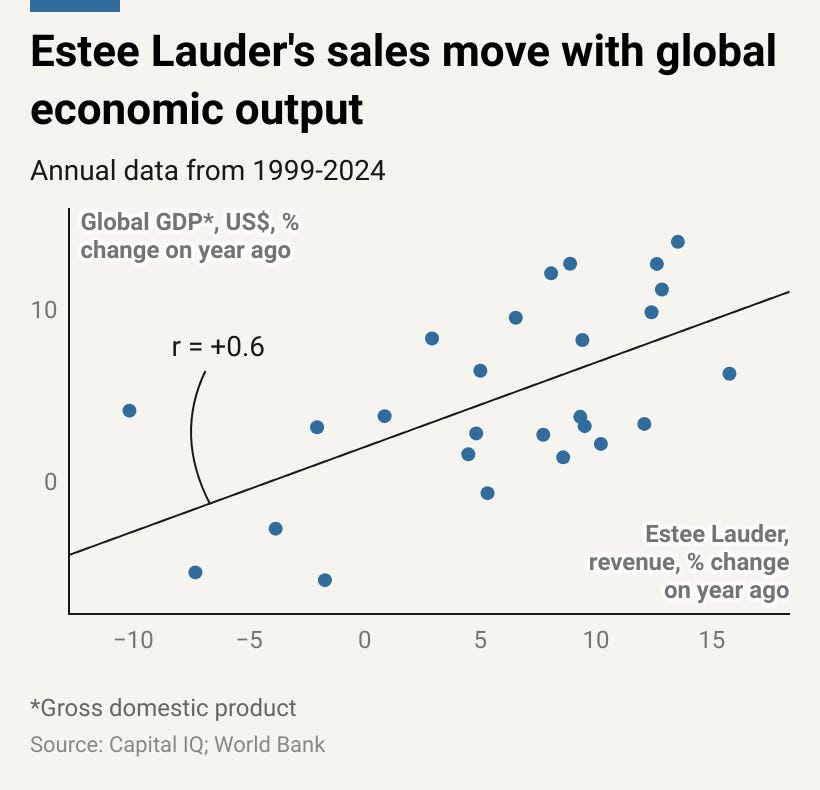

The lipstick effect isn’t real because Estee Lauder’s sales are not countercyclical. That is to say, they don’t go up when the economy shrinks, as you would expect if the effect was real. Nor do they fall when the economy booms. Using data from 1999 to this year, 𝑉𝑎𝑙𝑢𝑎𝑏𝑙 found that the change in Estee Lauder’s sales had a correlation with the change in global economic output of 0.6. That’s a moderate, positive relationship. When the economy expanded, the firm sold more. And when it contracted, the firm’s top line dropped. Only in 2001, when Mr Lauder invented the phrase, did the firm’s sales buck that trend.

The firm’s segments aren’t countercyclical either. All divisions—skin care, makeup, fragrance, and hair care—had a positive relationship with economic growth. However, the pandemic changed things for the makeup division. Its correlation with growth was a modest 0.3. And the makeup division’s sales fell a cumulative 24% since 2020, while all other segments grew.

That result matches the results of a recent survey by Kantar, a market researcher. They interviewed 300,000 women and found that those women buy and wear less makeup than they did before the pandemic. “Before, you wouldn’t have caught me picking up a pint of milk without my face on,” said Charlie, one participant. The lipstick effect may have existed when Mr Lauder tried to figure out why lippy flew off the shelves back in 2001, but it certainly doesn’t anymore. There is no evidence from Estee Lauder, the idea’s birthplace, to suggest that cosmetic sales predict recessions.

The result is the same when you look at other firms or the whole industry. The cosmetics industry may be insensitive to market conditions, but it’s not countercyclical. 𝑉𝑎𝑙𝑢𝑎𝑏𝑙 found that the other big cosmetics firms’ sales also correlated with growth. These companies included LVMH, Shiseido, L’Oreal, and Coty. Similarly, the personal care products industry has a low beta. Based on 𝑉𝑎𝑙𝑢𝑎𝑏𝑙’s data, the industry has a product beta of just 0.2, making it roughly as economically insensitive as utilities or real estate. For context, a product beta estimates how sensitive a product or service is to economic cycles.

