Vol. 2, No. 3

On the cost of capital. Credit creation, cause & effect. The Bank of England is out of control. Undervalued cable television and online advertising businesses.

Valuabl is an independent, value-oriented journal of financial markets. Delivered fortnightly, Valuabl helps contrarians pop bubbles, buy low, and sell high.

In today’s issue

The cost of capital (3 minutes)

Credit creation • Cause & effect (5 minutes)

Careening out of control (5 minutes)

Investment idea #1 (11 minutes)

Investment idea #2 (16 minutes)

The cost of capital

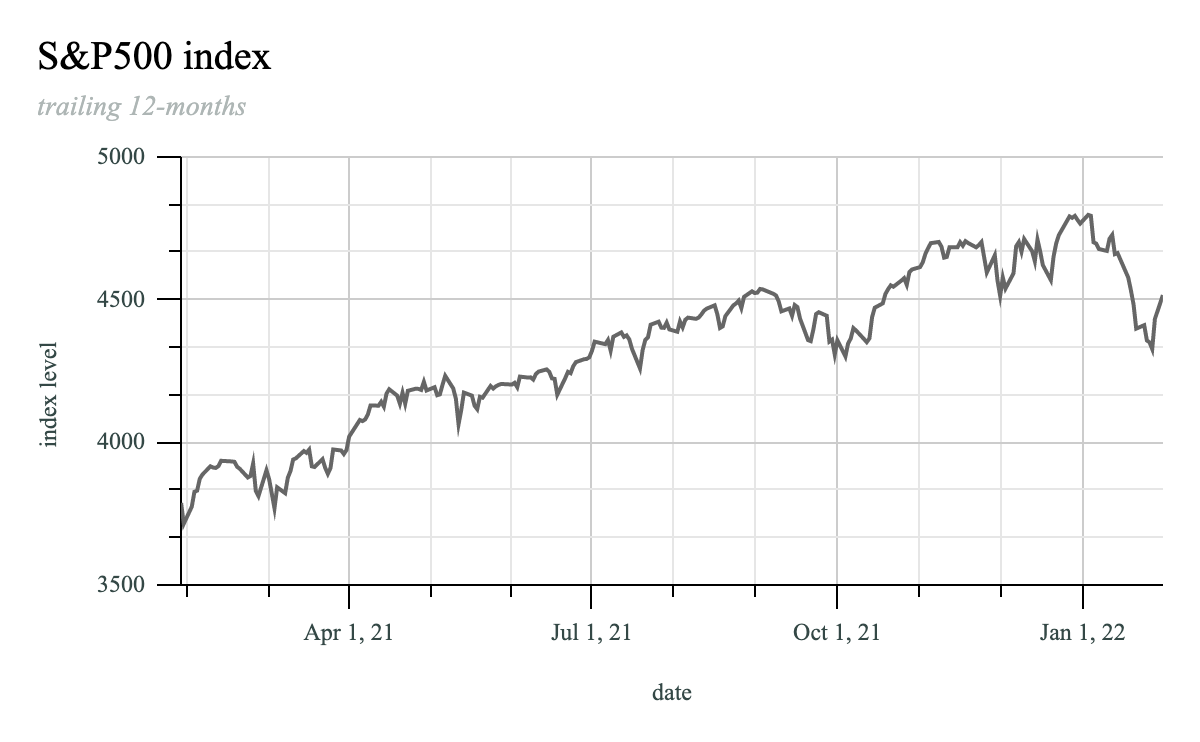

Apocalyptic headlines covered newspapers last month as shares fell. “Stocks haven't experienced a start to the year this rough in a very long time,” wrote Julia Horowitz for CNN Business1. Despite bouncing back during January's last two trading days, U.S. stocks finished the month 5.9% below the start and 3.2% below the mid-month level. Is the media’s indigestion a sign of impending doom, or does it signal an addiction to markets that always go up? The adage of the pundits is, “If in doubt, zoom out.”

The S&P500 is trading around the same level as in August last year but is distinctly up from February, providing solace to the ‘zoom-out’ crowd. While this provides some longer-term context, it doesn’t tell us anything about the future, and it plays into the eroticisms of the ‘everything-bubble’ crowd. Will stocks go up, down, or sideways next month? No one knows.

