Vol. 4, No. 4 — Owning the world

The Norwegian sovereign wealth fund; Uber’s shares aren’t cheap; The American consumer is doing fine; A market correction is around the corner; Value in groceries

Welcome to 𝑉𝑎𝑙𝑢𝑎𝑏𝑙, a twice-monthly newsletter with expert financial analysis in a straightforward style. 𝑉𝑎𝑙𝑢𝑎𝑏𝑙 helps professional investors make sense of markets and find undervalued stocks.

New here? Subscribe now. Or check out our investment idea track record. Already a subscriber? Explore all of 𝑉𝑎𝑙𝑢𝑎𝑏𝑙’s essays and investment ideas.

Read time: 43 minutes.

In this issue

Quote | Travis Kalanick

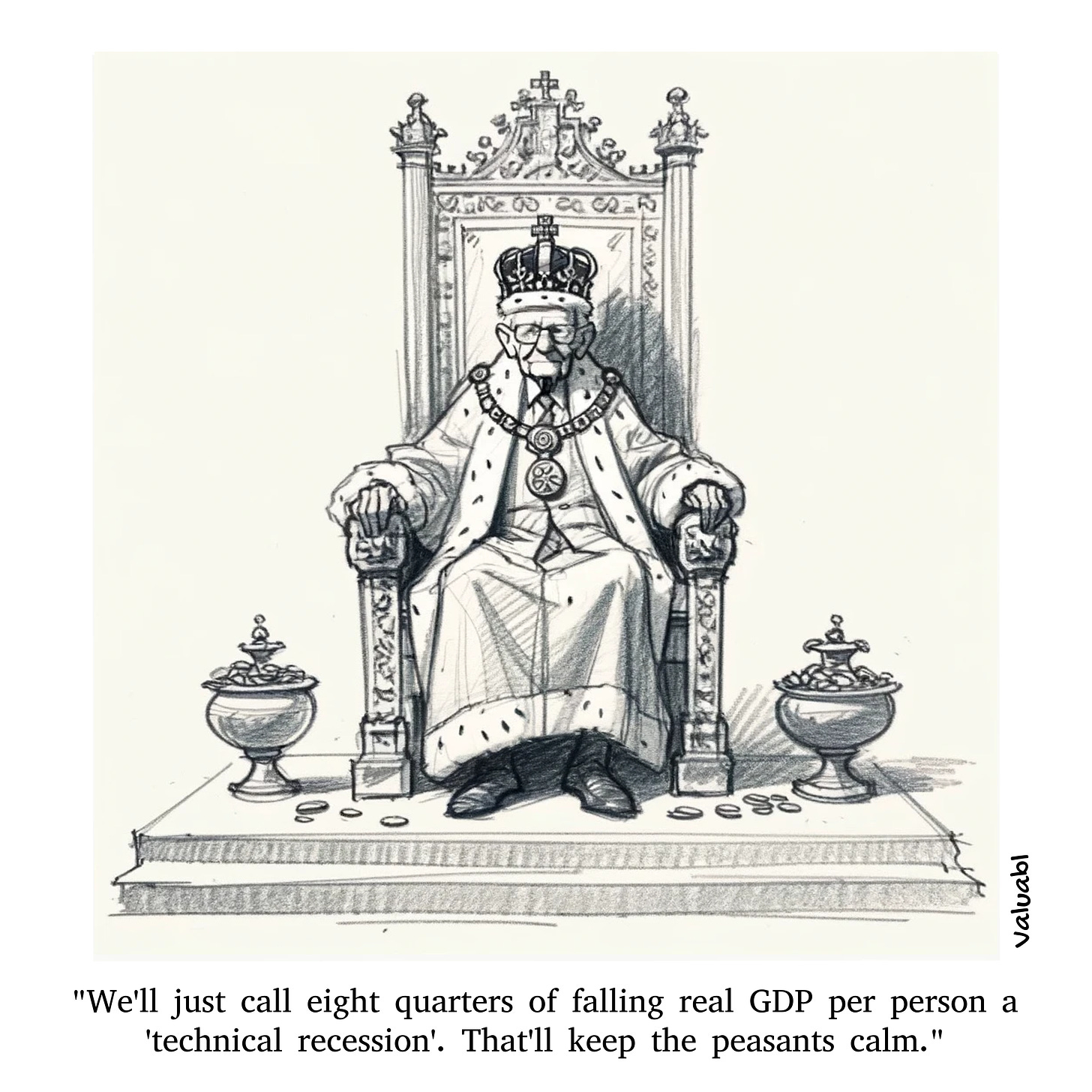

Cartoon | Meanwhile, in Buckingham Palace…

Finance | Owning the world

Finance | A not-so-free ride

Economics | Shop ‘til you drop

Markets | Correction inbound?

Investment idea | Value in groceries

Quote | Travis Kalanick

“Acknowledging mistakes and learning from them are the first steps.”

Cartoon | Meanwhile, in Buckingham Palace…

Finance | The Norwegian sovereign wealth fund

Owning the world

The Oil Fund has made Norwegians incredibly wealthy. Its brilliant yet simple plan means they’ll only get richer.

In the 2013 dark comedy, "The Wolf of Wall Street", Leonardo DiCaprio plays Jordan Belfort, a sleazy money-hungry broker from New York. In it, when giving a speech to riled-up brokers working for him, he proclaims, "I have been a rich man, and I have been a poor man. And I choose rich every f***in' time!"

The Norwegian government has heeded Belfort's call. A hundred years ago, Norway was one of the poorest countries in Europe. It was rural, undeveloped, and reliant on fishing. But in 1969, an exploration ship found oil in the North Sea. They didn't pump the first barrels until 1980, but by the 1990s, the country produced millions of tonnes of oil each year.

This newfound wealth was great, and the welfare state expanded. In 1996, the government set up a sovereign wealth fund, the Oil Fund, to invest the surplus money from the country's oil profits. Since then, the size of this fund has grown by 18.7% per year. So, what's the story with this fund? It's an incredible piece of government foresight that has made the country rich. And its design will ensure Norwegians stay rich for generations to come.