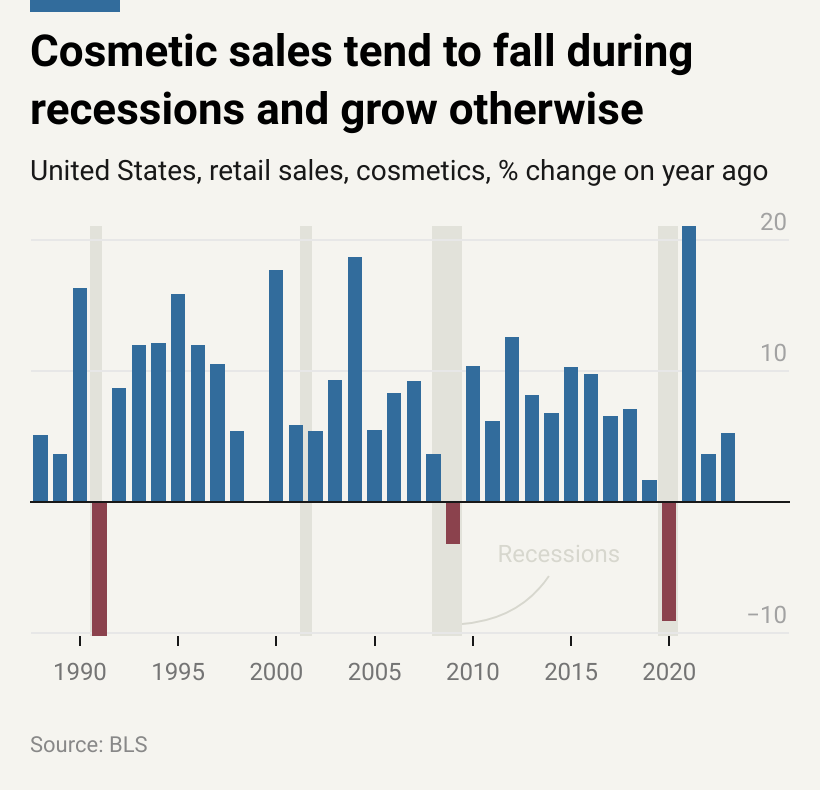

Other external research backs this up. Kline + Company, another market researcher, found no negative relationship between lipstick sales and recessions. And data from the Bureau of Labour Statistics confirms this. Real output for stores that sell cosmetics or perfumes tended to fall during recessions and rise the rest of the time. Outside of Mr Lauder’s new-millennium observation, there is no evidence that the lipstick effect predicts a recession. It’s time to discard it as it will lead astray those who use it.

Looking forward, it would seem like a recession is around the corner since Estee Lauder’s sales are falling. But that's not quite right. The headline number obscures what the segment data shows us: the American economy will grow while the rest of the world struggles. Estee Lauder’s American sales and economic growth have a strong historical correlation. And, the same relationship exists outside the US.

As the firm’s stateside sales rose, up 1% in the 2024 financial year ending in June, that suggests the American economy grew. But, outside America, the firm’s sales fell 3%, suggesting economic struggles. This result matches 𝑉𝑎𝑙𝑢𝑎𝑏𝑙’s prediction that there won’t be an American recession but that many other countries would struggle. It’s time to give up on anecdotal hodgepodge and read my lips: the American economy is booming. ◼︎

SPREAD THE LOVE: Share 𝑉𝑎𝑙𝑢𝑎𝑏𝑙 with your friends and colleagues to look like the smartest person they know. You’ll also go into the draw to win a free six-month subscription. The will be one draw every two weeks, and winners will be notified by e-mail.

Letters to the editor

Mind your valuation model

Just read your article on OpenAI’s valuation, and I think your methods are a bit outdated. OpenAI is even now reportedly raising capital at a $150bn valuation, not $100bn. That’s a massive jump and kind of shifts the whole conversation about whether their valuation is “generous but not insane.” I don’t think you understand how venture capital markets work. The value depends on the comps and what private equity investors are willing to pay.

Also, the piece seems to downplay OpenAI’s potential to dominate the market despite heavy competition from the big tech players. But let’s be real—OpenAI has been leading the AI game, and even with the giants pouring in cash, they haven’t really caught up yet. Plus, while training costs are dropping, that doesn’t necessarily mean margins will shrink; it could actually help OpenAI scale more efficiently. Just wanted to throw you my two cents. Maybe it’s time to update your thinking?

— David Martinez, San Francisco

An aisle of opinions

Honestly, your bit about supermarket prices is a joke. A mate showed me it. Saying Coles and Woolies aren’t price gouging? Come on! Every time I hit the shops, prices are up again. They’re raking in massive profits while we’re battling to afford basic groceries. Feels like corporate greed to me. Blaming “higher costs” is just an easy out. Maybe if you talked to everyday Aussies struggling with their grocery bills, you’d see things differently. The big supermarkets are taking us for a ride.

— Steve Thompson, Sydney

Warren-ting praise?

An outstanding article that brilliantly highlights how investors often overanalyse Warren Buffett’s investment moves. Berkshire’s cash reserves are practical decisions rather than signals.

— Sebastian Fairchild, London

Reply directly to this email or send your commentary, critiques, and rebuttals to valuabl@substack.com. You can also direct message ValuablOfficial on X. Please include your name and city. Letters may be edited for brevity.

Finance | America’s corporate resilience

How America Inc defeated the Fed

The Federal Reserve’s interest rate sword looks dull. Here’s how corporate America insulated itself against higher rates.

It looks like nothing can stop corporate America. Revenues and profits across the nation keep rising. American businesses generated $2.8trn of annual after-tax profits in the second quarter, according to the Bureau of Economic Analysis. That's up from $2.6trn 12 months ago, a 6.6% increase. America Inc, as we will call an imaginary company made up of all the country's public firms, is in great financial shape.

That comes as a surprise to many. Central bankers, talking heads, and many investors figured rate hikes would hammer profits. They reckoned that interest bills would surge, and that would force companies to sack workers and divert money to paying off debts. But, despite one of the most aggressive rate hike cycles in modern history, that hasn't happened. The economic train continues to chug. Rate hikes haven't hammered profits because America Inc insulated itself against rate hikes which rendered them ineffective. There are three ways it did it.