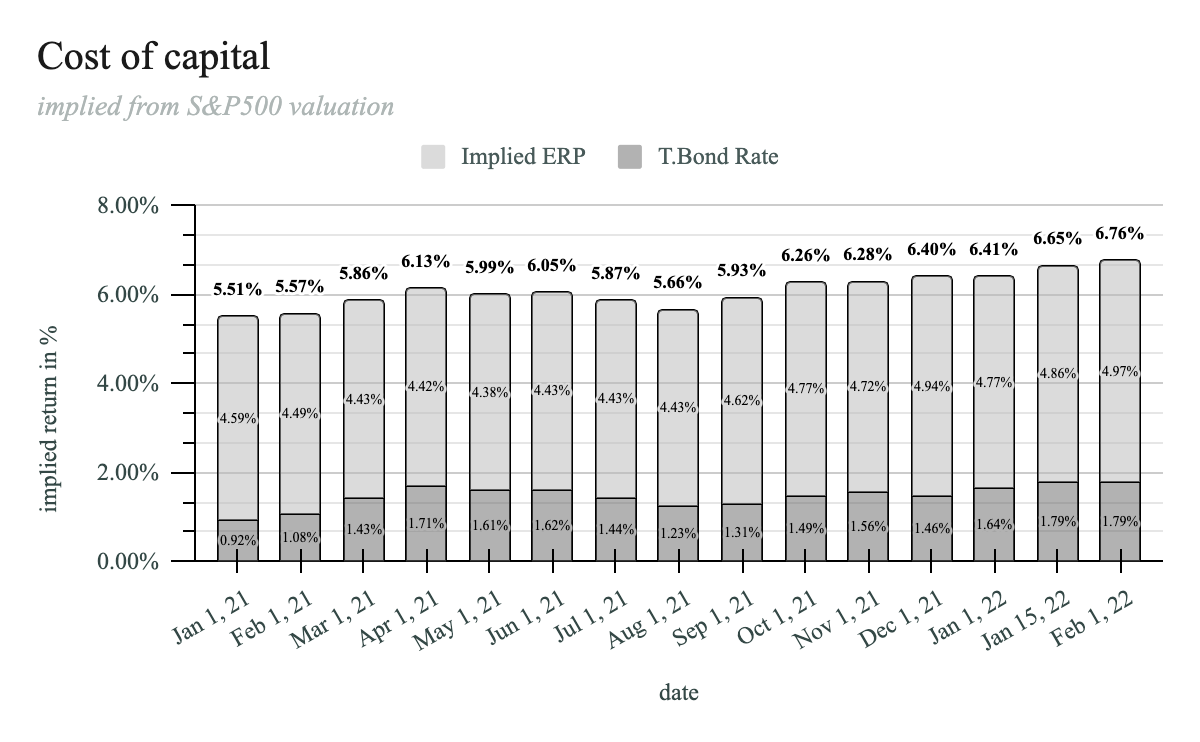

The cost of capital—and its twin, the implied return—for U.S. stocks remains at historic lows. It was 6.76% on February 1, 11bp higher than January 15 and 110bp up from August last year.

Despite panic in the equity markets, sovereign debt markets were more sanguine as the 10-year U.S. Treasury yield hovered around 1.79%. In contrast, the panic in equity markets saw the equity risk premium (“ERP”) rise from 4.86% to 4.97%, causing the market’s decline. Investors are now pricing more risk into stocks and demanding a higher return. However, as the 10-year breakeven inflation rate remains at 2.44%, they’re still willing to tolerate negative risk-free real returns.

Finally, using the average ERP of the last five years, analysts’ consensus earnings estimates, and the current 10-year Treasury yield, I value the S&P500 at 4,333—suggesting it is 4% overvalued.

