Vol. 2, No. 19

Markets might not be doomed; American tech is still king; Private sector wage bills are rising and the government has a choice to make; Value in a coal digger

Valuabl is an independent, value-oriented journal of financial markets. Delivered fortnightly, Valuabl helps investors pop bubbles, buy low, and sell high.

HOUSEKEEPING

I’m weighing up starting a fortnightly thread for intelligent discussion and debate. Would you like to see this?

Money talks—it just needs an interpreter

Take an annual subscription to Valuabl and get three months for free.

In today’s issue

Cartoon: Flatten the curve

Cost of capital (6 minutes)

Global stocktake (4 minutes)

Rank and file (2 minutes)

Credit creation, cause & effects (9 minutes)

Debt cycle monitor (2 minutes)

Investment ideas (10 minutes)

“Selling, in particular, can be a challenge; many investors are tempted to become more optimistic when a security is performing well. This temptation must be resisted; tax considerations aside, when a security reaches full valuation, there is no longer a reason to own it.”

— Seth Klarman

Cartoon: Flatten the curve

Cost of capital

Interest rates and capital costs are capitalism's most consequential yet misunderstood prices, connecting the future to the present. Here’s what happened to the price of money and the market in the past fortnight.

•••

If you only looked at the price of stock markets two weeks ago and again today, you would think markets were asleep. Despite rising rapidly and falling just as quickly in the past fortnight, stock prices are flat for the period. The S&P 500, an index of big American businesses, fell 0.2% to 3,946. Investors trimmed $4trn from global market capitalisations (see: Global stocktake) while inflation-adjusted risk-free rates rose.

The market has fallen 17% since January and 11% over the past year. But it is up 7% from its June lows. The VIX, an estimator of investor uncertainty, hovers around 27.

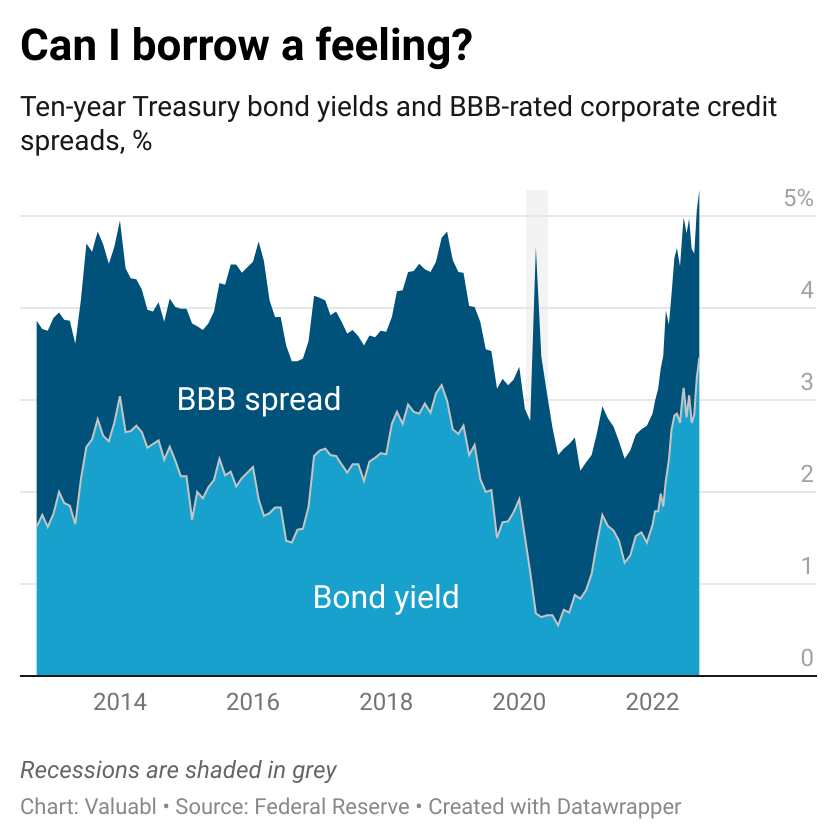

The price of government bonds fell again. Yields, which move inversely to prices, went up despite shrinking inflation expectations. The yield on a ten-year American Treasury bond, a key variable for valuing financial assets worldwide, climbed by 27bp to 3.4%. Bond investors' forecasts for inflation over the next decade dropped by 2bp to 2.5% per year.

