Vol. 4, No. 5 — r/IPO

What you need to know about Reddit's IPO; Australian iron ore miners needn't worry about China's housing collapse; Markets look a bit frothy; Value in coffee

Welcome to 𝑉𝑎𝑙𝑢𝑎𝑏𝑙, a twice-monthly newsletter with expert financial analysis in a straightforward style. 𝑉𝑎𝑙𝑢𝑎𝑏𝑙 helps professional investors make sense of markets and find undervalued stocks.

New here? Subscribe now. Or check out the investment idea track record. Already a subscriber? Explore all of 𝑉𝑎𝑙𝑢𝑎𝑏𝑙’s essays and investment ideas.

I have started a new newsletter. In it, I will share my analysis of one undervalued high-quality stock each month—a 15-minute read on the best investment I found. Each pitch will include the company’s background, investment thesis, catalysts, valuation, and risks.

Subscribe below.

Read time: 40 minutes

In this issue

Quote | Keith Gill, aka Roaring Kitty

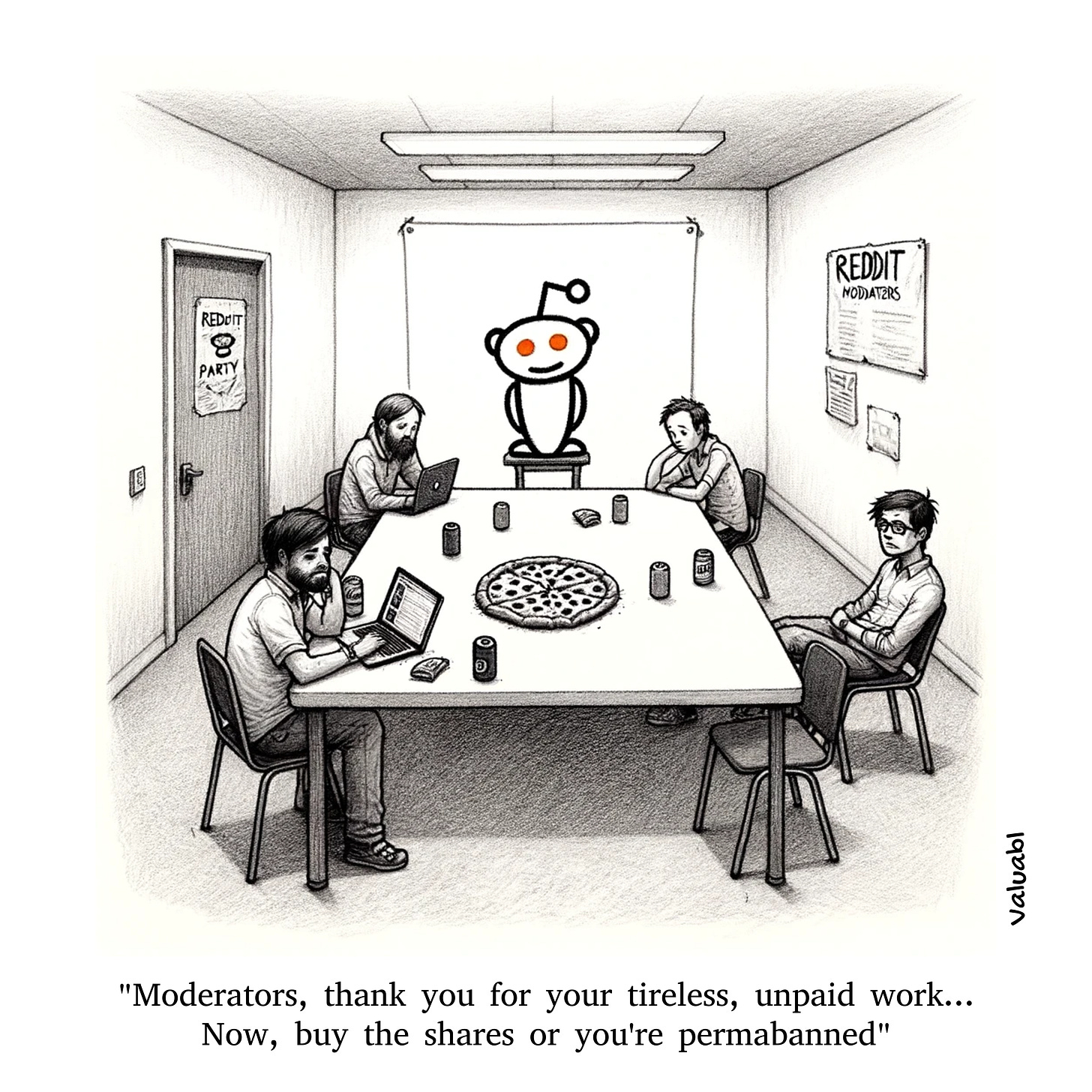

Cartoon | Reddit moderators pizza party

Finance | r/IPO

Economics | Steely resolve

Markets | Frothy

Investment idea | Value in coffee

Quote | Keith Gill, aka Roaring Kitty

“I am not a cat.”

Cartoon | Reddit moderators pizza party

Finance | Reddit’s initial public offering

r/IPO

Reddit is going public. Here’s what you need to know before you yolo into the shares

Last week, Reddit, the company behind the forum of the same name, declared they’re finally going public. The 19-year-old social media company filed an initial public offering (IPO) prospectus with the Securities and Exchange Commission (SEC), America’s financial market regulator. Soon, investors and apes alike can trade Reddit’s shares.

But the platform that hosts r/WallStreetBets, a community for adrenaline-seeking stock pickers that boosted GameStop shares during the pandemic, has been hush-hush about the details. They hope to generate a buzz and enjoy their users’ stock-pumping tendencies. But the company hasn’t declared how many shares they’ll sell or at what price. And other details about the firm’s capital structure are murky at best.

Whether you should buy Reddit’s shares when they’re offered will depend on your portfolio and what the offer price is. Reddit has a successful platform with valuable data, and should become quite profitable in the future. But the expected valuation seems a bit frothy—typical of IPOs. As a result, investors should be cautious.