Credit creation • Cause & effect

The Federal Reserve buys & sells securities…

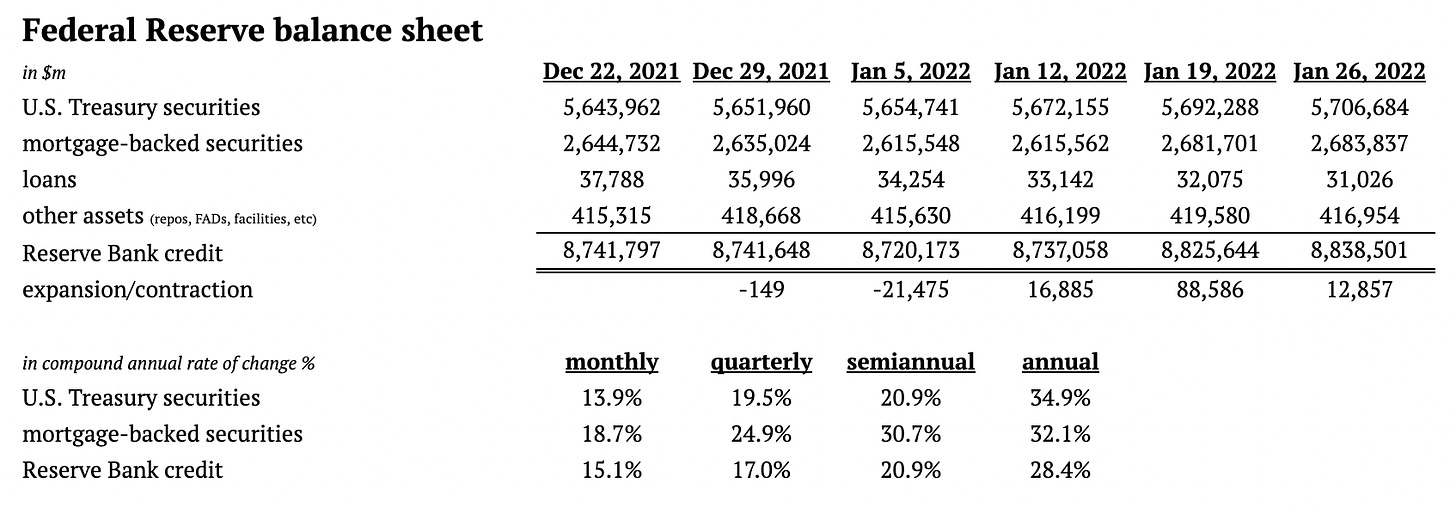

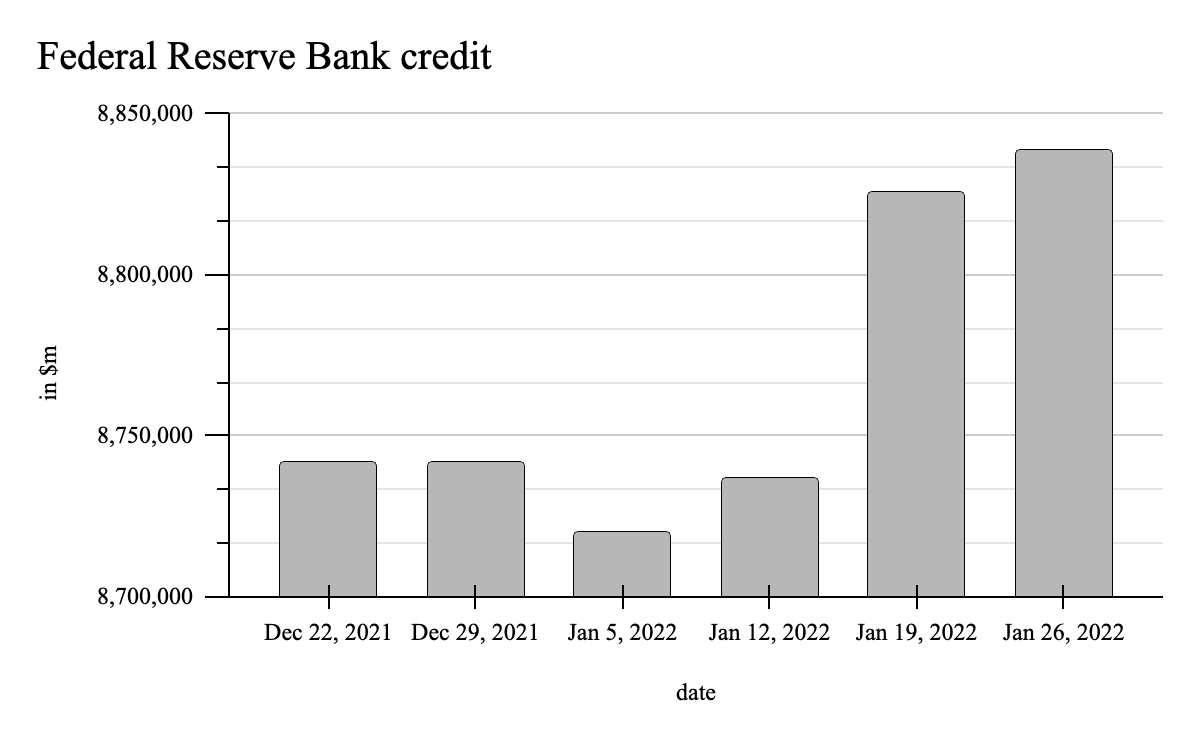

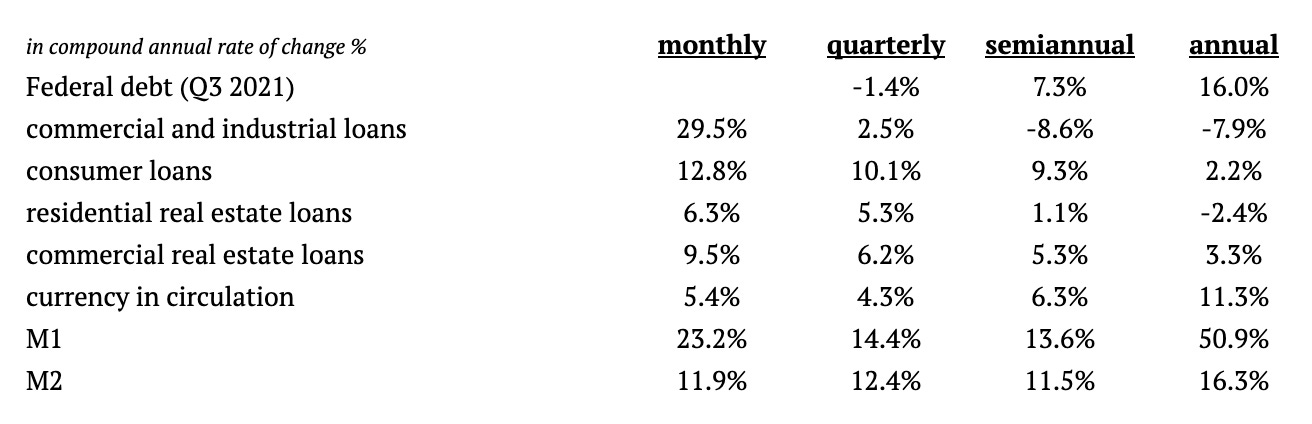

In the second fortnight of January, the Fed’s balance sheet expanded by $101.4bn as they bought more U.S. Treasury and mortgage-backed securities. Monthly, the total amount of Reserve Bank credit is growing at a 15.1% compound annual rate of change (“CAR”)—slower than the quarterly, semiannual, and annual rates, indicating that quantitative easing is decelerating.