The real interest rate, the difference between yields and expected inflation, rose by 29 basis points—this follows its 20bp rise last. Fixed-income investors expect to increase their purchasing power by an almighty 1% per year. This limp real-return is 200bp better than at the start of the year and is the highest since 2018.

Perhaps money is worth something, after all?

Investors reckon stocks are slightly less risky than they did last fortnight. The equity risk premium (ERP), the extra return investors want for buying stocks instead of bonds, went down by 8bp to 5.1%. The premium is still in line with the past five years' average. It is up 30bp since the start of the year and 86bp in the past 12 months.

The cost of equity, the return stock-investors demand to part with their money, is 8.5%, up 19bp from last fortnight when Valuabl last went to press. Equity costs—which we can think of as expected returns—have risen 220bp since January and 300bp in the past year.

Creditors are charging slightly less for risk than they did a fortnight ago. Corporate bond prices fell less than government ones did. Credit spreads, the gap between BBB-rated corporate bonds and Treasury yields went down 3bp. These spreads are up 61bp since the start of the year and 70bp over the past 12 months.

The corporate cost of debt, the return that creditors demand to lend to companies, is 5.2%, up 24bp since the last issue. Debt costs—the expected returns bond investors should get—have risen 251bp since the start of the year and 284bp in the past 12 months.

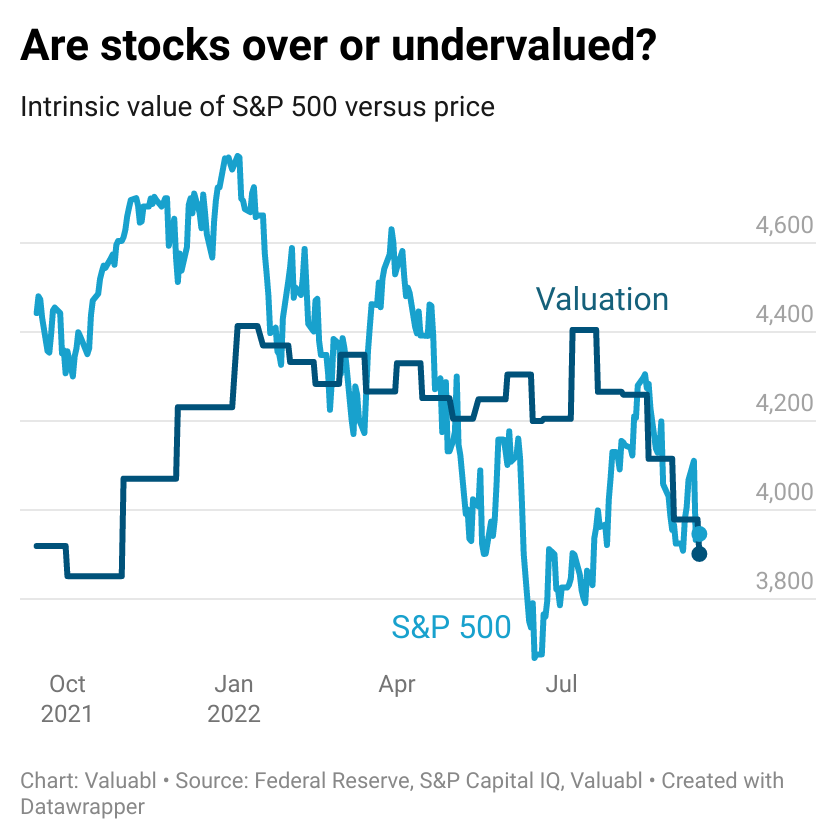

Using the average ERP of the past five years, the current ten-year Treasury bond yield, analysts' consensus earnings estimates, and a stable payout ratio based on the S&P 500's average return on equity over the last decade, I value the index at 3,901 compared to its level of 3,946.

While analysts expect big American companies to earn about the same next year as they expected them to last fortnight, rising real interest rates continue to slug valuations. If you live by the printer, you die by the printer.