… to influence interest rates, …

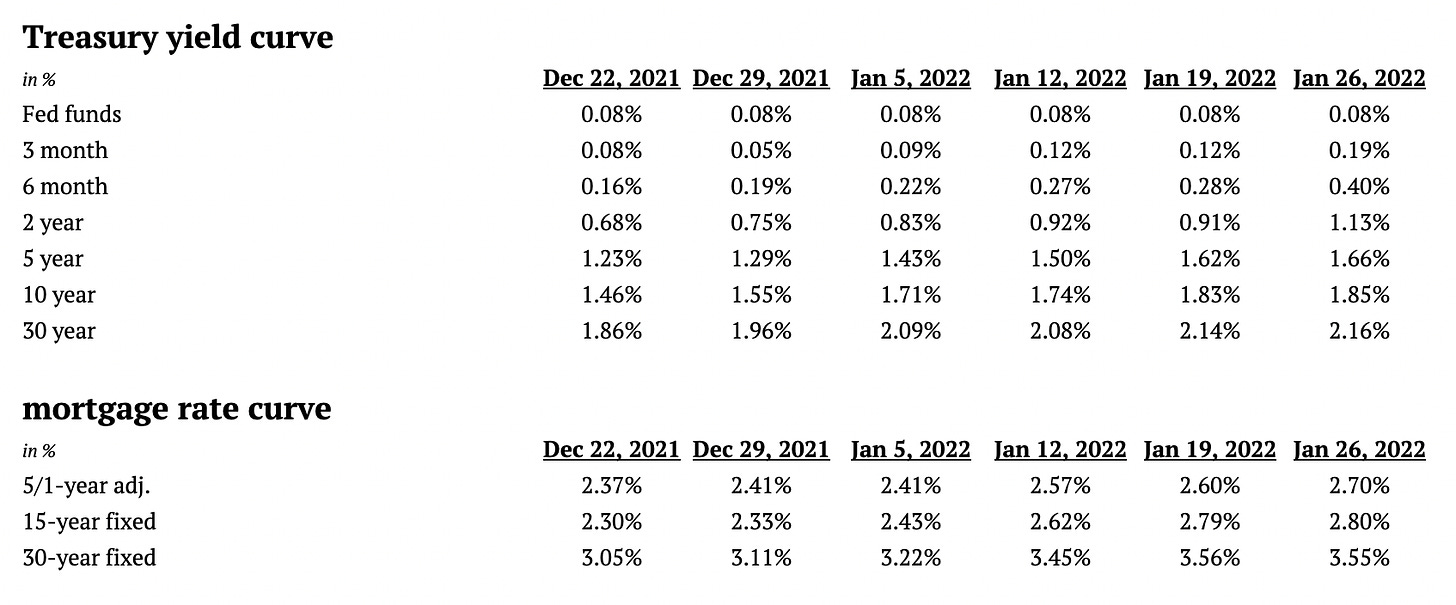

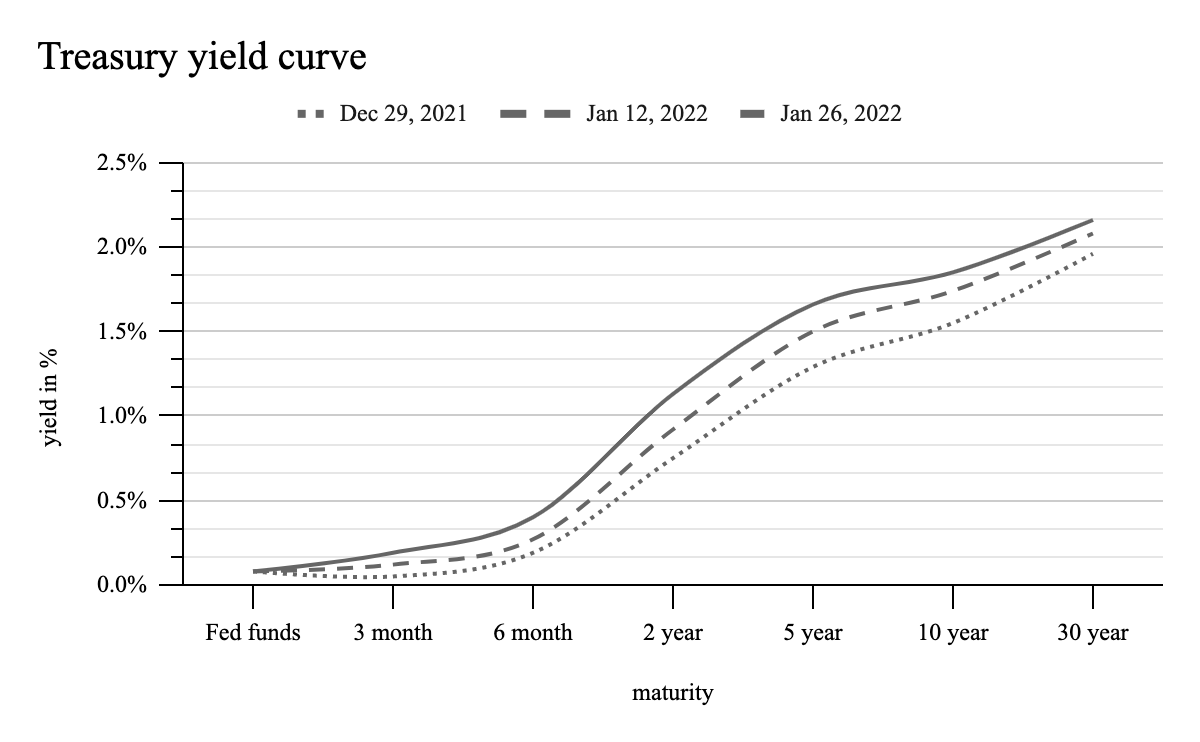

Yields rose across all maturities except the Federal funds rate, causing the yield curve to climb. Over the last six weeks, 30-year Treasury yields have increased from 1.86% to 2.16%, while 30-year fixed-rate mortgages in the U.S. now cost an extra 50bp more.

… to influence lending & borrowing, …

Commercial and industrial loan activity expanded substantially last month but remains below the semiannual and annual levels. Consumer loans, as well as residential and commercial real estate loan activity, accelerated, too. The amount of United States Dollar currency in circulation continued inflating, but its growth has decelerated over the last 12 months, while the M1 and M2 money supplies continue growing at prolific paces.

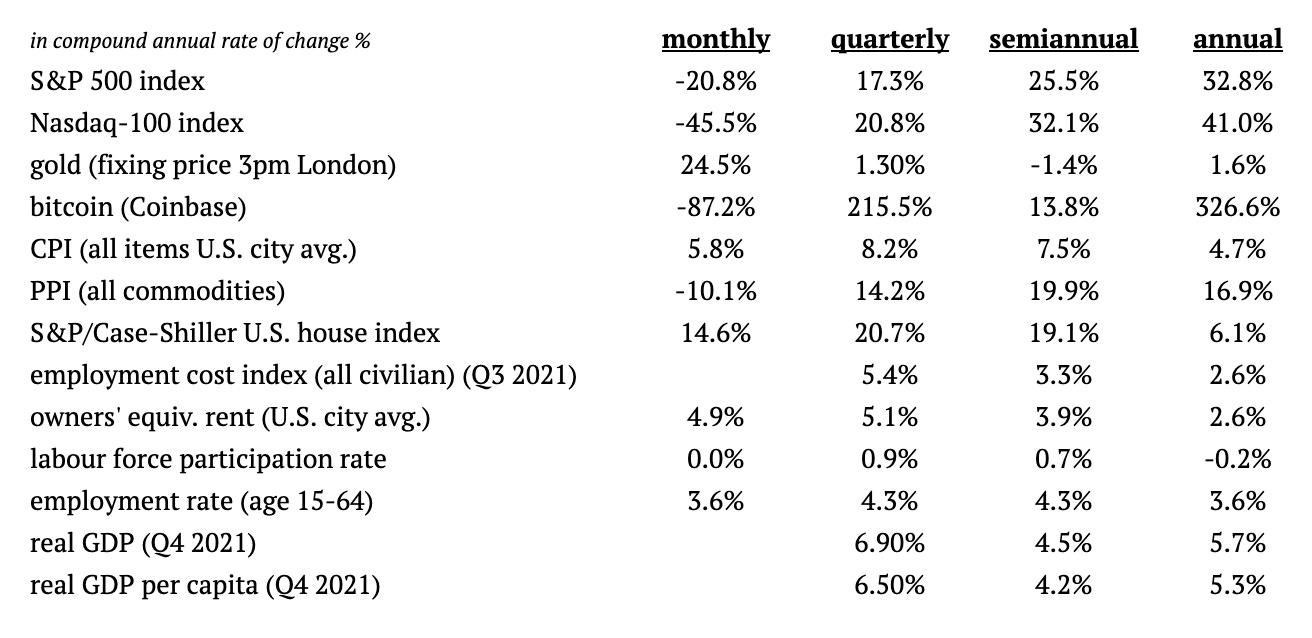

… prices, employment & productivity

Bitcoin fell dramatically alongside stocks—especially the speculative end—but the gold price ticked up. The CPI continued to rise at a historic pace, but the all-commodity PPI fell. The expansion in credit, especially in real estate lending, drove the S&P/Case-Shiller U.S. house price index up at a 14.6% annualised rate over the last month and 20.7% over the quarter. Employment costs and rents are accelerating, while employment ticks up and labour force participation remains flat.