This valuation suggests the S&P 500 index is 1% overvalued compared to 9% at the start of the year and 15% last year. Investors buying this index of stocks can expect an 8.5% per year return at these prices and be fairly compensated for their risk.

Analysts and investors are worried about interest rates. If the Fed continues pushing rates up, as they are likely to, the impact on equity values is nuanced.

On the one hand, higher nominal rates suggest higher inflation. By definition, this means businesses are raising prices and, with them, their top lines. On the other hand, higher rates push discount rates up and pull aggregate private spending, the total amount of consumers and business purchases, down. This makes future profits, which could be lower, worth less now—a double whammy.

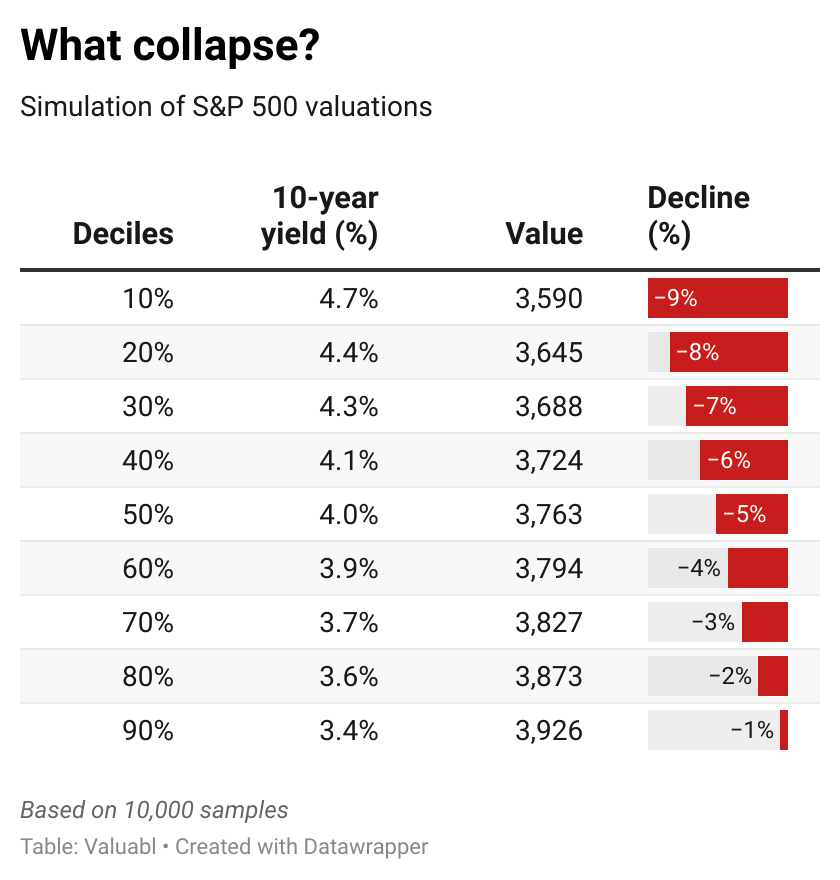

To model some of this, I simulated valuations for the S&P 500. I assumed analysts, on average, are right about their earnings forecasts, but that interest rates will trend towards 4% over the next year. I sampled the stable interest rate from a normal distribution using past volatility, with the following results:

If interest rates continue to rise, the effect on stock valuations, holding everything else constant, depends on how high you think they go. The discount effect of higher rates suggests slightly lower valuations, not necessarily a market collapse.

But in the real world, we can’t hold everything else constant. Economies and markets react. Profits go up and down. If earnings fall, this will exacerbate devaluation in the short term. The level is uncertain, but the pedlars of doom should revise their history before writing-off every downgrade as the beginning of the end of the world.

There’s an old saying about timing versus time in.

READY FOR MORE?

Global stocktake

An aggregate look at valuations of regional stock markets to help us find suitable ponds to fish for value. Which markets are over or undervalued?

•••

Investors trimmed $4trn from global stock markets last fortnight. The market capitalisation, the cost of purchasing all publicly traded shares, dropped to $98trn. Accountants wrote $400m off global balance sheets in the fortnight, and investors remain bearish. However, corporate earnings and payouts rose slightly.